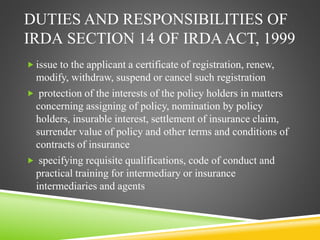

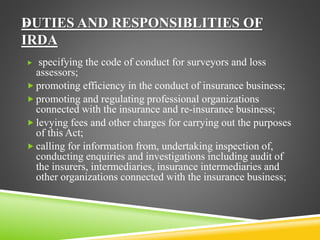

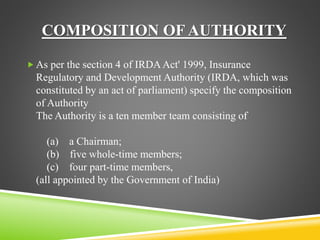

The Insurance Regulatory and Development Authority (IRDA) was established in 1999 through an act of Parliament to regulate and promote the insurance industry in India. The IRDA aims to protect policyholders' interests, ensure the orderly growth of the insurance sector, and administer the provisions of the Insurance Act. It issues licenses, monitors compliance, protects customers, and settles disputes. The IRDA is composed of 10 members, including a chairman and five full-time members, all appointed by the Government of India.