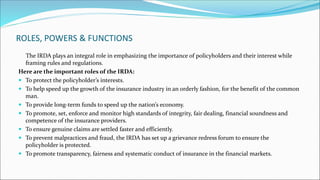

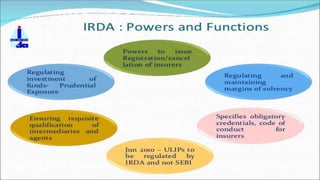

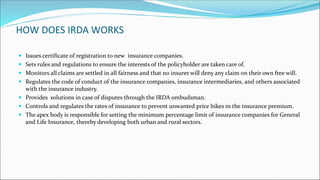

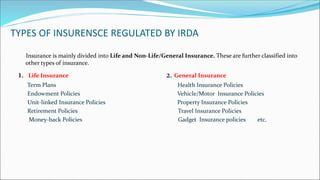

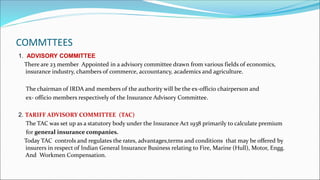

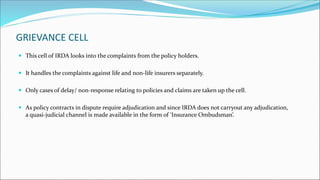

The Insurance Regulatory and Development Authority of India (IRDA) is the insurance regulator in India. It was established in 2000 to regulate and promote the insurance industry. IRDA aims to protect policyholders' interests and ensure the financial soundness of insurance companies. It regulates 31 general insurance and 24 life insurance companies. IRDA's roles include issuing licenses, setting rules and regulations, handling disputes through its ombudsman, and regulating insurance premium rates. It oversees both life insurance (e.g. term plans, retirement plans) and general/non-life insurance (e.g. health, motor, property policies). IRDA has various committees that advise on regulatory matters and handle complaints and disputes.