Embed presentation

Downloaded 63 times

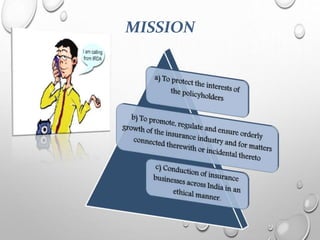

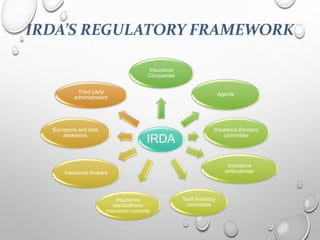

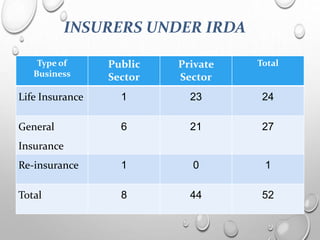

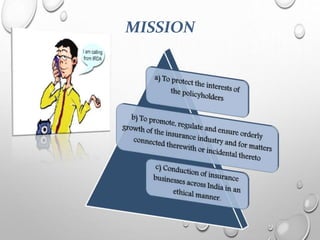

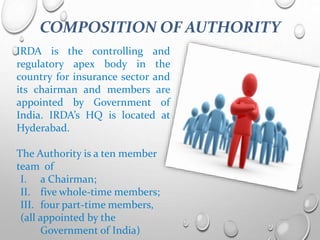

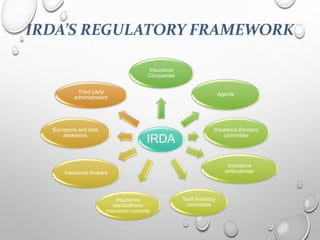

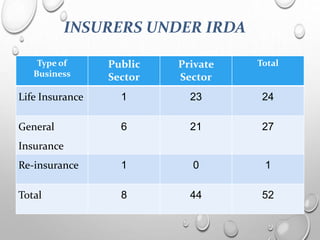

The Insurance Regulatory and Development Authority (IRDA) was established in 2000 as an autonomous body to regulate and promote the insurance and reinsurance sectors in India. Its primary goals are to enhance market efficiency and protect consumers, with a governing body appointed by the Government of India. The IRDA's framework includes various stakeholders, duties such as registration and consumer protection, and oversees both public and private insurance entities.