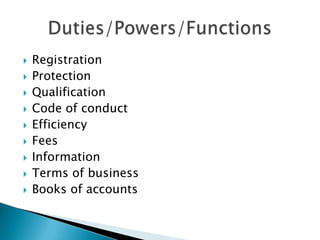

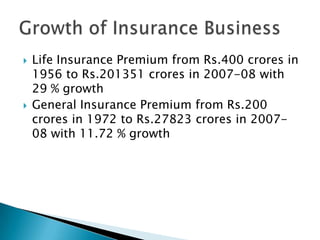

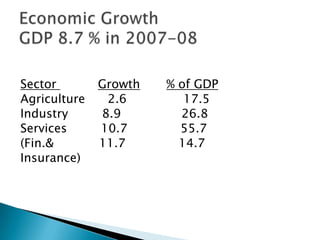

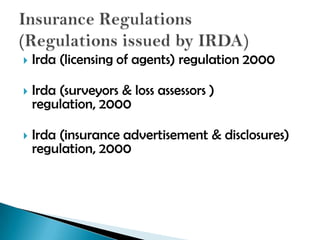

The Insurance Regulatory and Development Authority (IRDA) is the apex regulatory body for insurance in India. [IRDA] was established by an Act of Parliament to regulate, promote, and ensure the orderly growth of the insurance industry. IRDA is headquartered in Hyderabad and is responsible for protecting policyholders' interests, promoting an ethical insurance sector, and overseeing the growth of insurance across India. IRDA consists of a chairman and nine other members appointed by the Government of India.