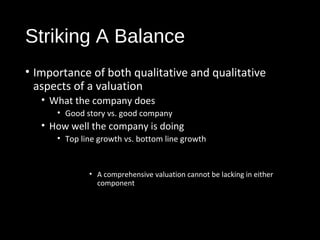

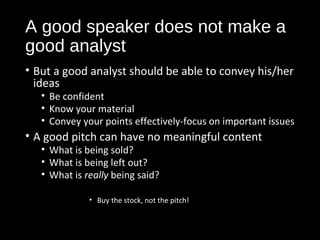

The document discusses important aspects to consider when evaluating a company valuation. It emphasizes the need to consider both qualitative and quantitative factors, including understanding the business model, underlying economics, competitive advantage, and financial assumptions. A good valuation analyzes the company's ability to generate sustainable competitive advantages and profits through a robust business model, supported by realistic financial projections and assumptions.