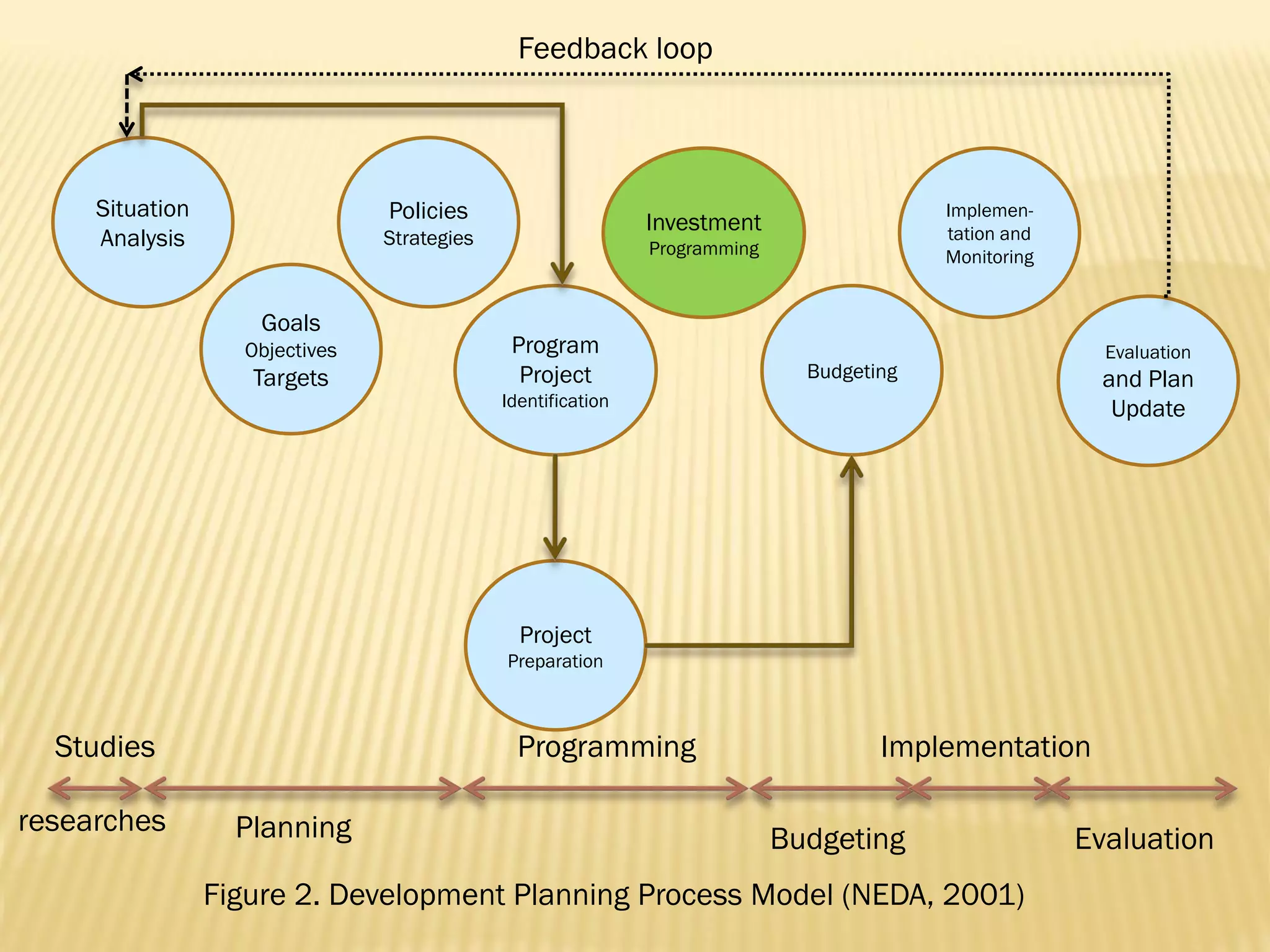

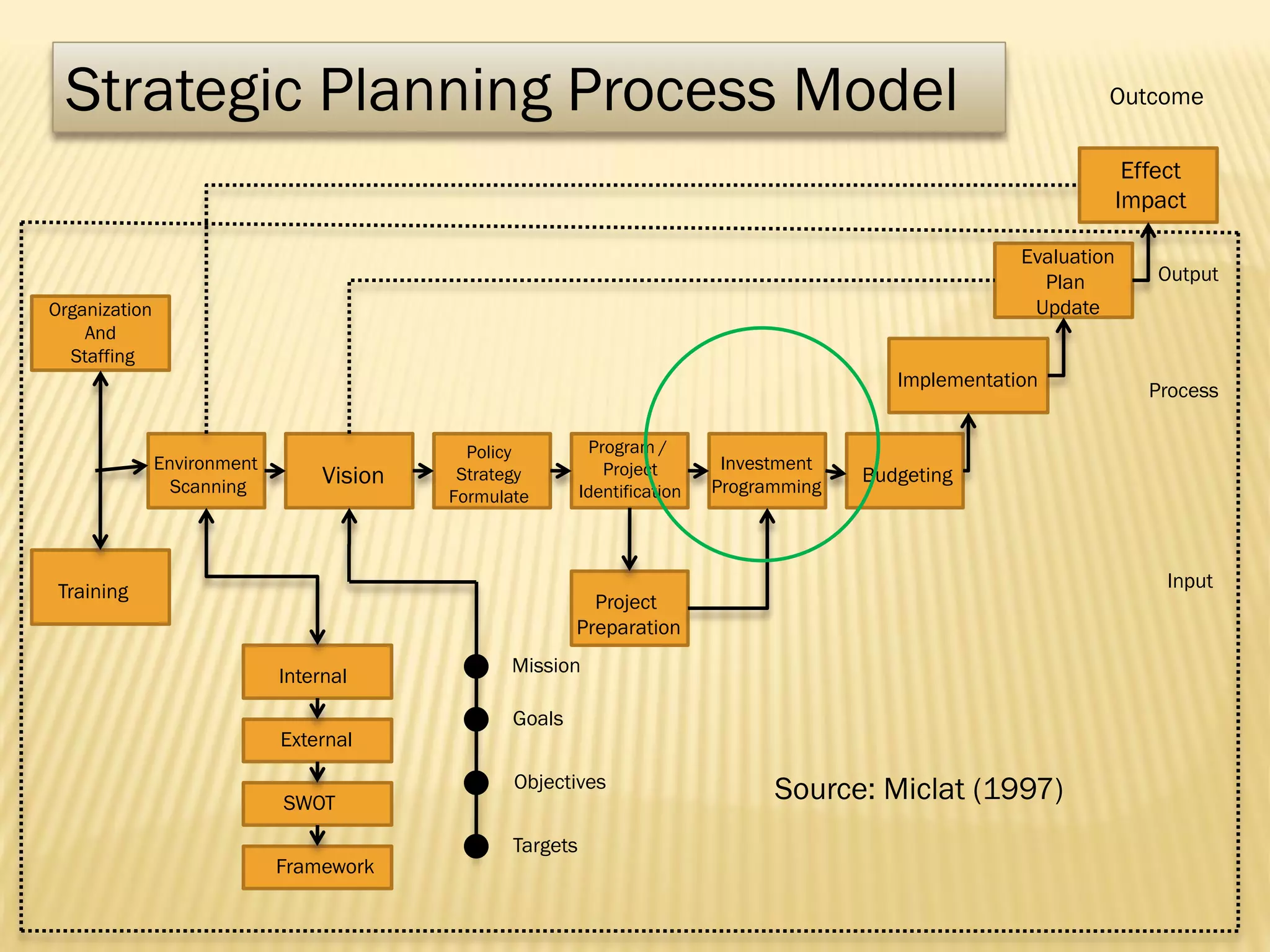

1. The document discusses investment programming as it relates to development planning and strategic planning processes. It outlines the steps in each model.

2. Investment programming involves systematically identifying, preparing, selecting, and scheduling programs and projects given limited resources to generate assets and capital for future benefits. The investment program is the basis for budgeting.

3. There are various types of investments that can be included in an investment program, such as capital expenditures, social/human development outlays, equity investments, project development costs, and other attributable expenditures. Other common types of investments discussed include bonds, stocks, real estate, mutual funds, and precious objects.