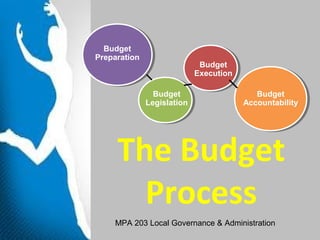

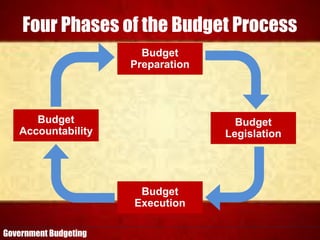

The document discusses the four phases of the budget process:

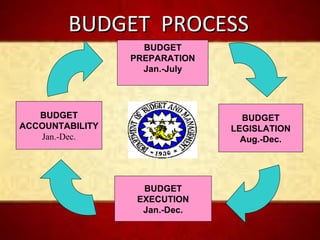

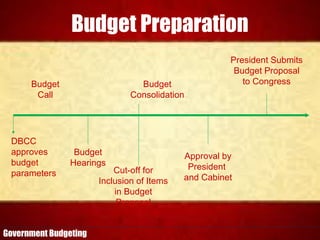

1) Budget Preparation which occurs from January to July and involves developing budget parameters and proposals.

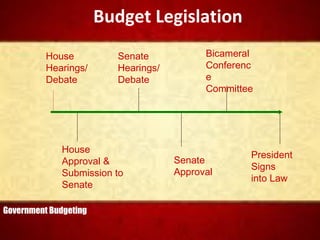

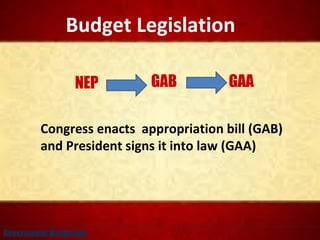

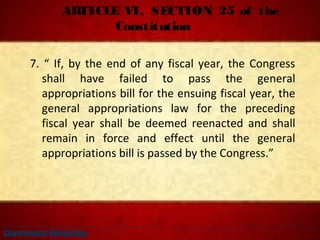

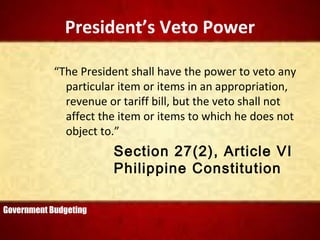

2) Budget Legislation from August to December where Congress debates and approves the budget through legislation.

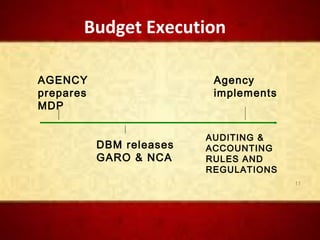

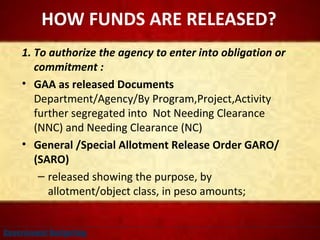

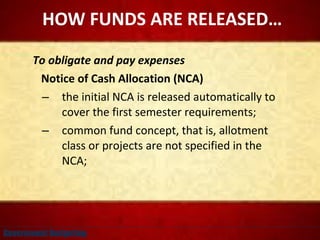

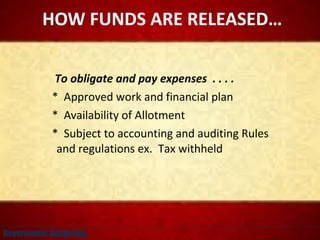

3) Budget Execution from January to December which is when approved funds are released and agencies implement projects.

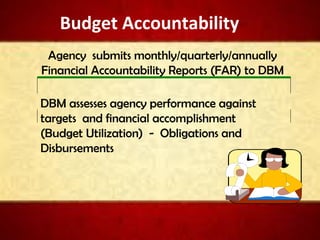

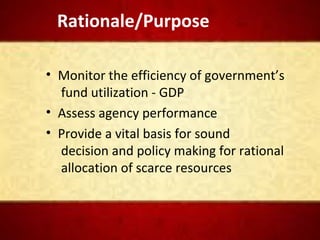

4) Budget Accountability also from January to December involves agencies reporting on financials and performance so the budget utilization can be assessed.