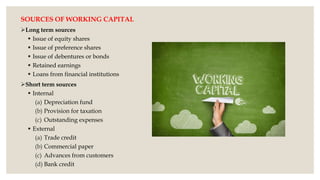

Working capital refers to the funds used to meet daily business expenses. It includes current assets like cash and inventory needed to operate on a day-to-day basis. Proper management of working capital, accounts receivable, accounts payable and inventory is important for business liquidity and efficiency. Techniques to manage inventory include determining optimal stock levels, ABC analysis of inventory items and just-in-time systems. Sources of working capital include both long-term sources like equity and loans as well as short-term sources like trade credit, commercial paper and bank finance.