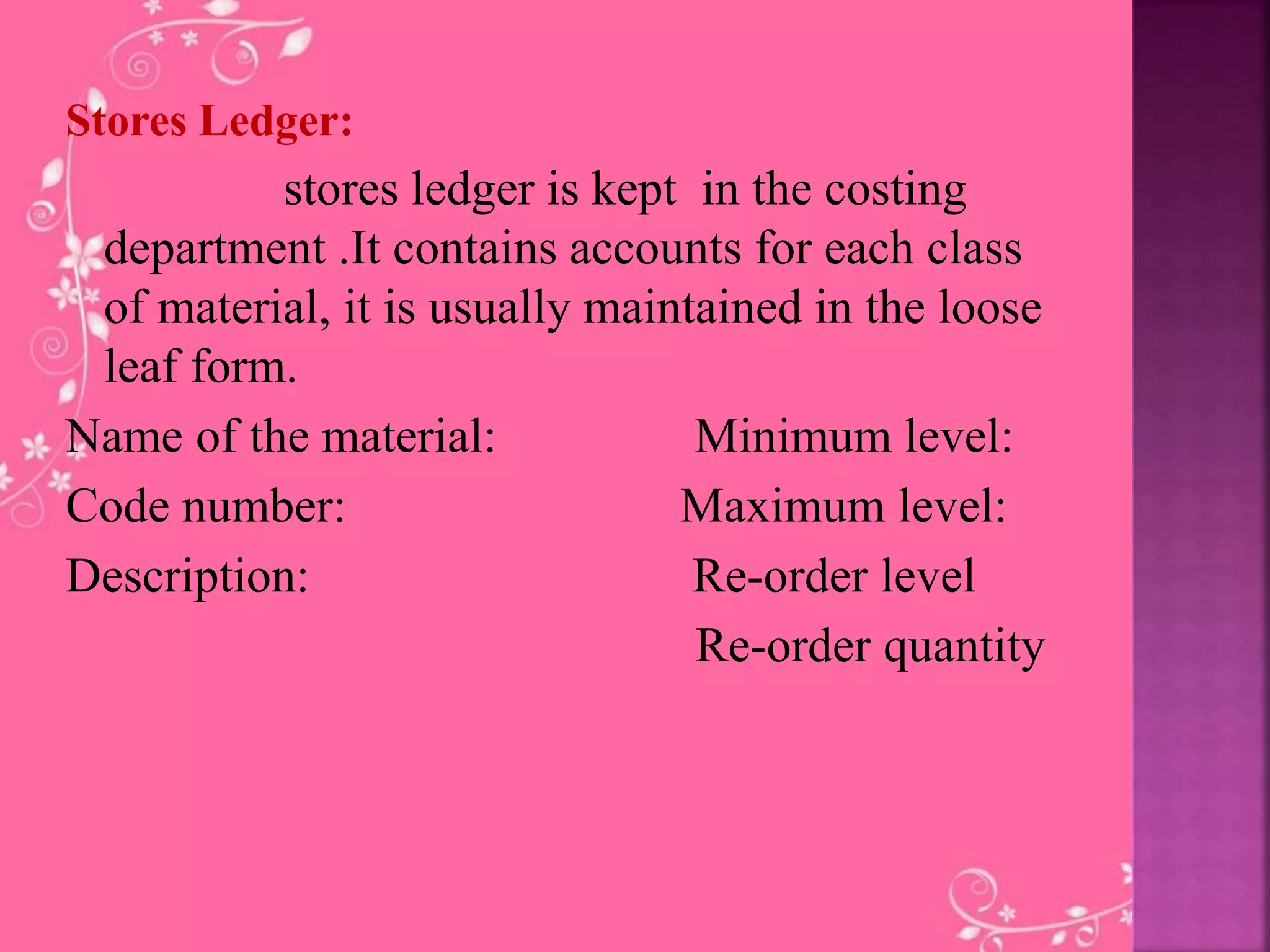

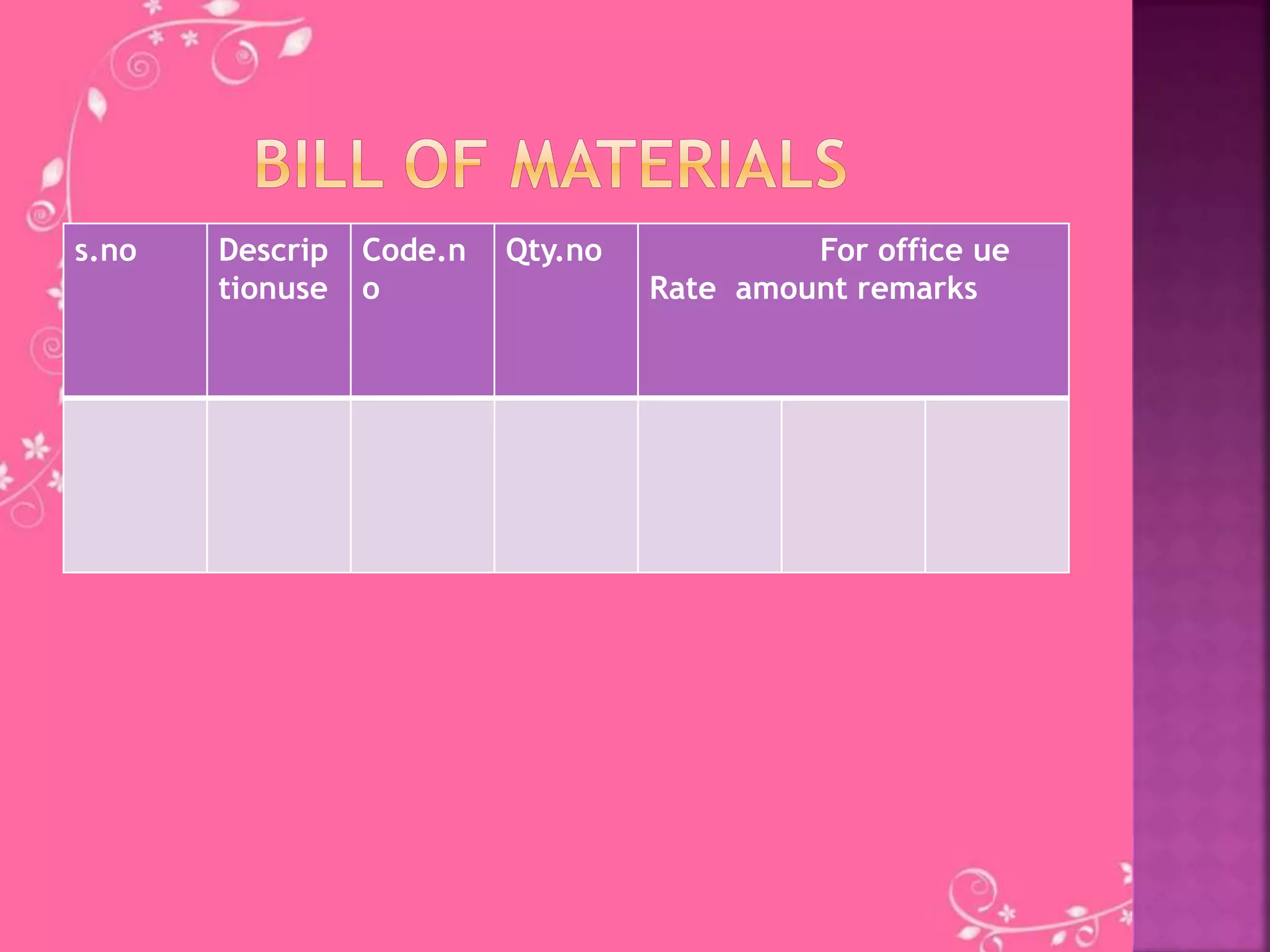

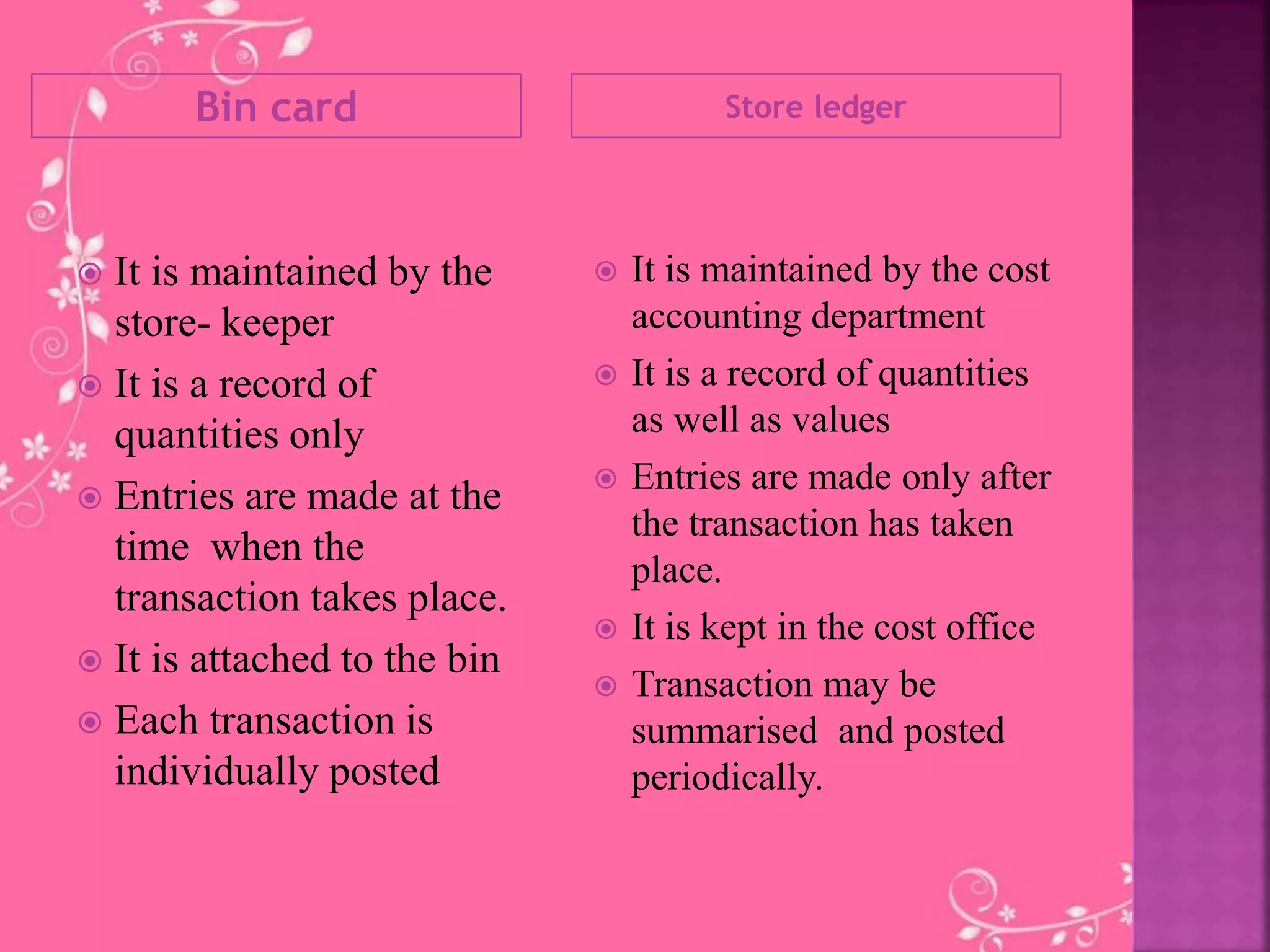

The document discusses various concepts related to materials management and costing. It defines key terms like cost, cost accounting, objectives of cost accounting. It describes different cost classification methods, materials control techniques like bin cards, store ledgers. It explains concepts of economic order quantity, reorder level, maximum and minimum levels. Finally, it discusses different inventory valuation methods like FIFO, LIFO, simple and weighted average.

![Economic Order Quantity : [EOQ]

It is not a stock level. It is ideal quantity

material to be purchased at any time . If purchase are

made of purchase are made in large quantity ,the cost

of holding the stock will be higher but the cost of

purchasing would be less.

Formula

EOQ=√2AO

C

A= Annual consumption in units

O=Ordering and receiving cost per order

C=Cost of carrying inventory per unit per annum](https://image.slidesharecdn.com/costingpart11-201201083533/75/Costing-part-1-1-22-2048.jpg)