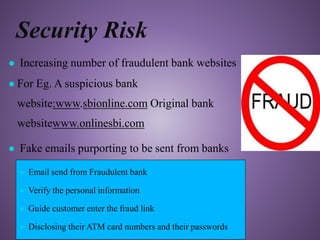

This document discusses internet banking and e-banking. It defines internet banking as a system that allows individuals to perform banking activities at home via the internet. It then outlines the development of e-banking, including some of the first online banking services introduced in the United States and India. The document also discusses the different types of internet banking systems and services offered by major banks in India. It concludes by covering the advantages and disadvantages of e-banking for banks, businesses, and customers.