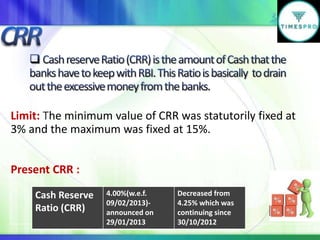

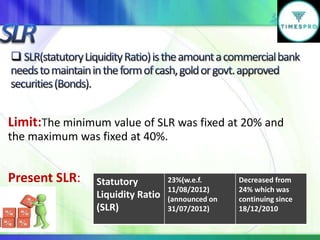

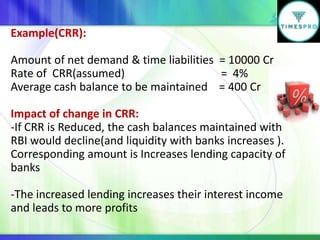

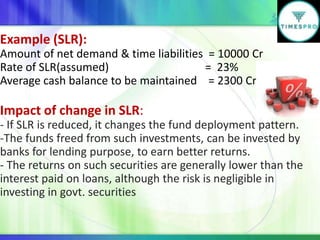

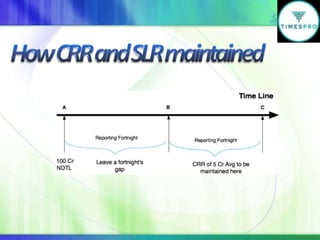

The document discusses the Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) requirements for banks in India. It notes that the RBI sets the minimum and maximum ratios for CRR (currently between 3-15%) and SLR (currently between 20-40%). It provides the current CRR and SLR rates, and explains how the ratios are calculated based on banks' net demand and time liabilities. It also discusses the impacts of increasing or decreasing these ratios, such as how a reduction in CRR or SLR increases banks' lending capacity.