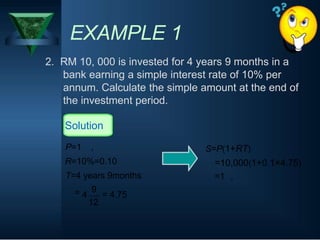

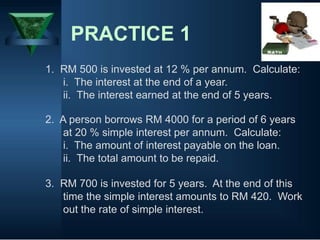

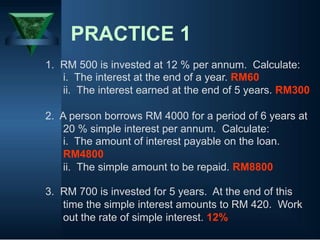

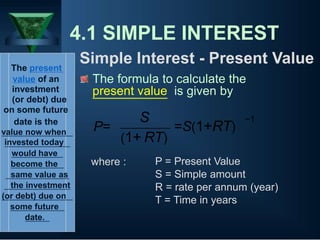

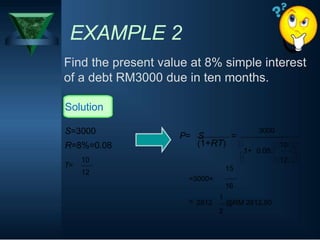

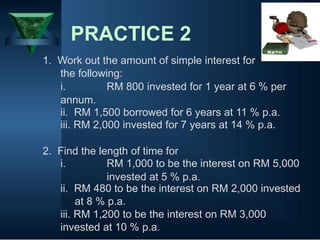

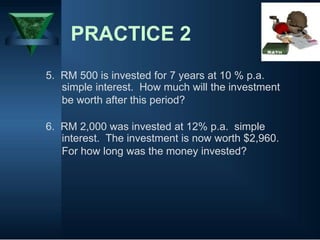

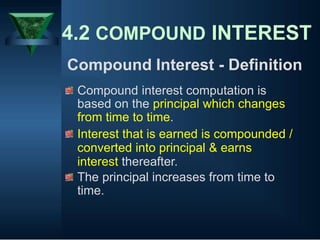

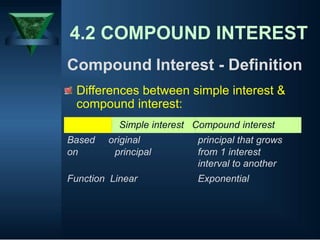

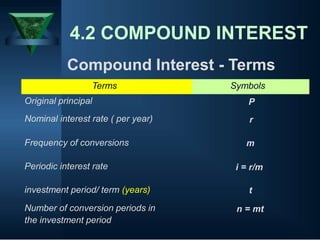

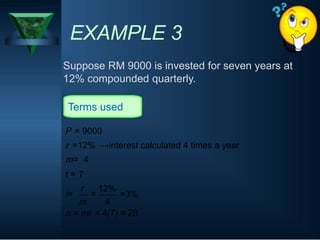

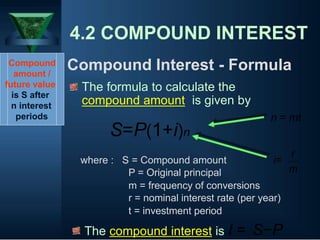

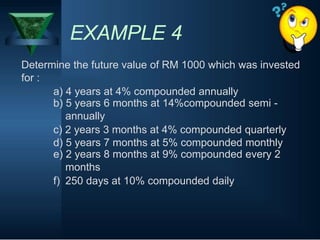

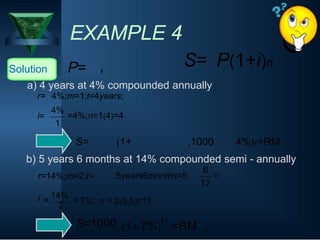

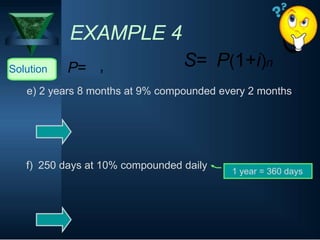

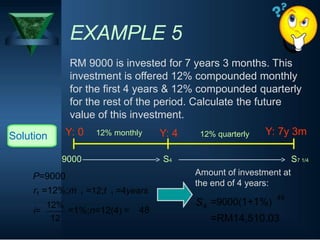

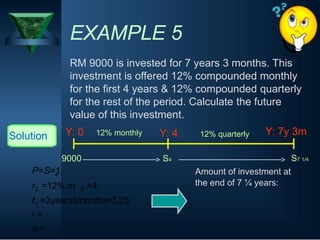

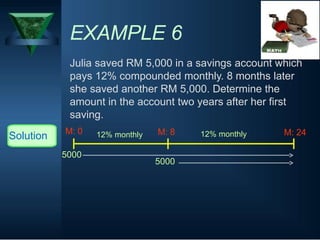

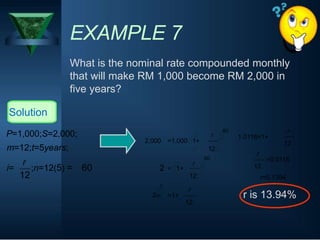

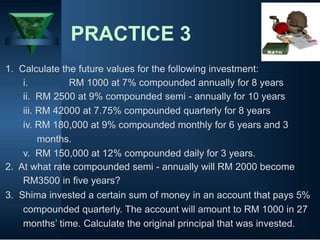

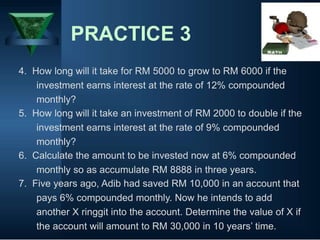

The document provides examples and practice problems on simple and compound interest calculations. It defines simple and compound interest, and provides the formulas to calculate simple interest, present value, and compound interest. Examples show how to calculate simple and compound interest amounts for various investment periods and interest rates. Practice problems provide additional calculations for students to practice applying the simple and compound interest formulas.