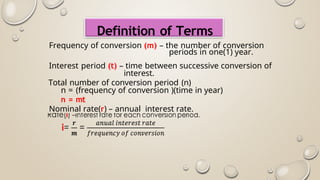

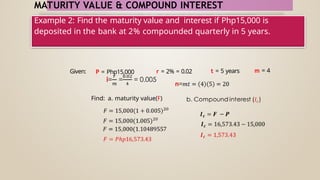

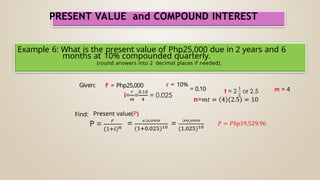

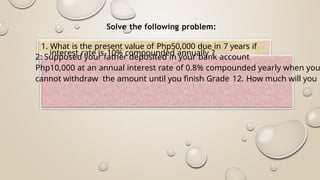

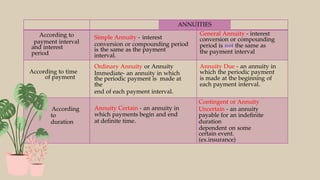

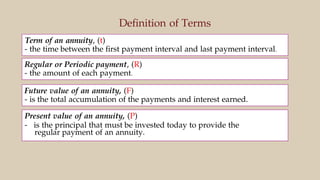

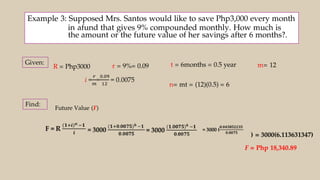

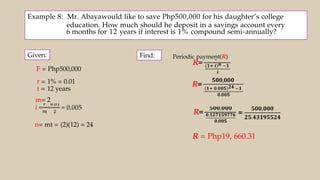

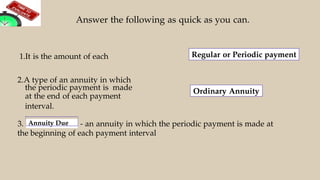

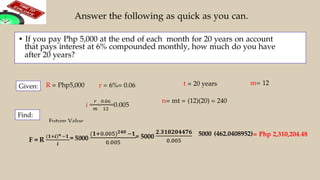

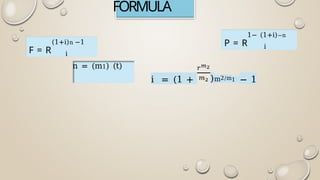

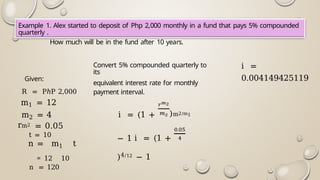

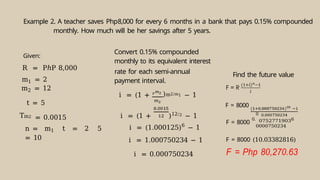

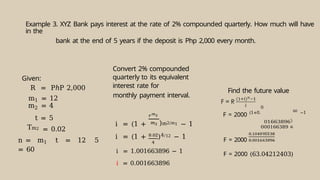

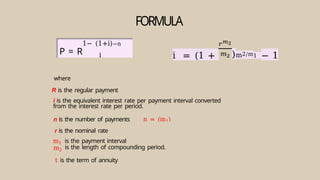

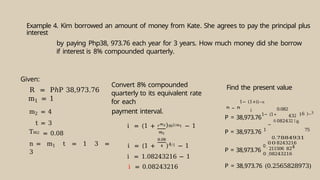

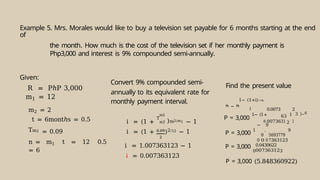

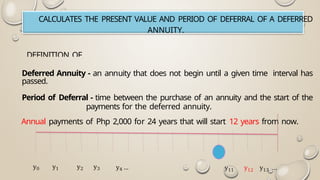

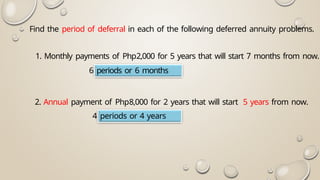

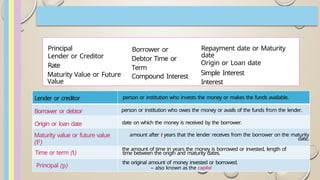

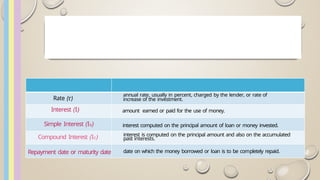

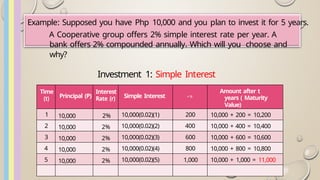

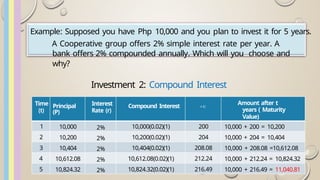

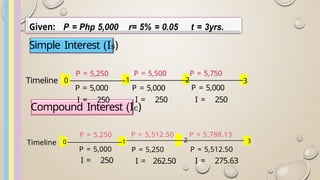

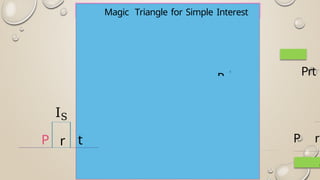

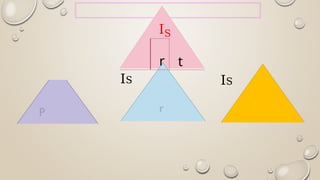

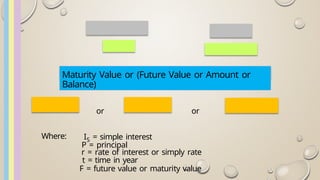

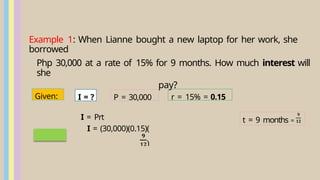

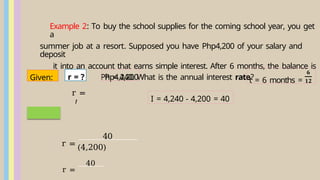

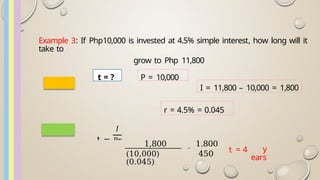

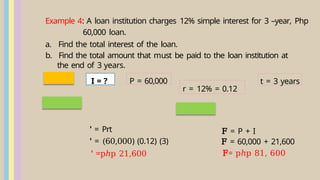

The document discusses the management of hard-earned money, focusing on concepts of simple and compound interest. It provides definitions and examples of calculating interest, maturity value, and present value while illustrating the benefits and drawbacks of both simple and compound interest over time. Additionally, it covers annuities, their types, and calculations for future and present values related to regular payments.

![Example 5: Find the maturity value of a loan amounting to Php50,000 at

9%

for 2 years .

r = 9% = 0.09

F = P(1 + rt ) or A = P + I

= 50,000[1 +( 0.09 )(2)]

= 50,000( 1. 18)

F = Php 59,000

t = 2 years

P = 50,000

F = ?](https://image.slidesharecdn.com/gen-math-ppt-all-250108015816-ab6eeb5c/85/Gen-Mattthhhhhhhhhhhhhghhhhh-PPT-All-docx-23-320.jpg)

![Example 6: Find the present value of Php86,000 at 8% for 3 years .

P = ?

P =

F

1 +

Tt

r = 8% = 0.08

=

86,000

[1 + 0.08

3 ]

=

86,000 86,000

= = Php

69,354.84

t = 3 years

F = 86,000

[1 + 0.24 ]](https://image.slidesharecdn.com/gen-math-ppt-all-250108015816-ab6eeb5c/85/Gen-Mattthhhhhhhhhhhhhghhhhh-PPT-All-docx-24-320.jpg)