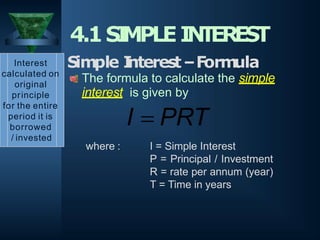

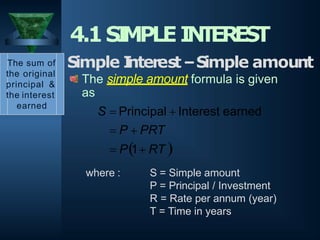

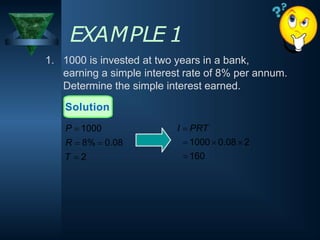

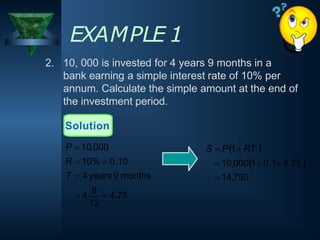

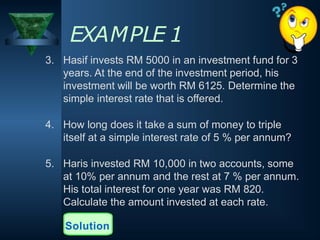

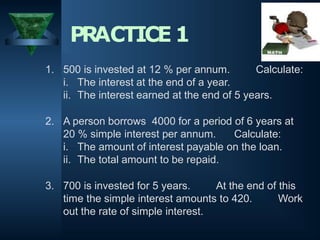

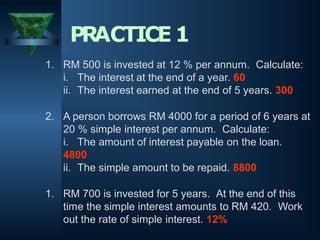

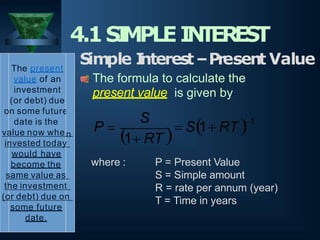

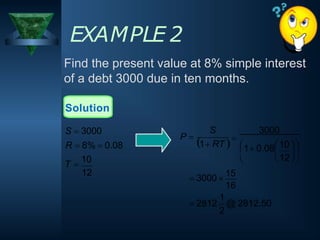

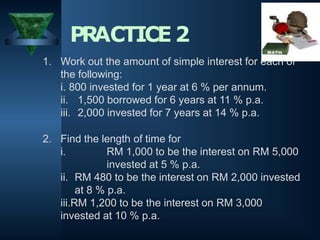

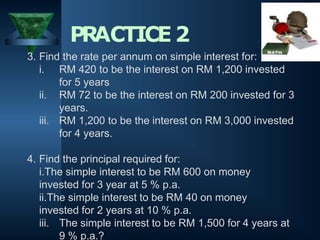

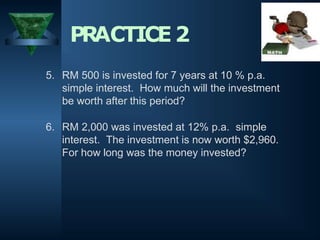

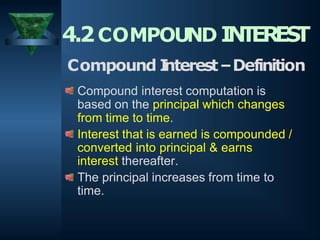

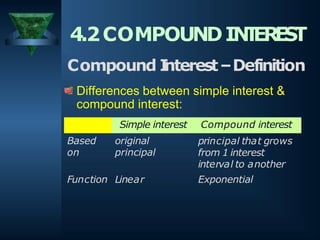

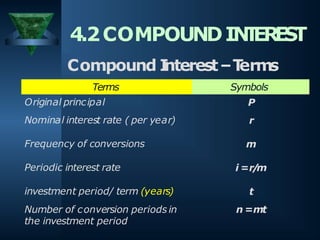

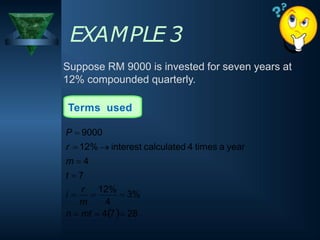

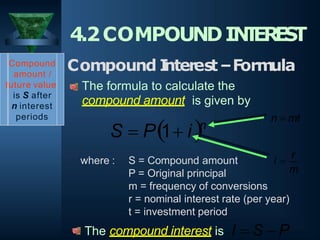

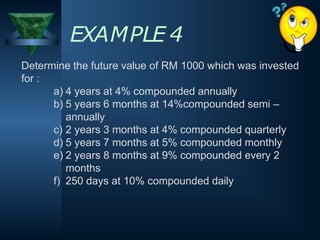

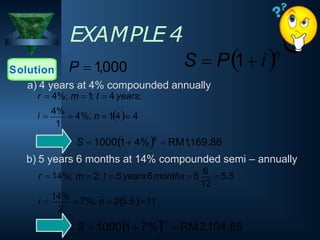

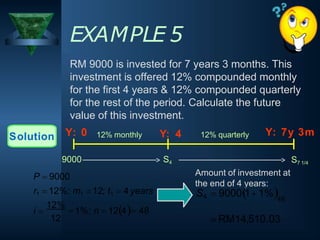

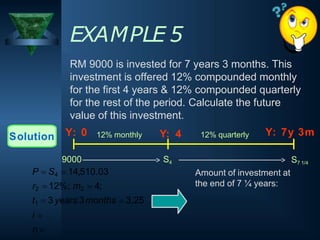

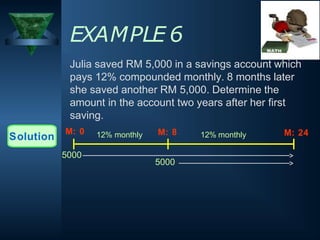

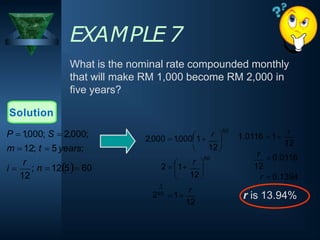

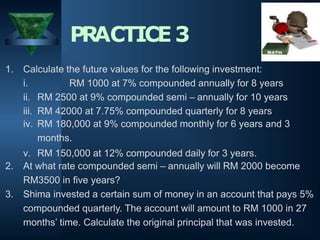

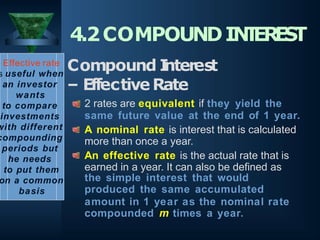

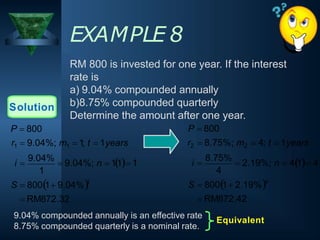

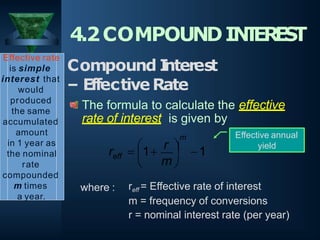

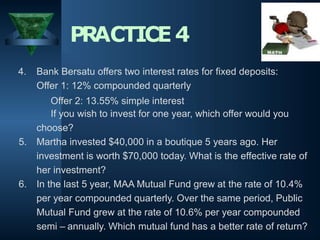

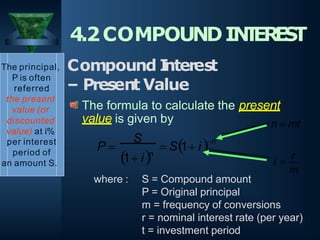

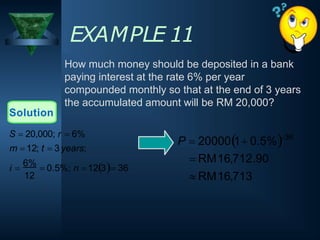

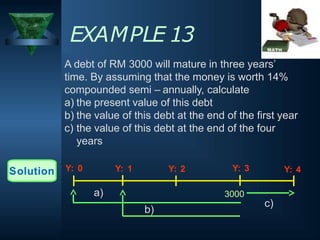

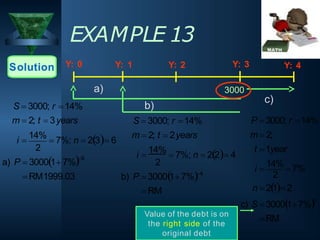

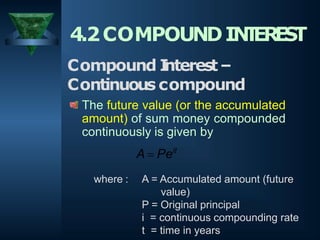

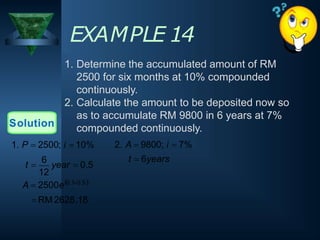

This document discusses simple and compound interest. It begins by defining interest and the two types: simple interest and compound interest. Simple interest is calculated on the original principal amount for the entire period. Compound interest is calculated on the changing principal amount, as interest earned is added to the principal over time. Formulas for calculating simple interest, simple amount, and present value are provided. Examples of calculating simple interest are shown. The document then discusses compound interest in more detail, defining terms, providing the compound interest formula, and working through examples of calculating compound interest amounts for various investment scenarios.