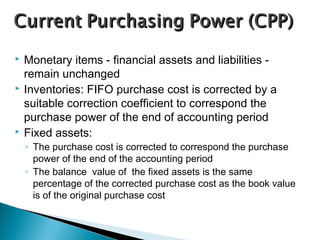

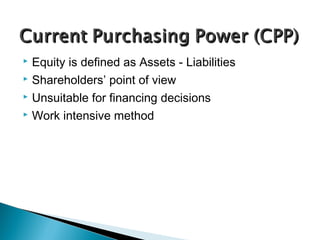

This document discusses different methods for accounting for inflation, including current purchasing power (CPP) accounting and current cost accounting (CCA). CPP accounting adjusts asset values and costs using price indexes to maintain the original purchasing power. The Finnish AHI method is a combination of CPP and CCA that uses the wholesale price index for yearly adjustments to variable costs and depreciation. It aims to maintain production capacity with simple calculations.

![TO

- VC

= GP

- FC

= OP

- IC

- D

= NP

TO = Turnover

VC = Variable Costs

GP = Gross Profit

FC = Fixed Costs

OP = Operating Profit

IC = Interest Costs

D = Depreciation

NP = Net Profit

Below we also need:

[ NG = Net Gain from

Liabilities

TP = Total Profit ]](https://image.slidesharecdn.com/inflationaccounting-uwsb-130610072055-phpapp02/85/Inflation-accounting-Unitedworld-School-of-Business-9-320.jpg)