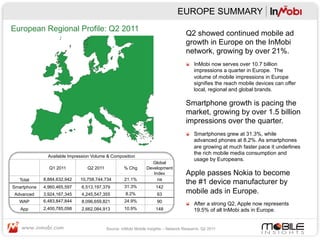

In this document, InMobi provides a summary of mobile advertising trends in Europe for Q2 2011 based on data from their global mobile advertising network:

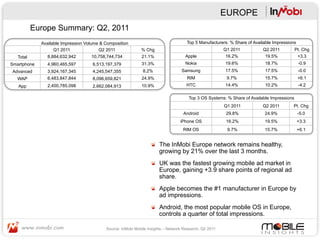

- Mobile ad impressions in Europe grew 21% in Q2 2011, with smartphones growing 31% and accounting for over 60% of total impressions.

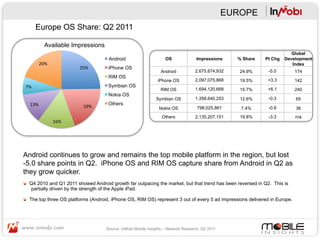

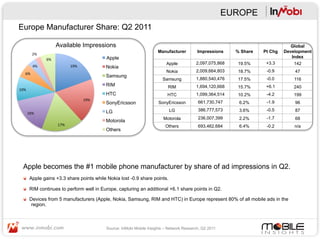

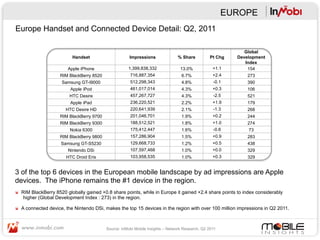

- Apple became the top device manufacturer in Europe, capturing 19.5% of ad impressions and growing faster than Android, which remained the top mobile platform but lost share.

- The top 3 platforms (Android, iPhone OS, RIM OS) accounted for nearly 60% of ad impressions in Europe, indicating fragmentation is decreasing in the region.