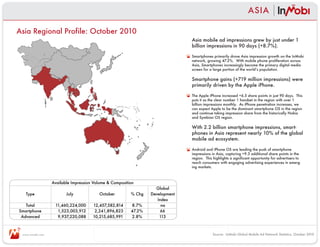

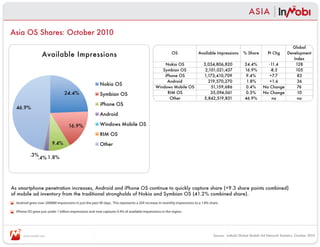

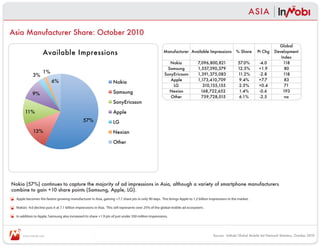

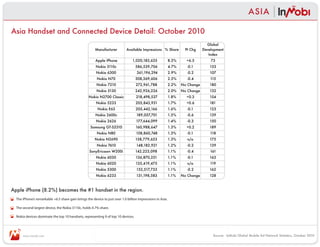

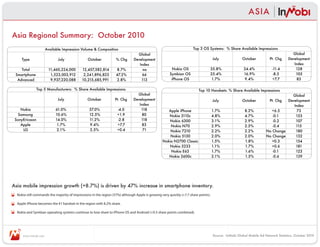

The October 2010 InMobi report highlights significant growth in mobile advertising impressions across the Asia Pacific region, driven primarily by smartphones, which saw a 47.2% increase in impressions. Nokia remains a major player with 57% of ad impressions, yet Apple has rapidly increased its market share, becoming the top handset with 8.2% in just 90 days. The report emphasizes the shift towards smartphone operating systems like iPhone and Android, which are gaining ground against traditional platforms like Nokia and Symbian.