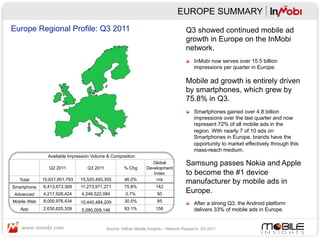

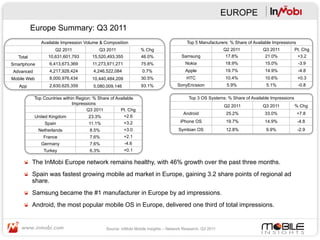

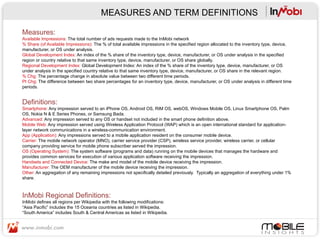

The document provides a summary of mobile advertising trends in Europe in Q3 2011 based on data from InMobi's global mobile advertising network:

- Mobile ad impressions in Europe grew 46% from Q2 2011 to over 15.5 billion impressions in Q3 2011, driven entirely by growth in smartphones which increased impressions by 75.8%.

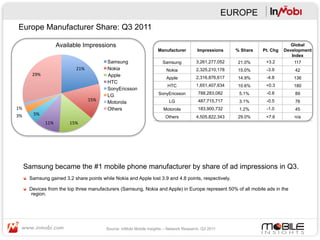

- Samsung surpassed Nokia and Apple to become the top device manufacturer by mobile ad impressions in Europe.

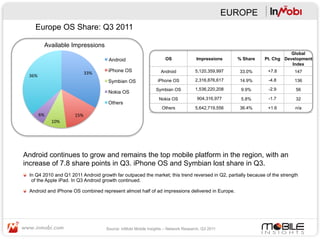

- The Android platform delivered 33% of mobile ad impressions in Europe, up from 25.2% in Q2, as Android growth outpaced the market.

- Android and iPhone OS combined accounted for nearly half of all ad impressions in Europe.