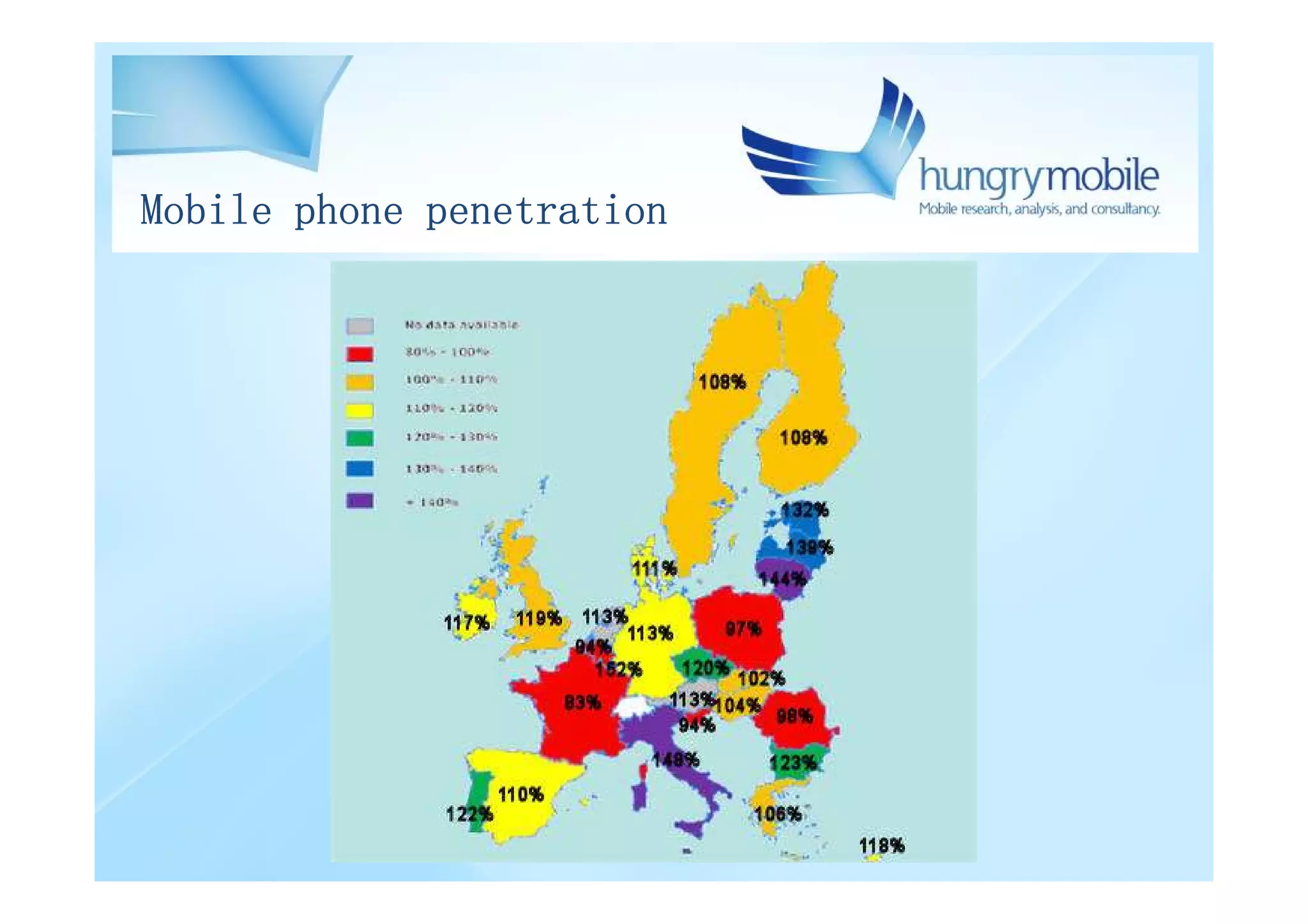

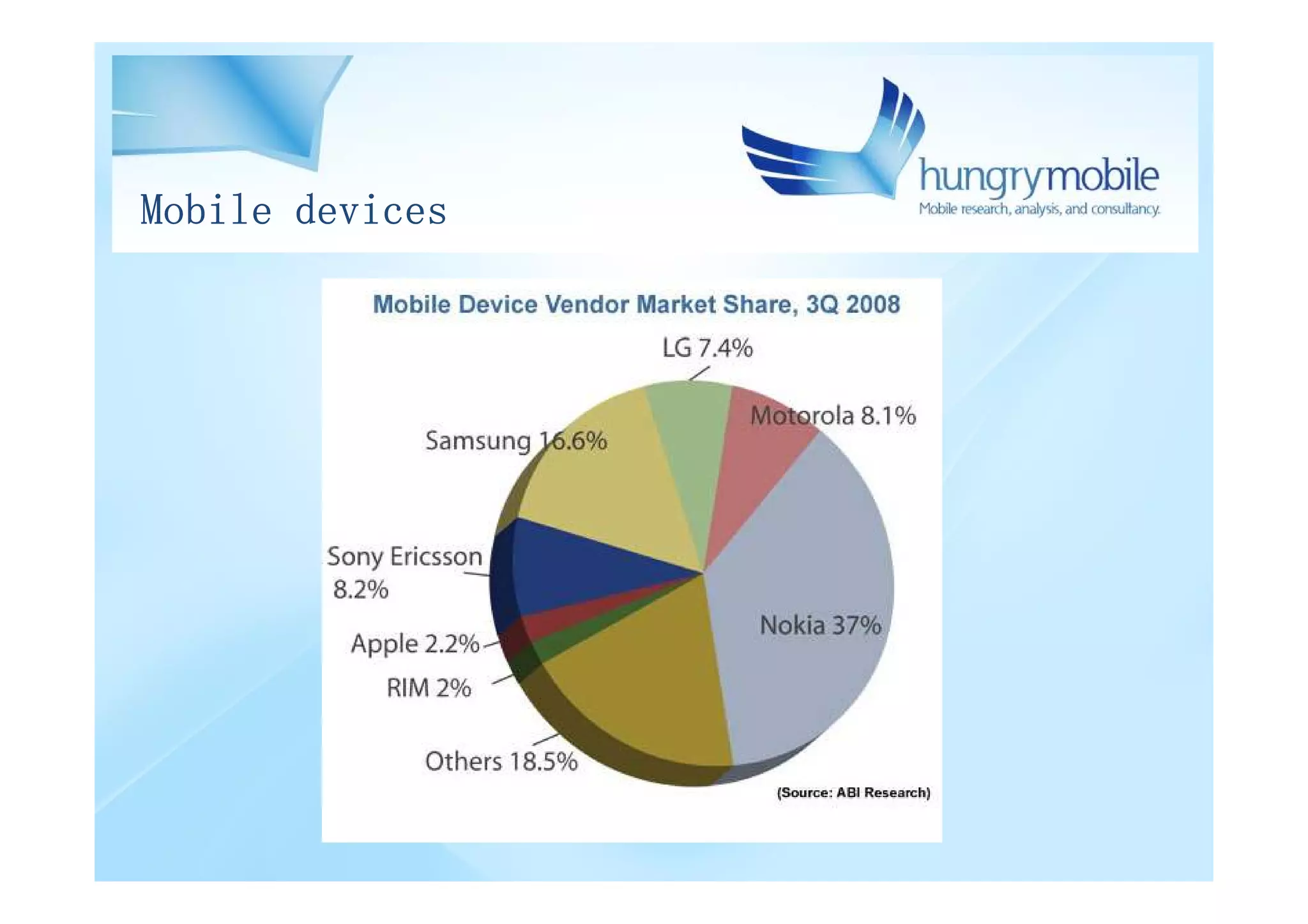

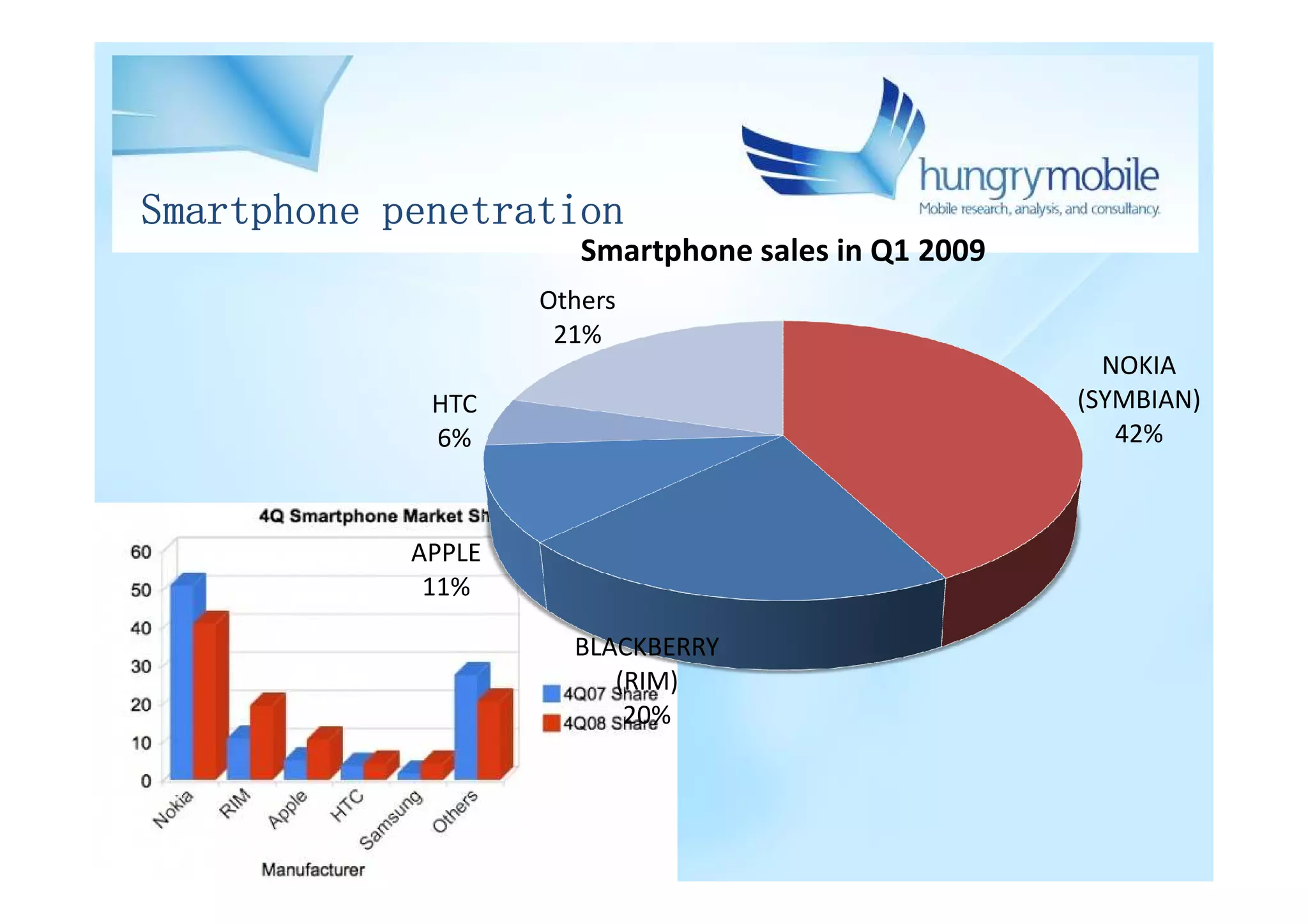

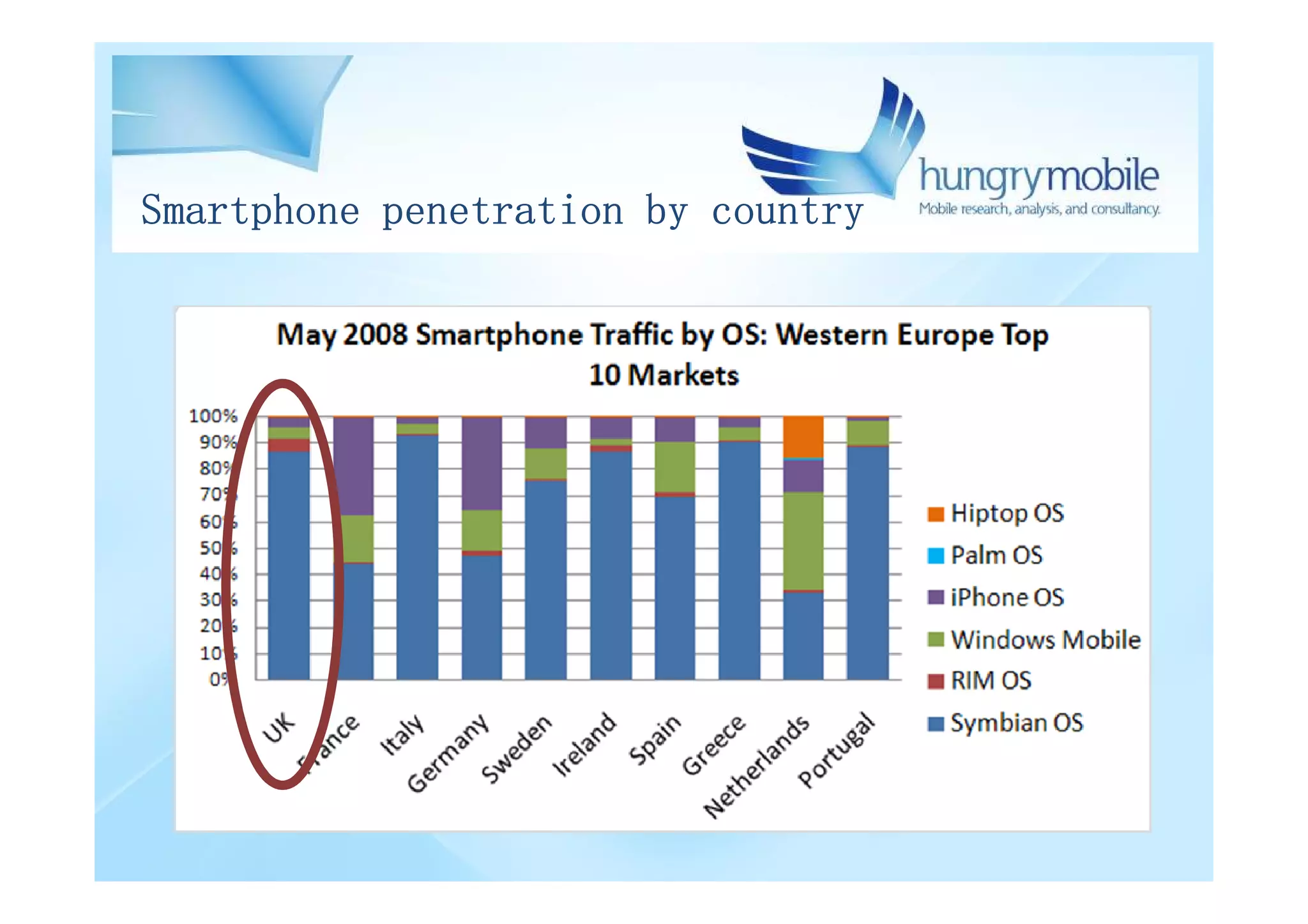

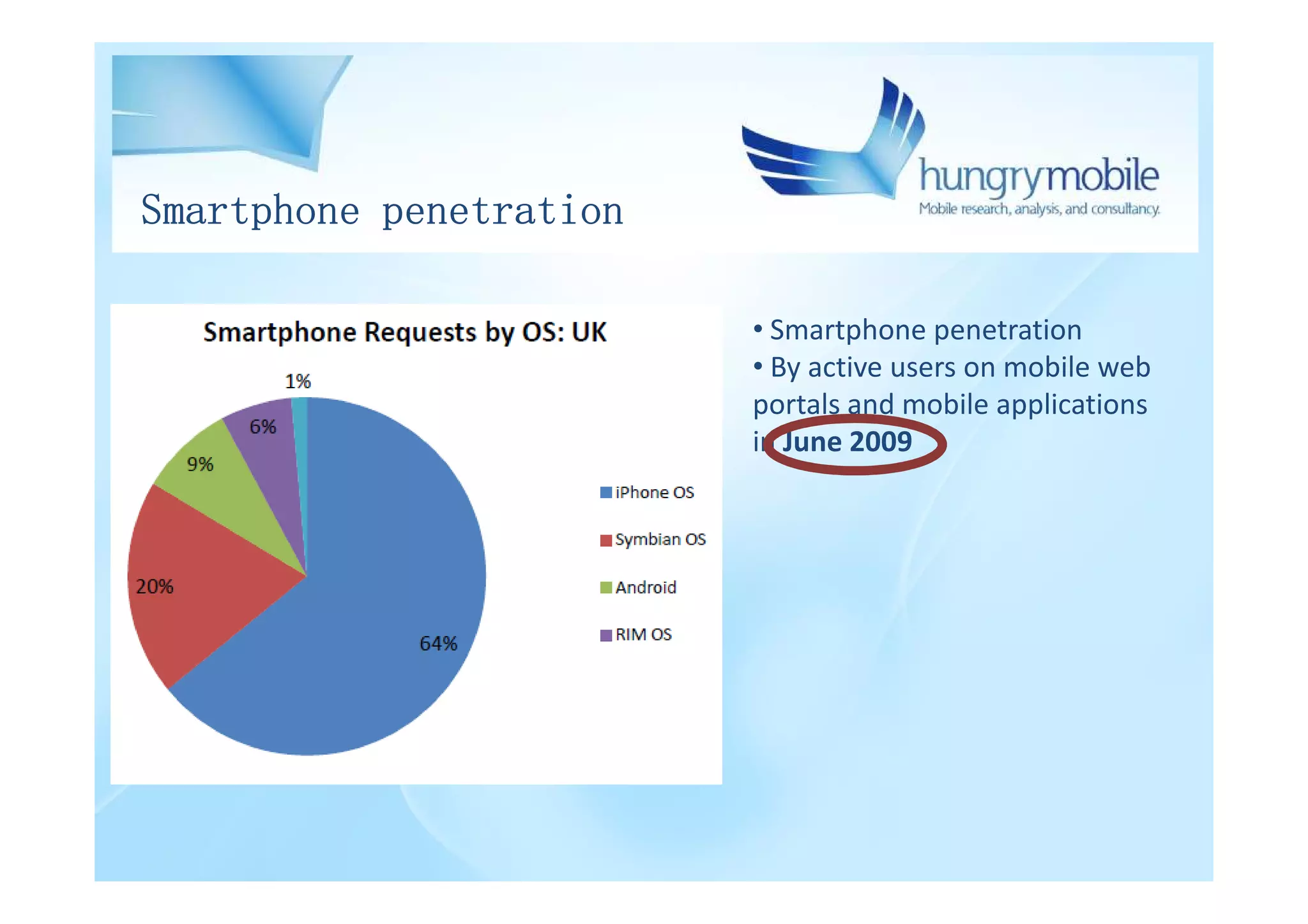

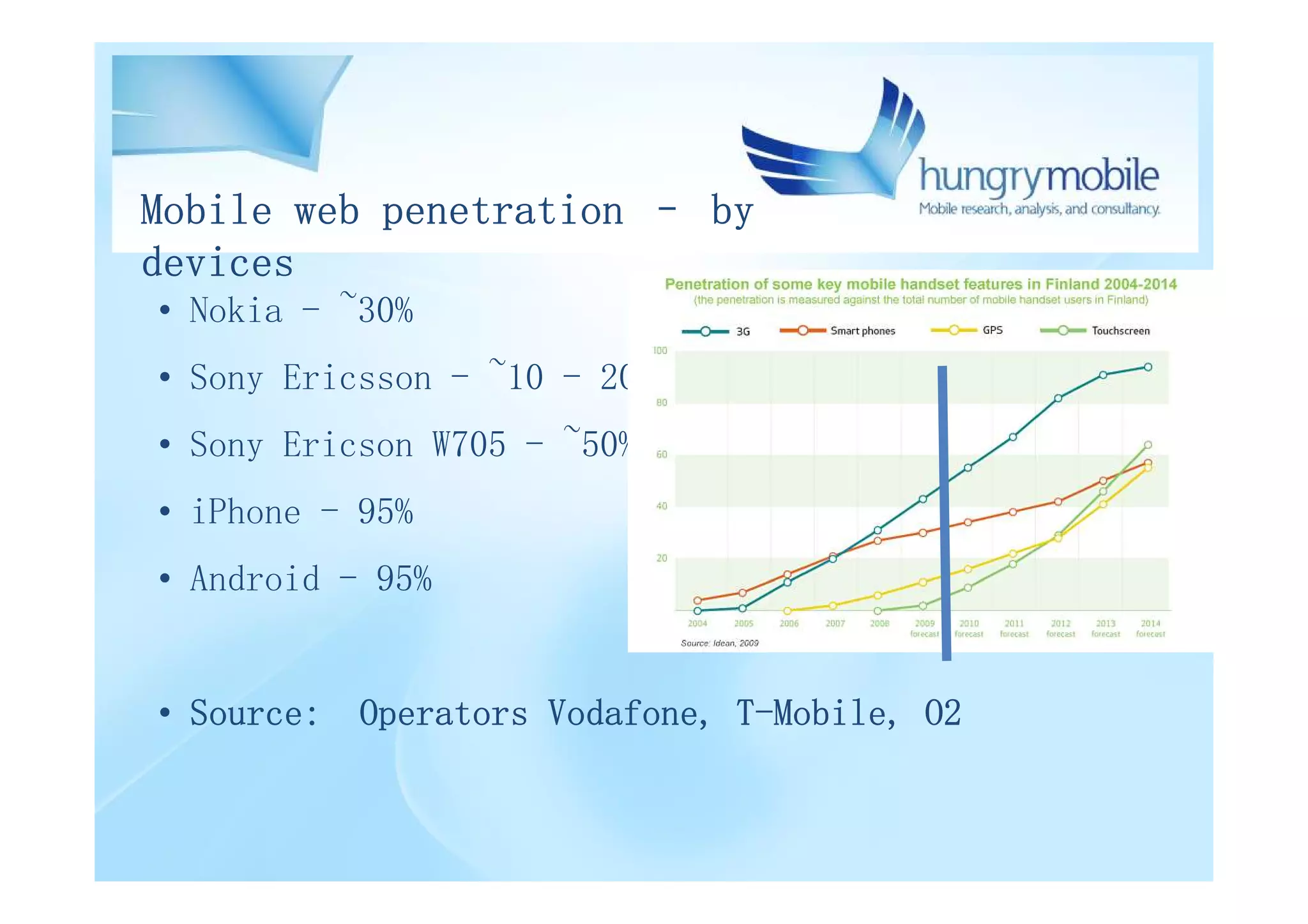

This document summarizes the evolution of mobile content and services in Europe over the past 10 years. It describes the transformation from basic phones to smartphones, the rise of mobile apps, and increasing smartphone and mobile web penetration across different European countries. It also discusses challenges like device diversity, localizing for different markets and carriers, and the difficulty of making money from mobile content. Finally, it provides best practices for success in Europe and predicts further growth of app stores and changes to operators' roles in the coming years.