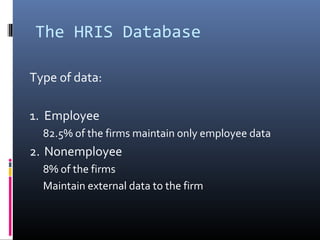

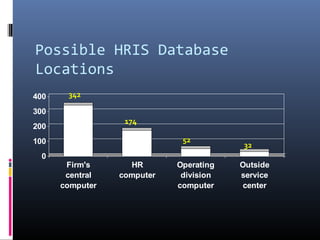

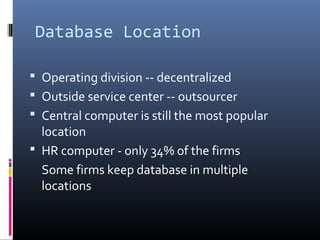

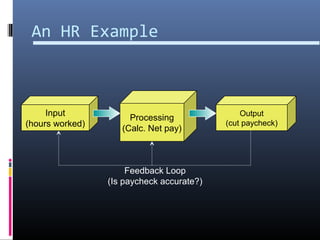

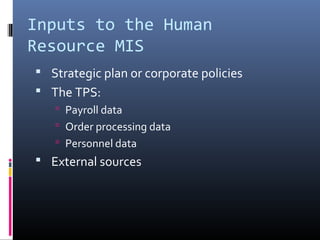

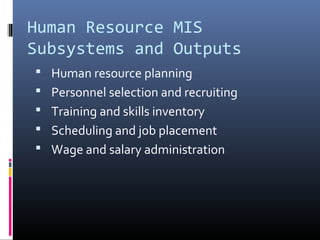

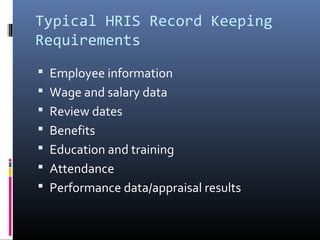

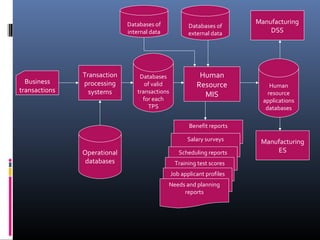

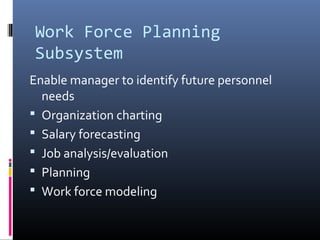

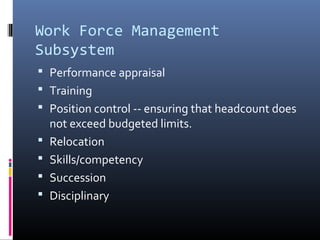

Human resource MIS systems evolved from paper files located in personnel departments to integrated digital systems. Key aspects of HR MIS include planning personnel needs, developing employee potential, and controlling personnel policies. The majority of firms maintain employee databases, while some also track external nonemployee data. Most firms store databases on central computers, while some use HR computers, operating division computers, or outsource storage. HR MIS provides subsystems and outputs for functions like human resource planning, recruiting, training, compensation administration, and benefits administration.