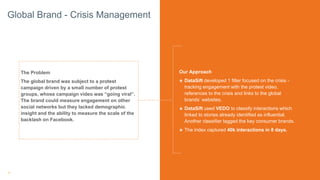

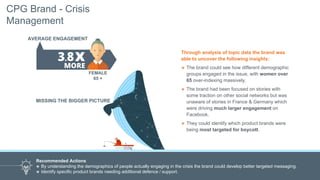

The document discusses optimizing marketing strategies using Facebook Topic Data, highlighting its ability to provide marketers with insights from a vast array of user interactions while maintaining privacy. It presents various use cases across different industries, emphasizing how brands can analyze consumer behavior, engagement patterns, and competitive positioning. Recommendations are provided on tailoring advertising strategies based on demographic insights and engagement metrics derived from the data.