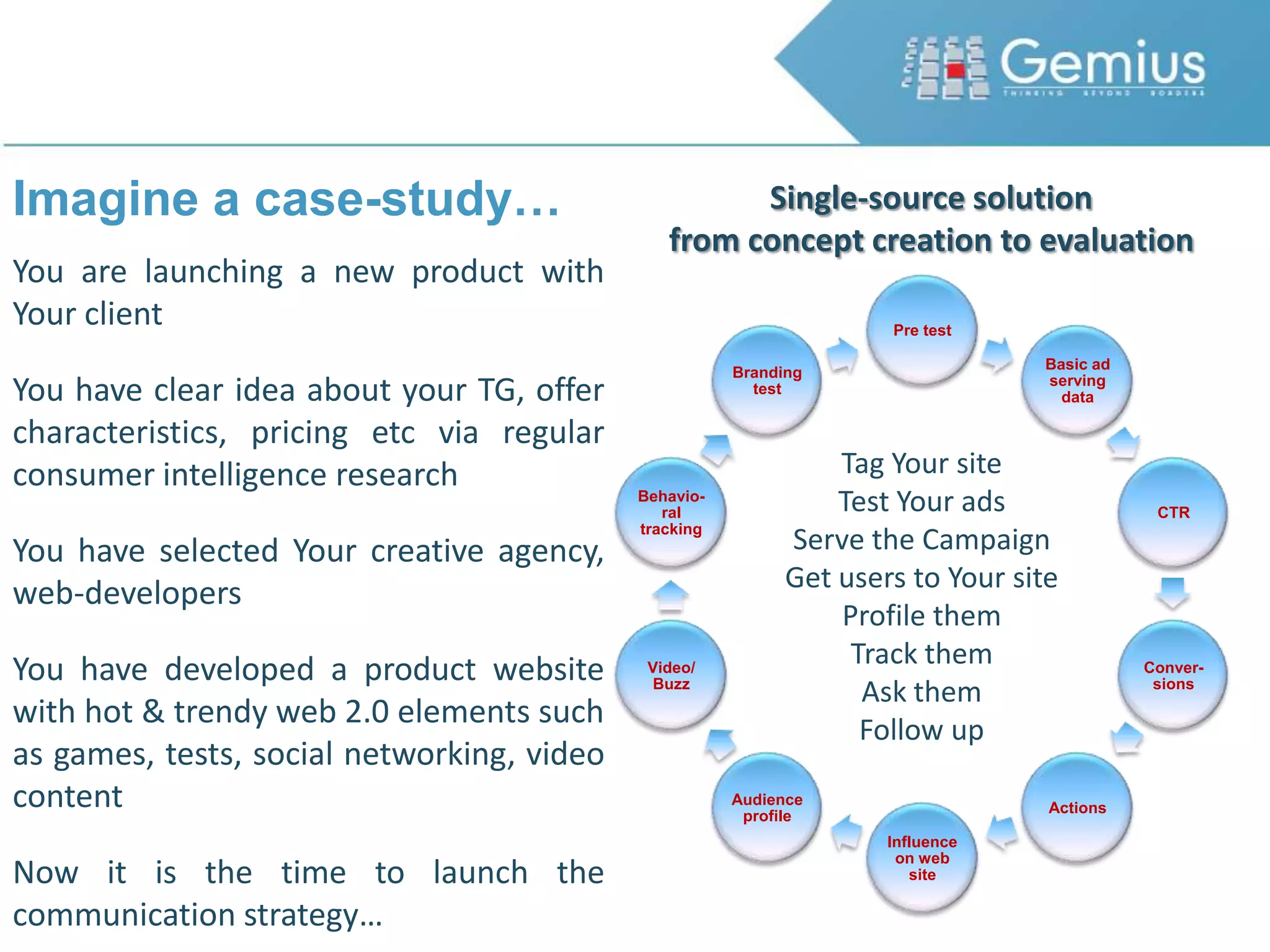

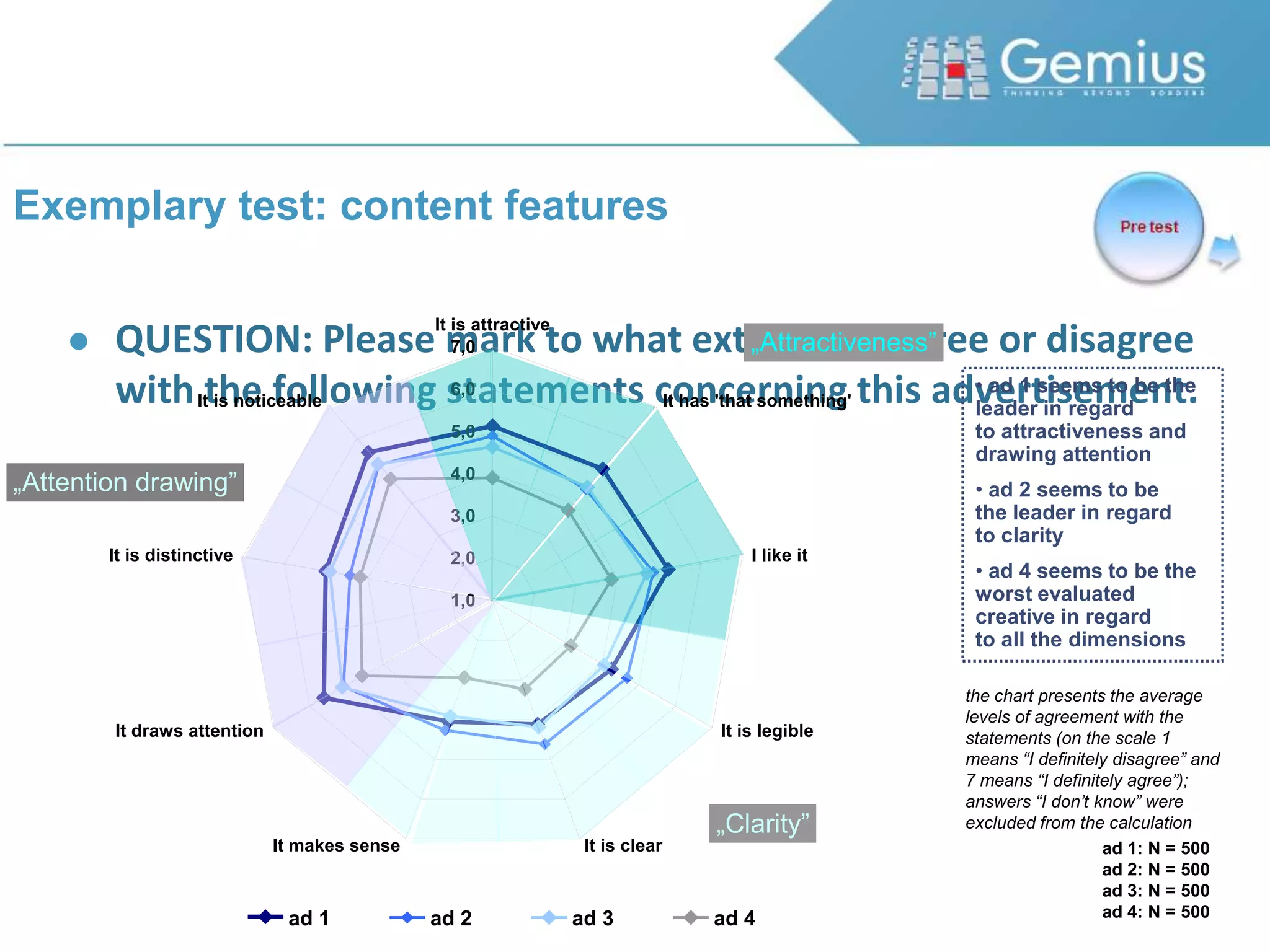

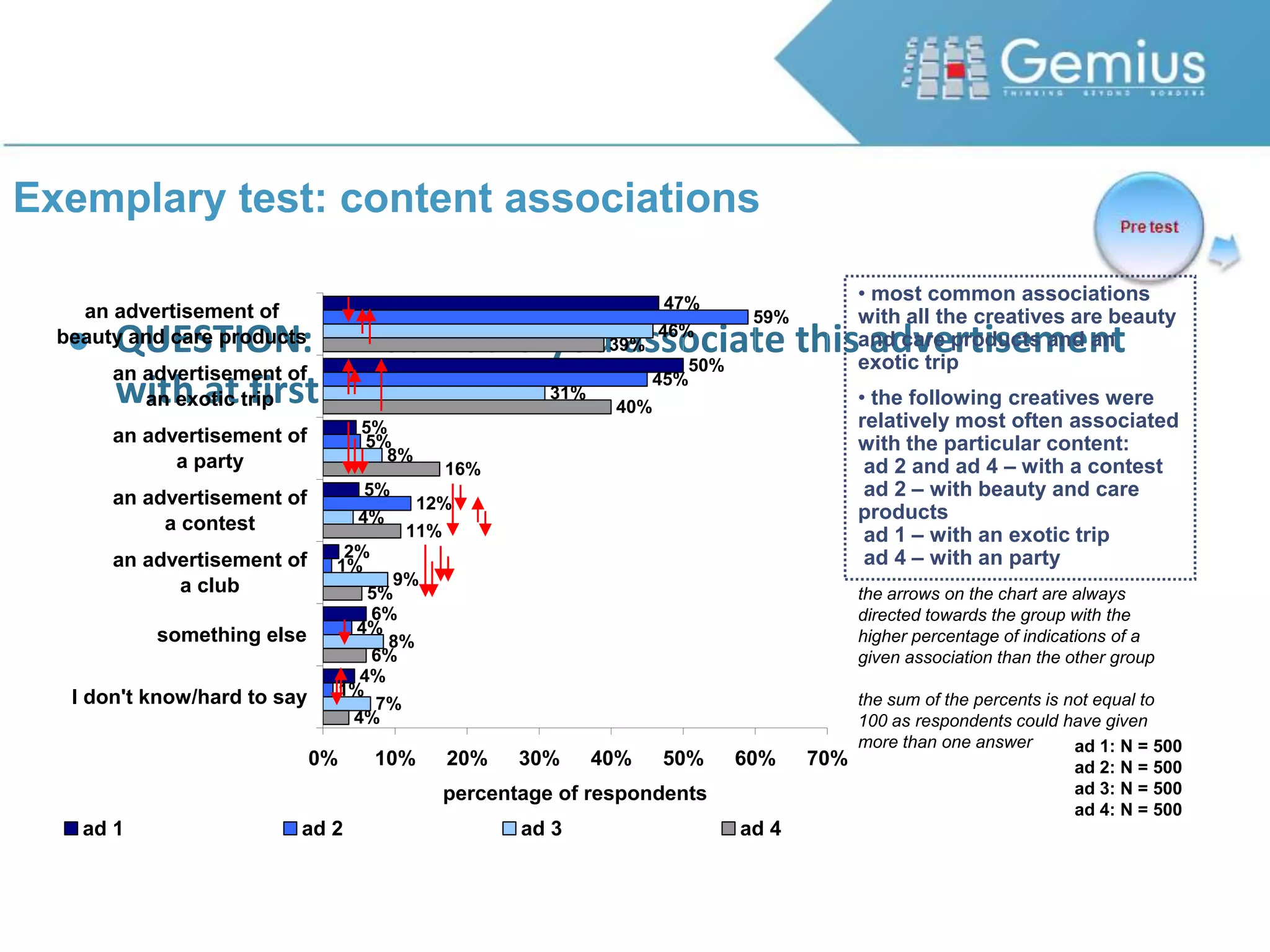

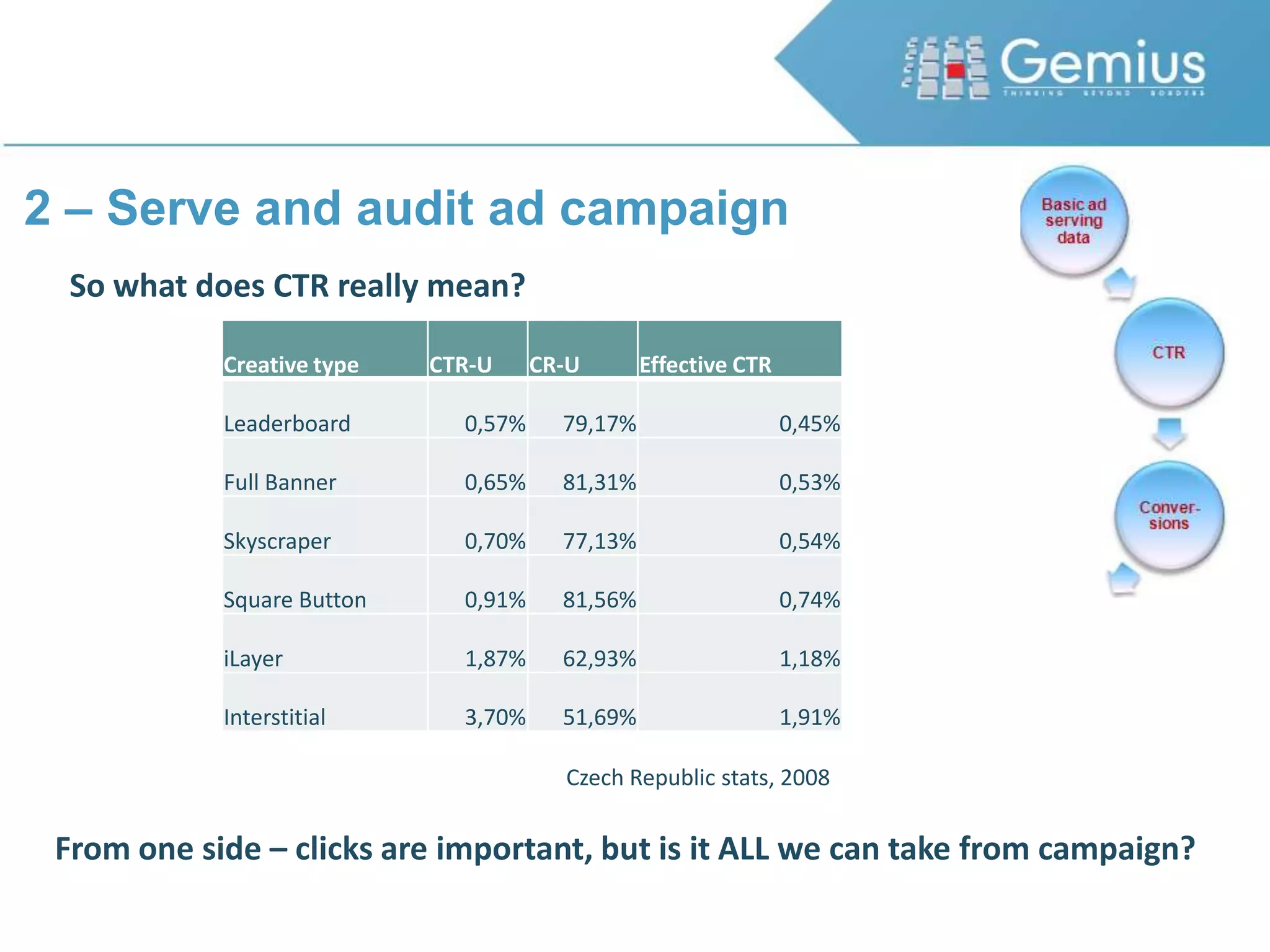

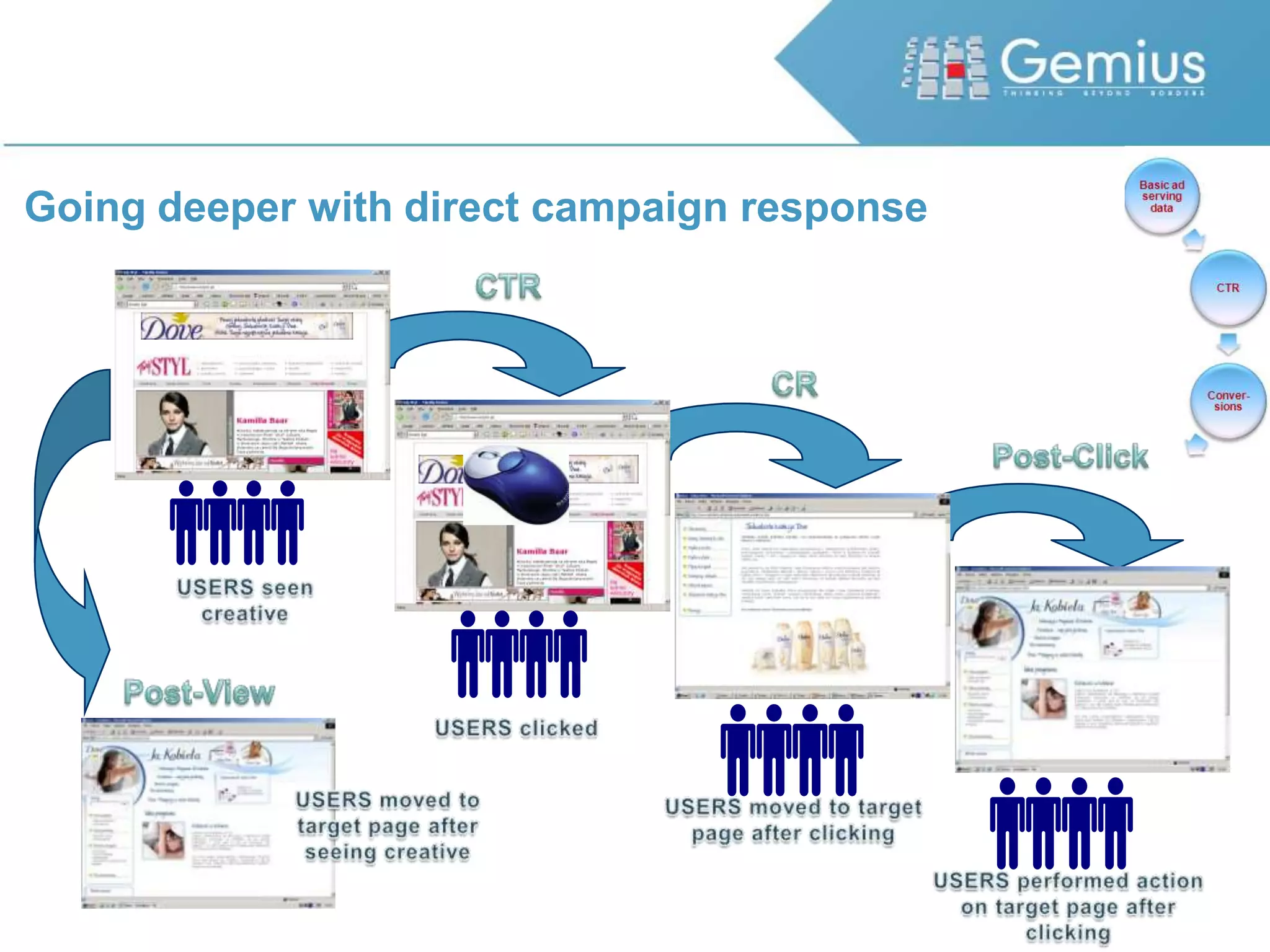

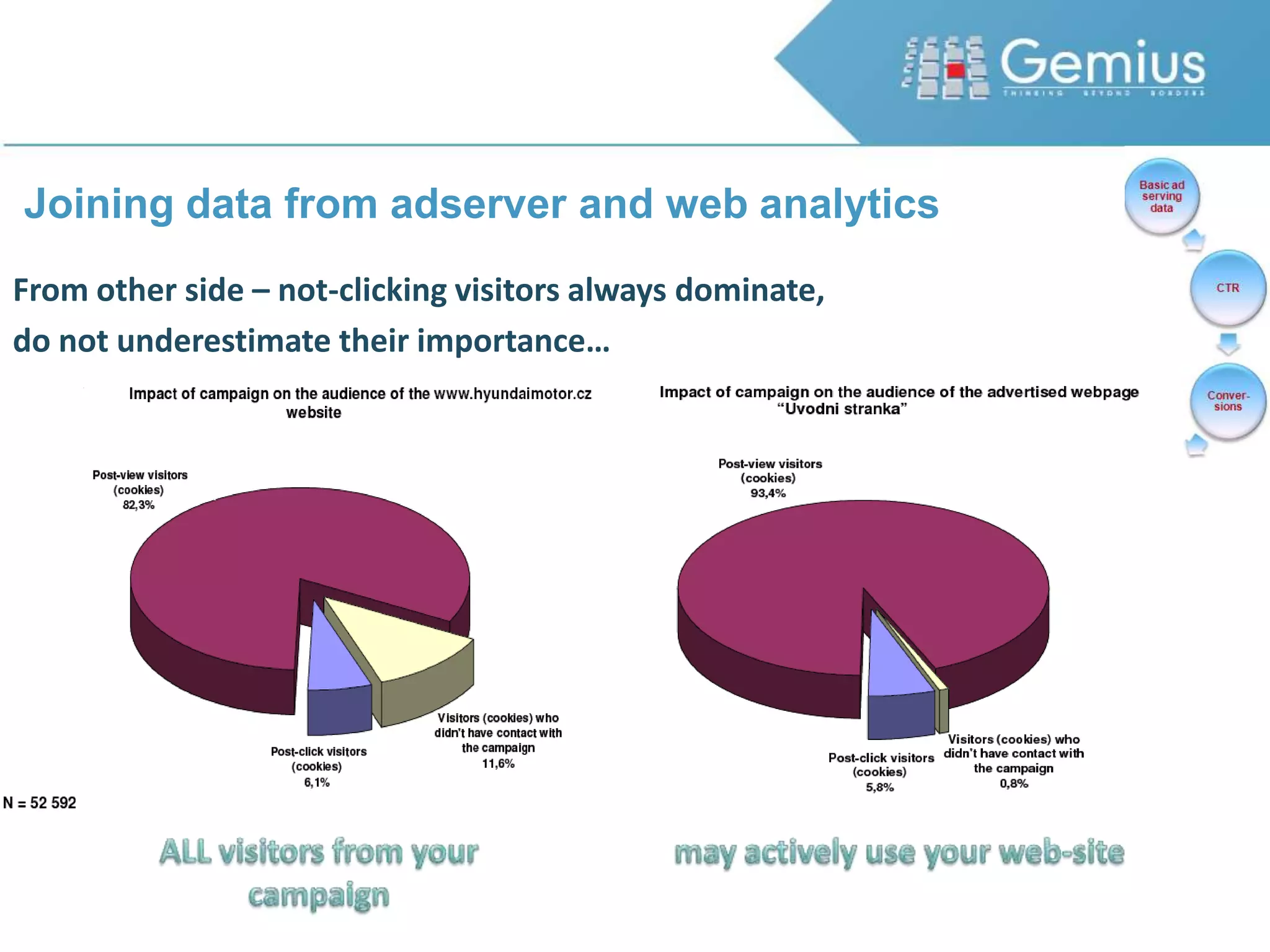

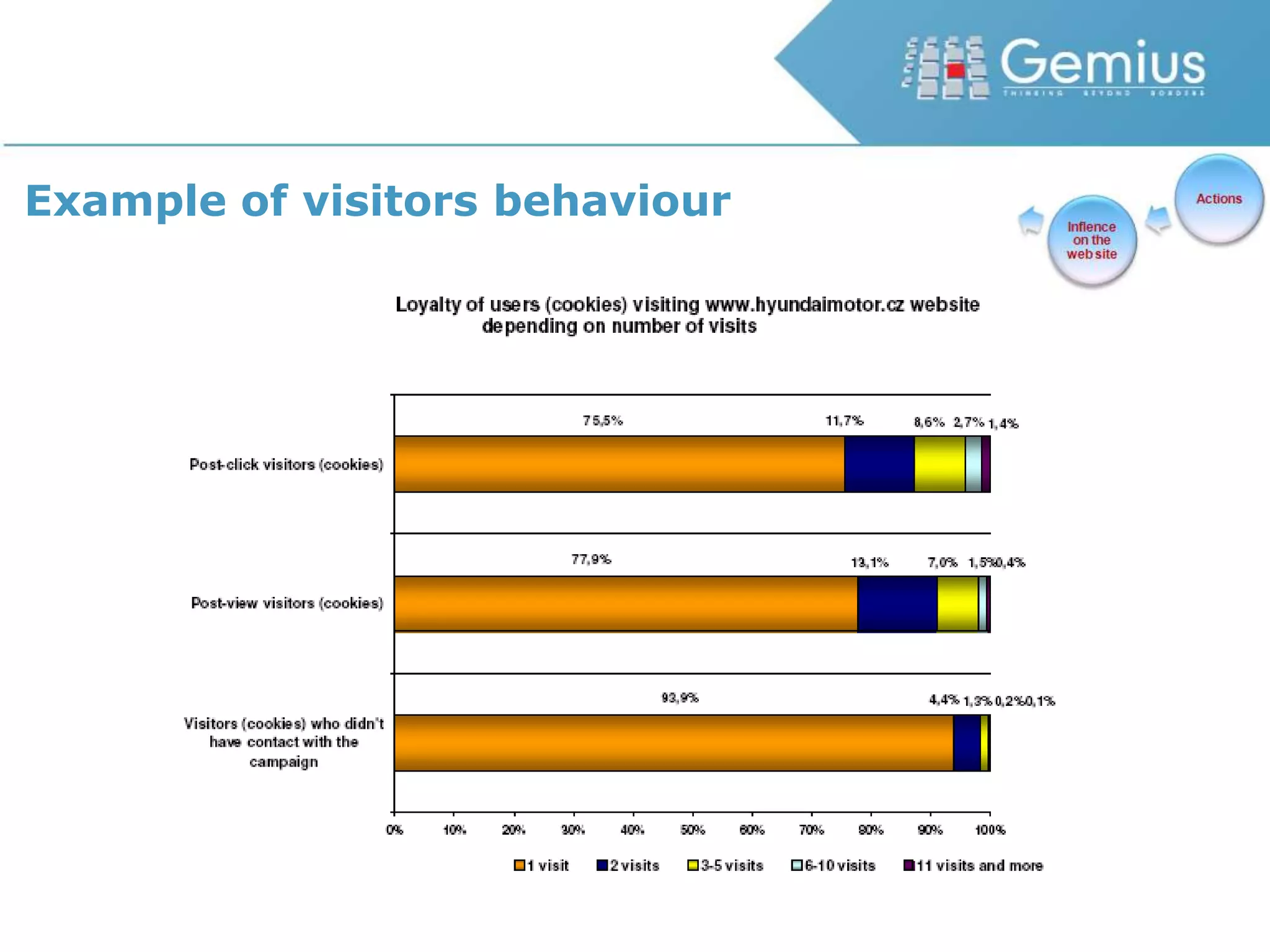

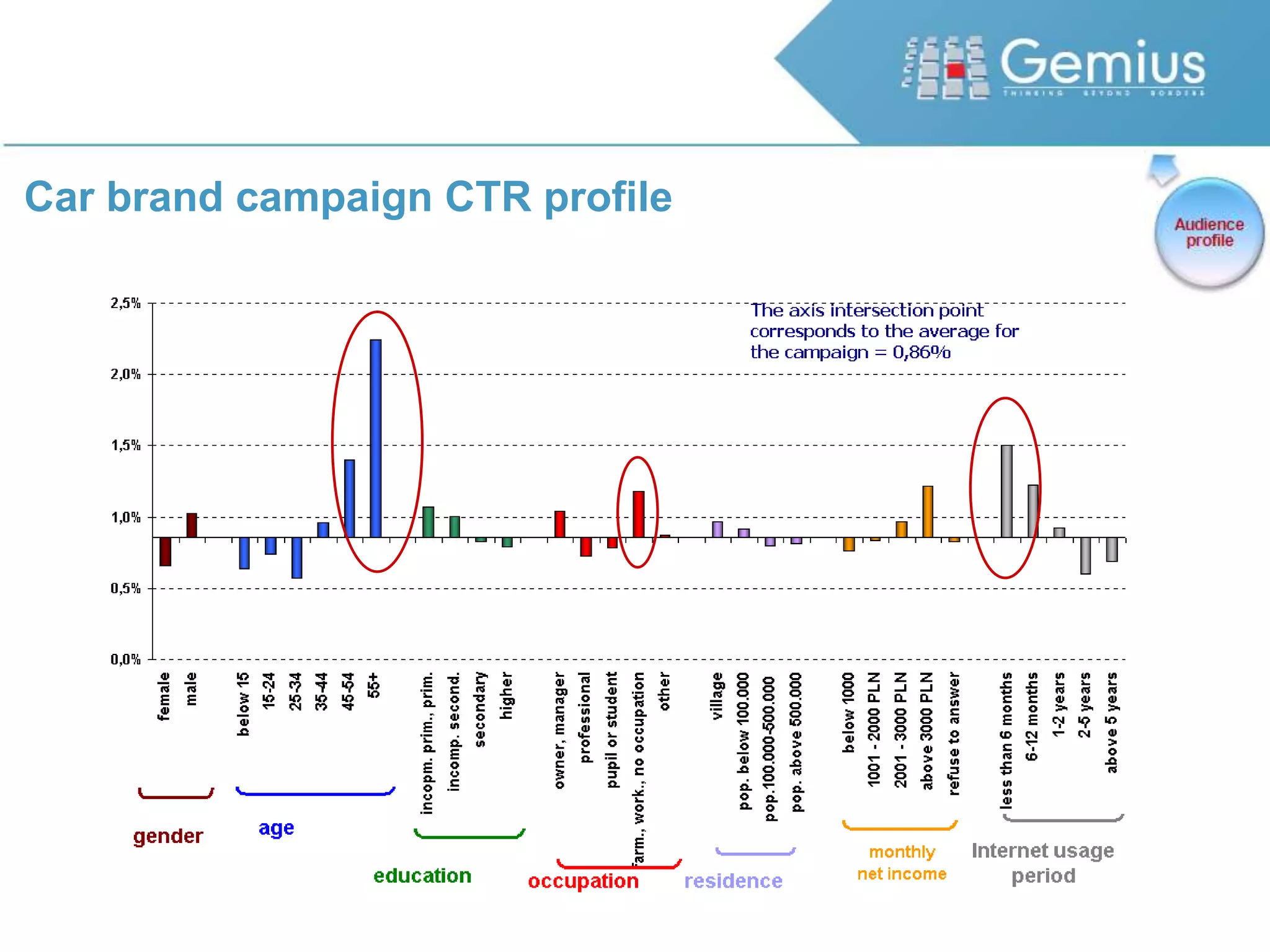

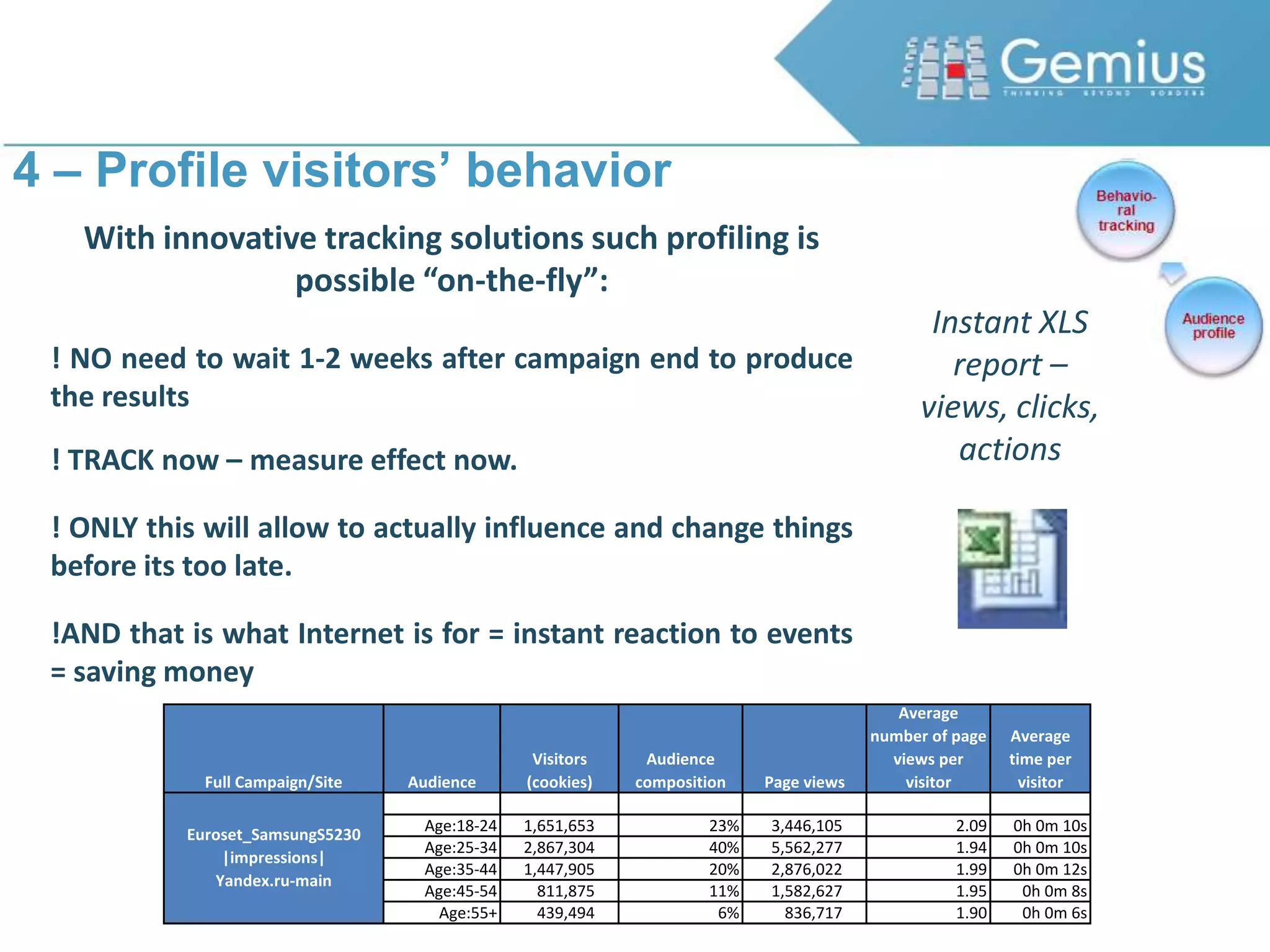

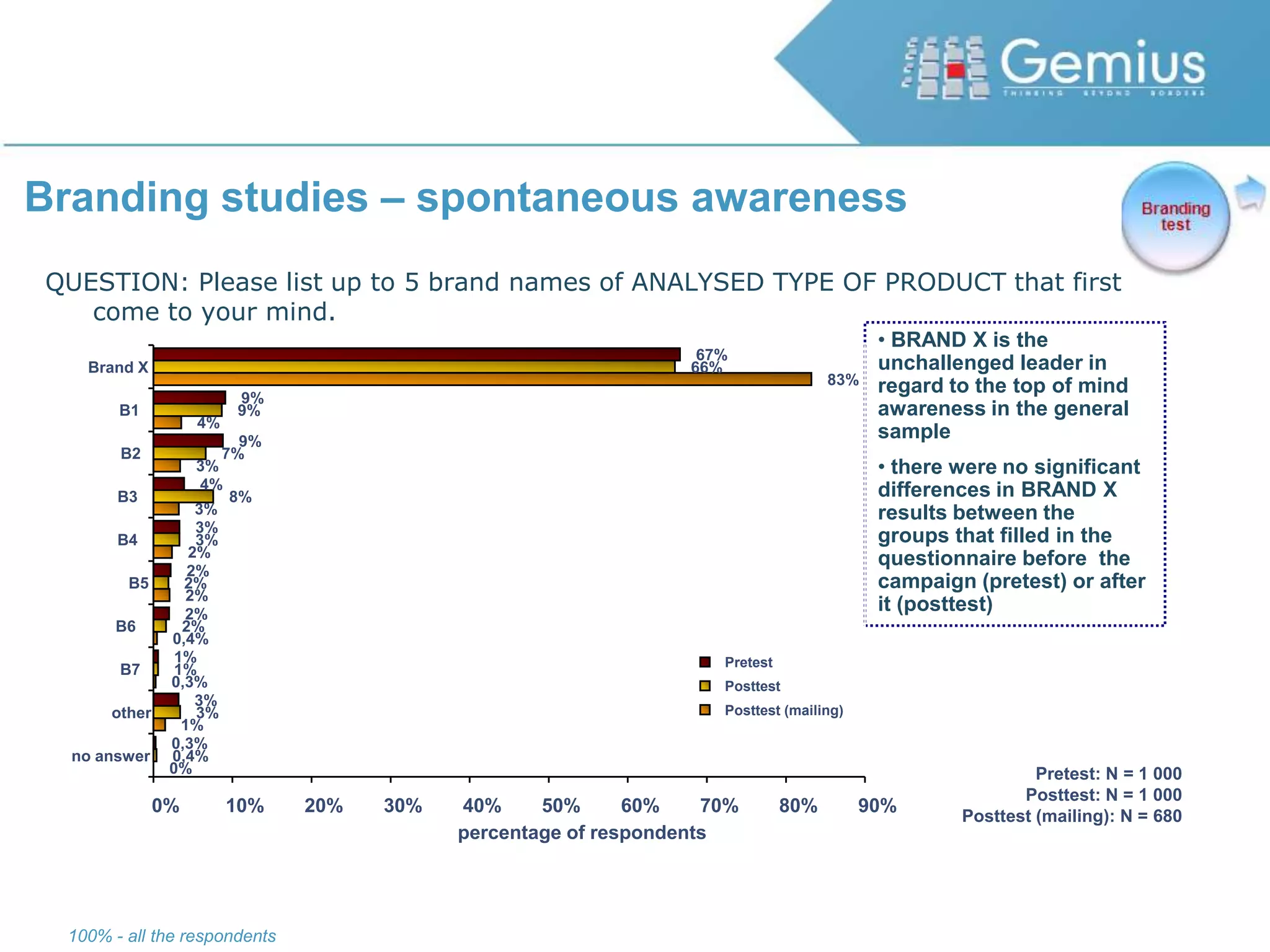

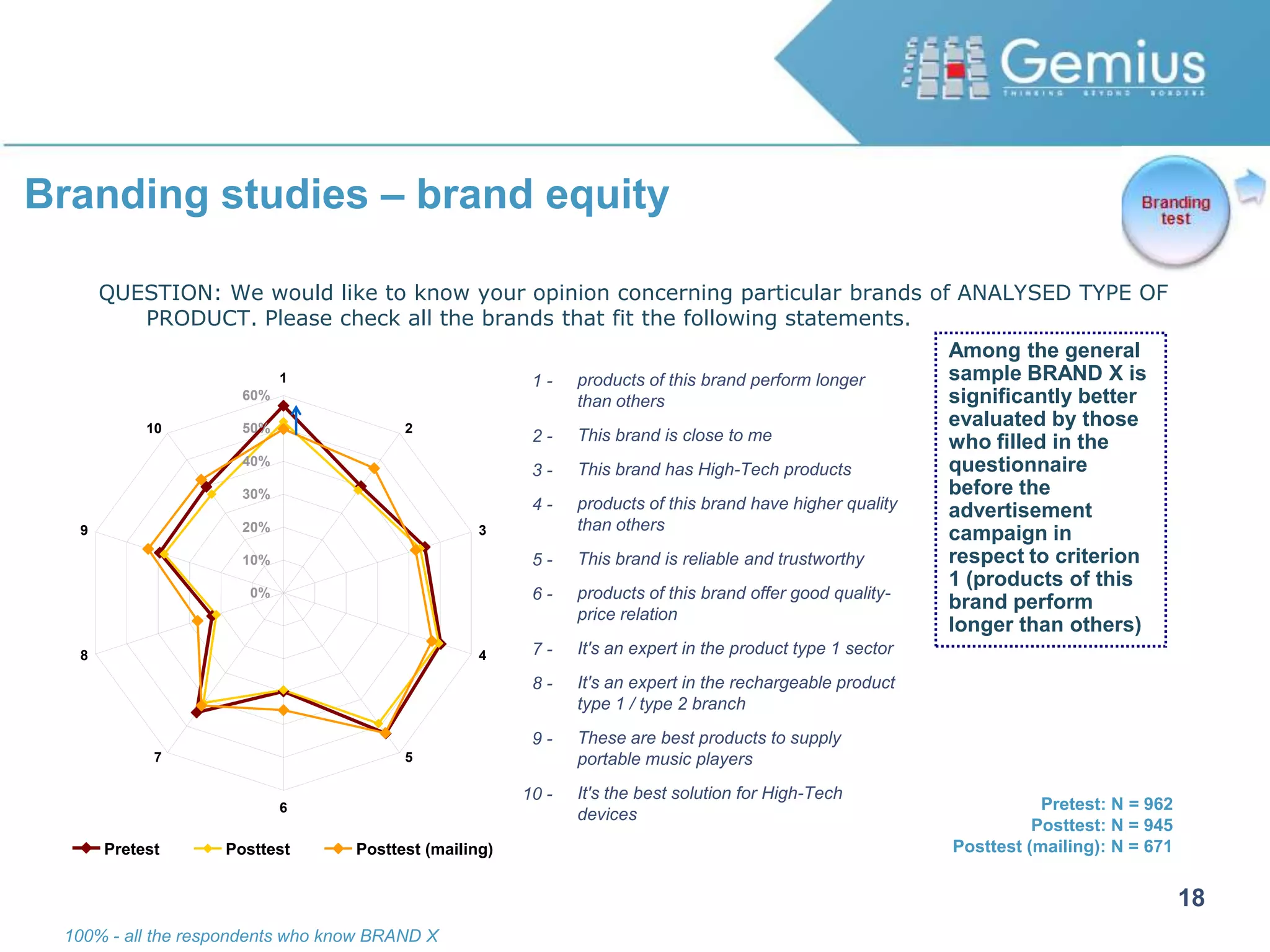

This document discusses measuring the success of online marketing campaigns from concept to evaluation. It recommends starting with pre-campaign copy testing to determine the most effective creative content. During the campaign, data from the ad server and web analytics should be joined to track user actions like click-through rate, conversion rate, and post-click and post-view behaviors. After the campaign, users should be profiled and their behavior analyzed to evaluate if the right audience was reached. Post-campaign branding studies can also assess the influence on brands through measures like awareness and brand equity. The key is integrating research functions like pre-testing, monitoring and post-analysis for a full picture of campaign performance.