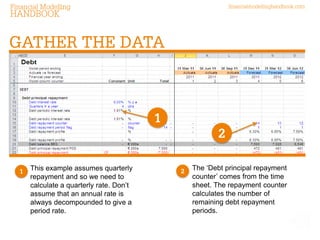

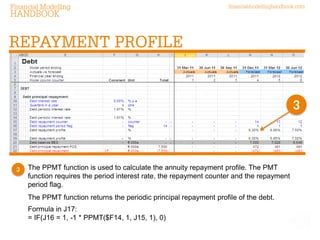

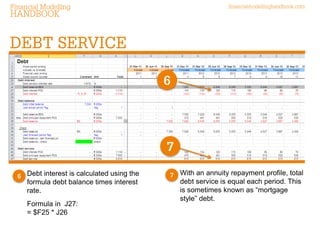

The Financial Modelling Handbook is a collaborative guide focused on building better financial models, particularly for debt annuity repayments. It details how to calculate an annuity payment profile using various functions and assumptions, emphasizing accuracy and methodology. Key steps include gathering data, calculating principal repayments, and determining debt service consistently across periods.