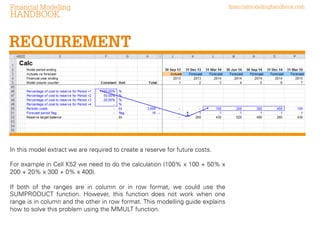

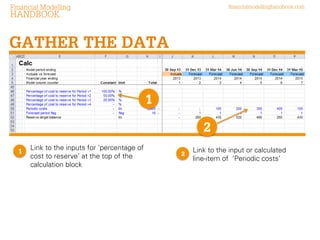

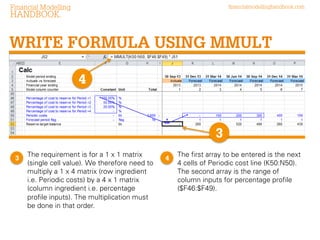

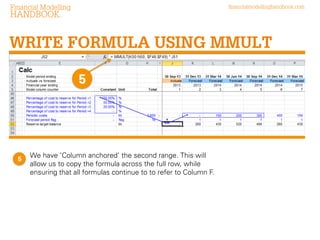

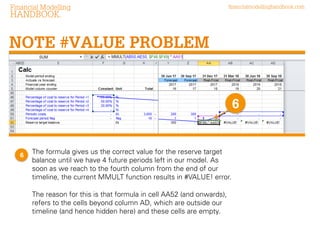

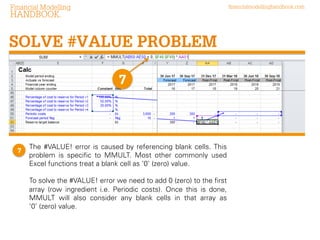

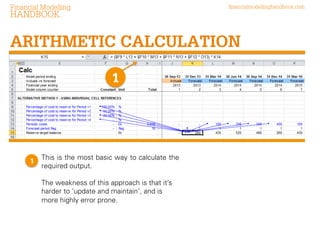

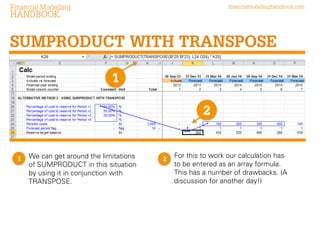

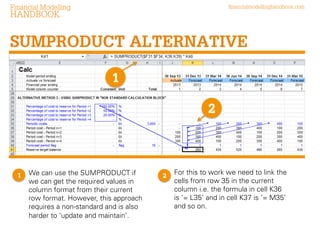

The Financial Modelling Handbook offers guidance on calculating reserve account target balances using the MMULT function, emphasizing the importance of collaboration in financial modelling. It provides solutions to common issues, such as the #VALUE! error caused by referencing blank cells, and discusses alternatives to MMULT, including using SUMPRODUCT with TRANSPOSE. The document serves as a comprehensive resource for building more effective financial models.