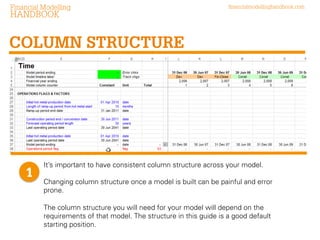

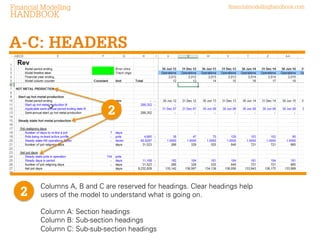

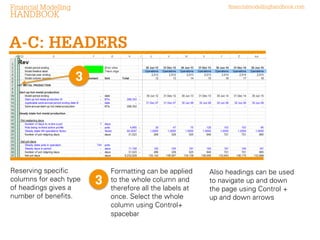

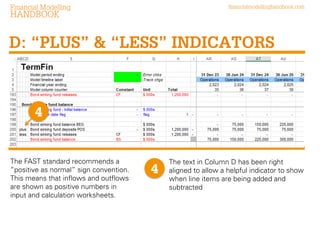

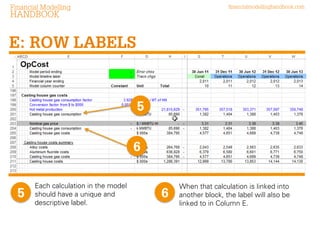

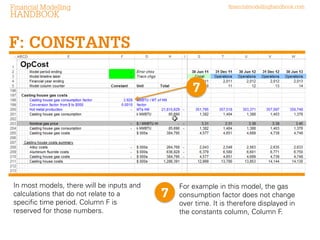

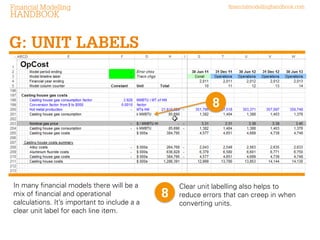

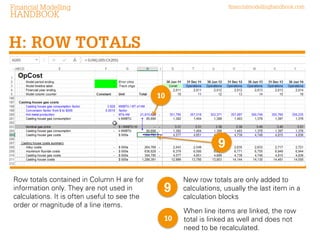

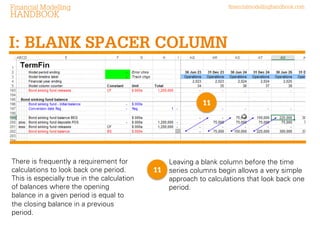

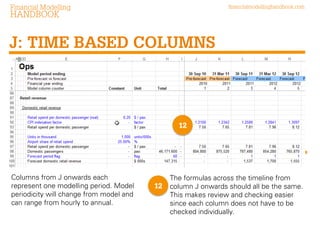

The financial modeling handbook emphasizes the importance of collaboration in creating efficient financial models and provides guidelines for a default model design. Key recommendations include maintaining a consistent column structure, using clear headings, applying positive as normal sign conventions, and ensuring unique labels for calculations. The guide serves as a foundational resource for building financial models, suggesting practices that enhance clarity and reduce errors.