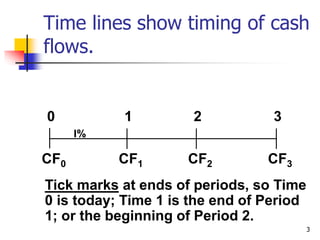

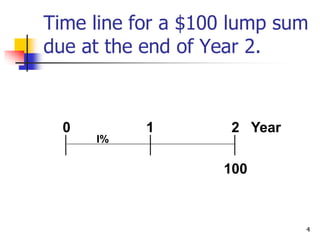

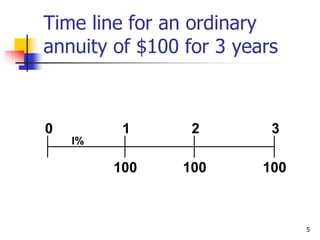

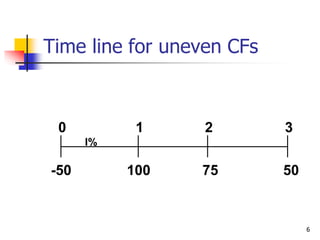

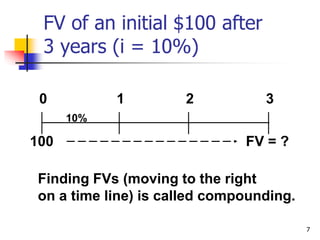

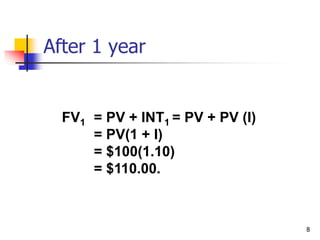

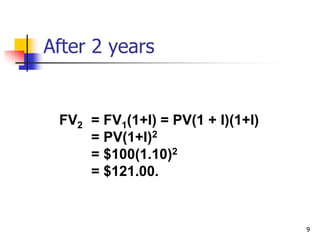

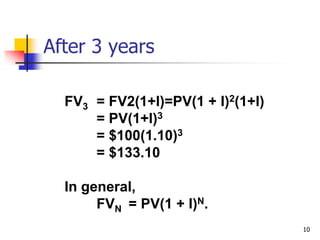

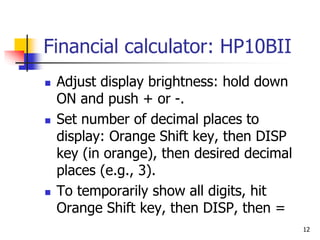

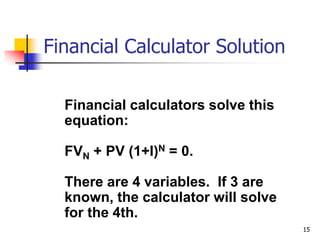

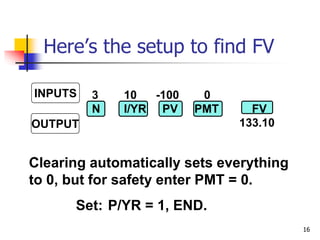

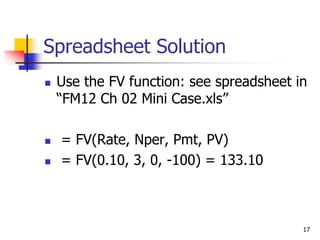

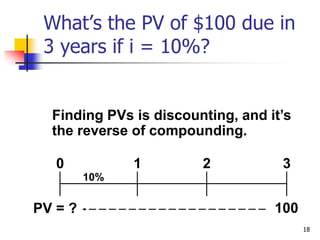

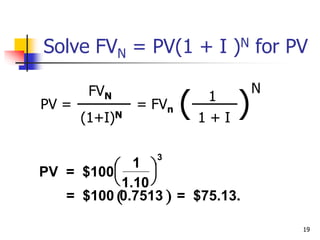

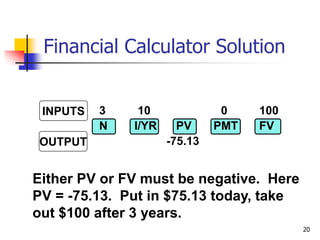

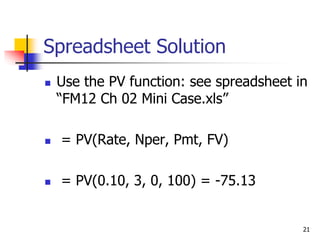

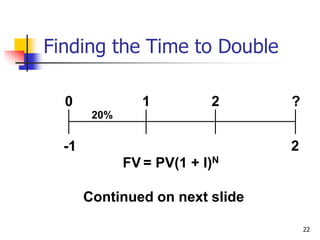

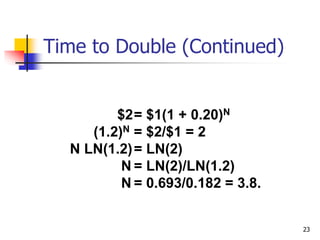

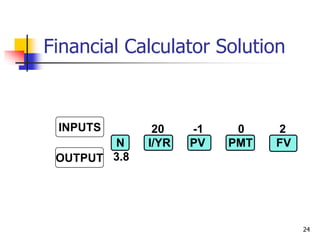

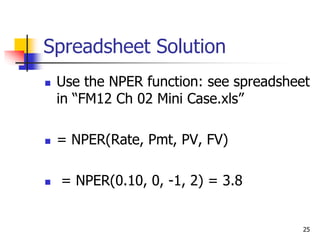

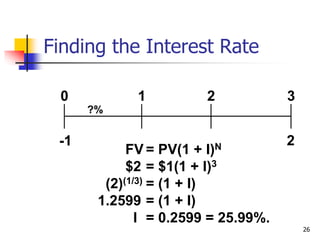

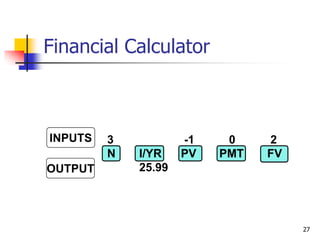

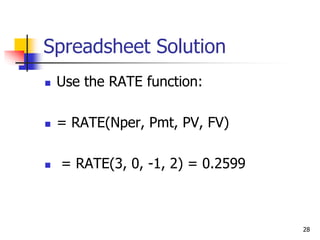

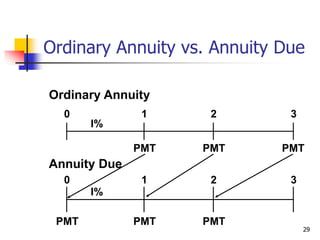

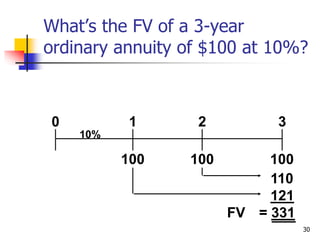

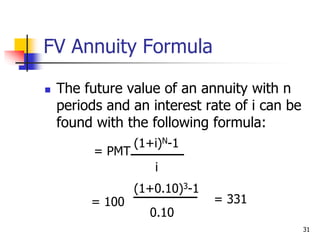

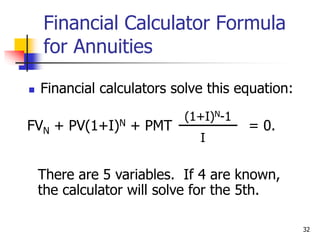

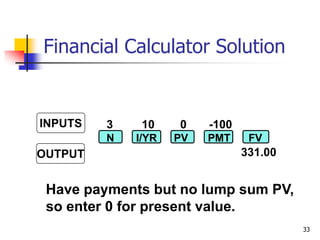

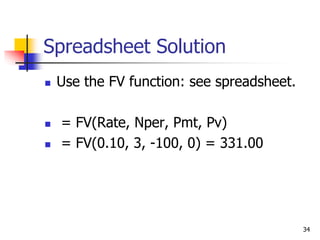

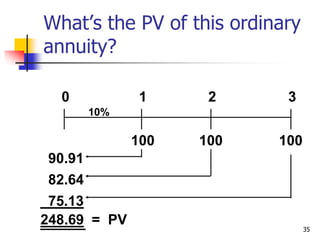

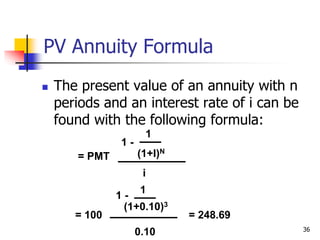

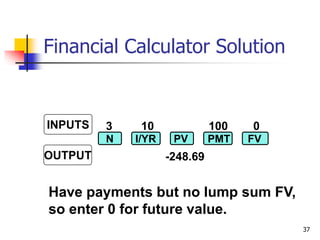

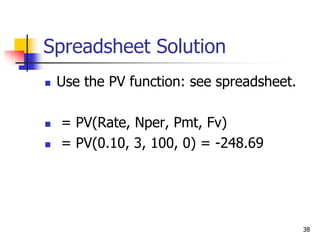

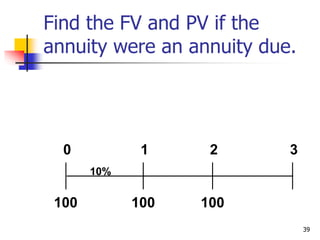

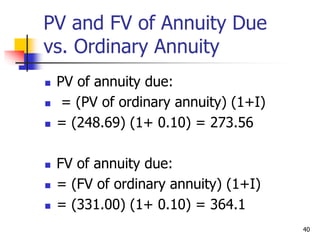

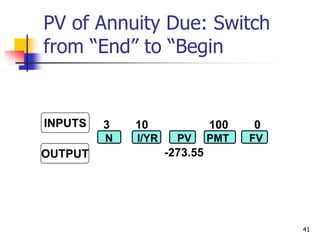

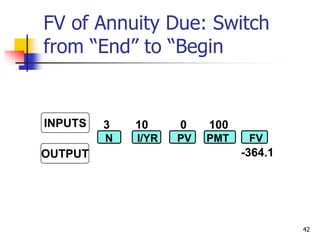

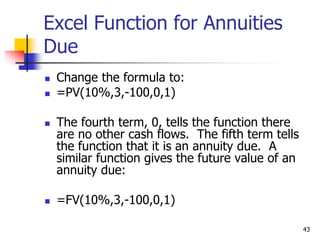

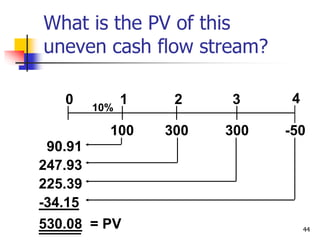

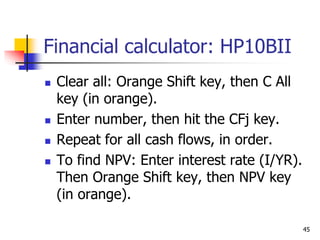

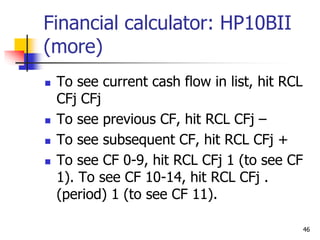

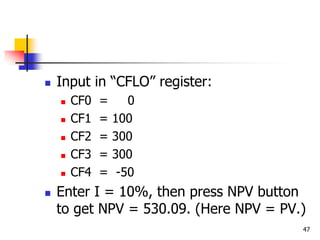

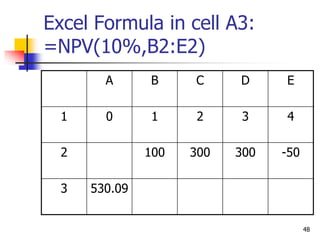

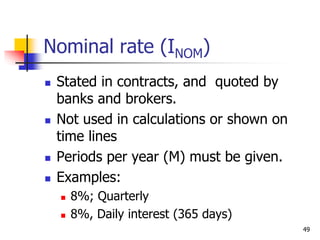

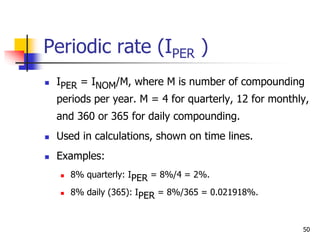

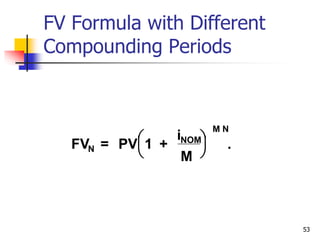

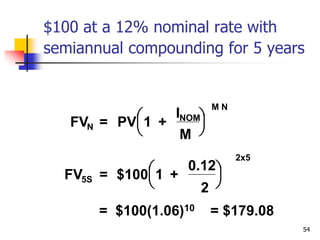

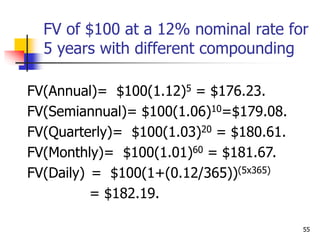

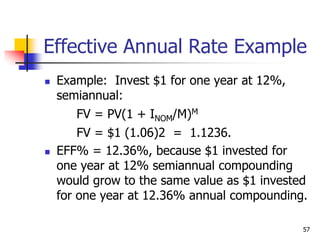

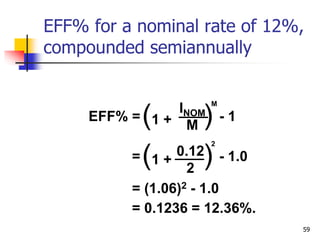

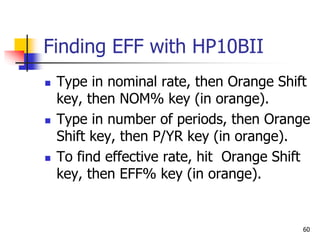

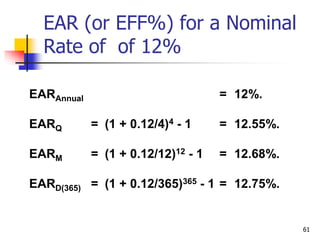

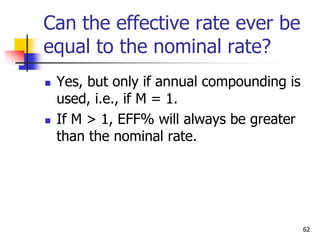

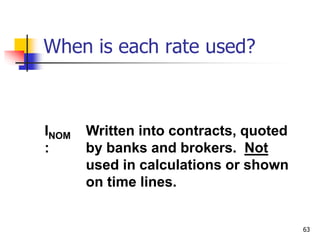

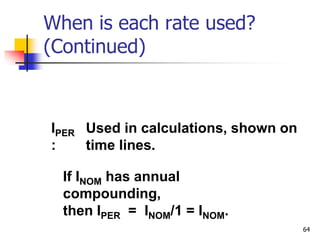

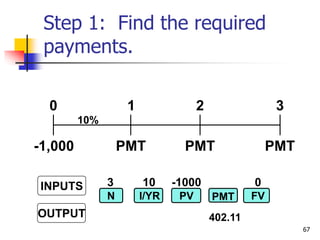

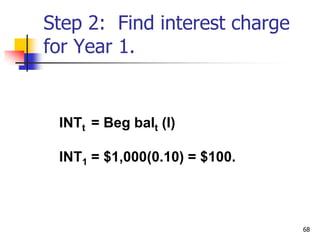

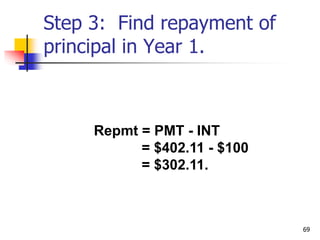

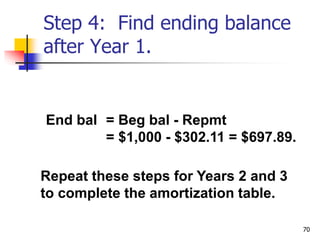

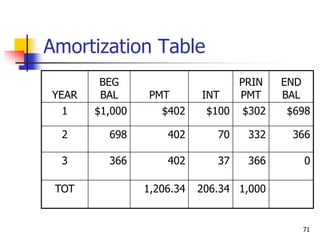

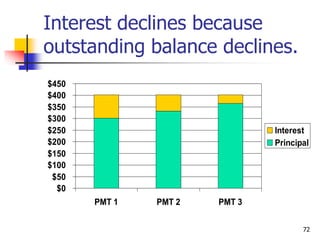

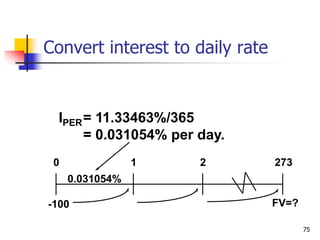

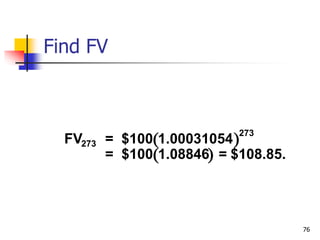

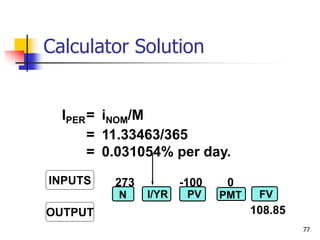

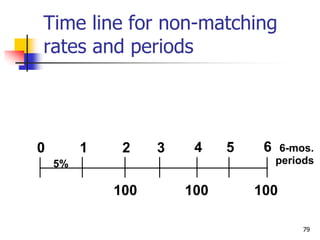

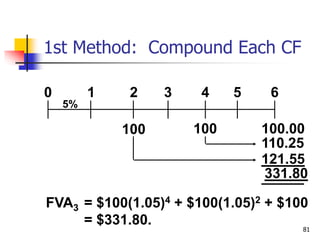

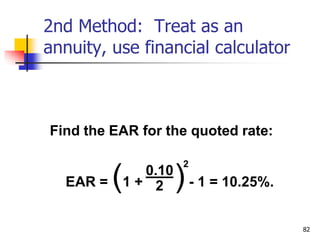

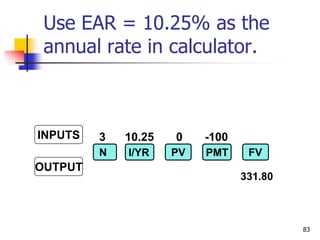

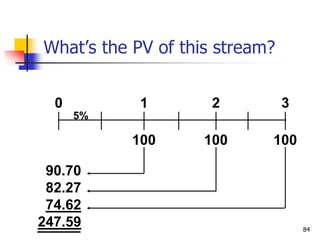

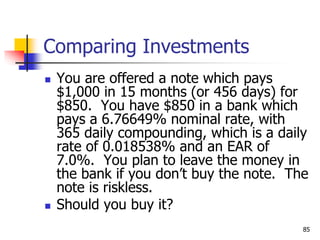

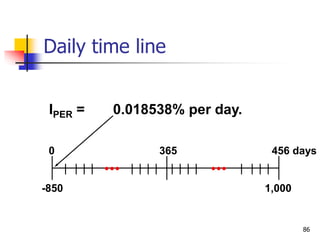

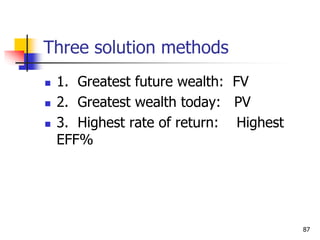

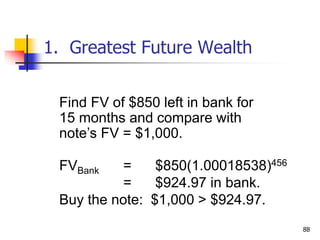

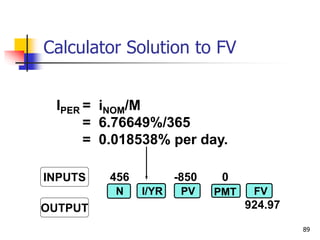

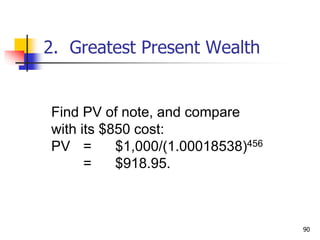

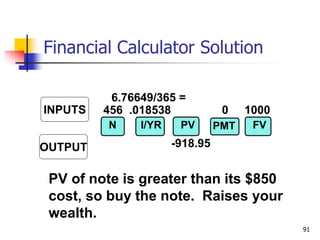

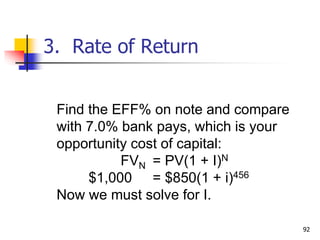

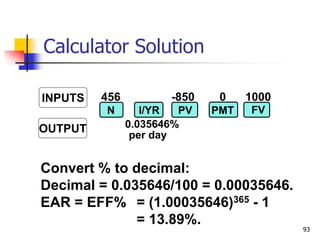

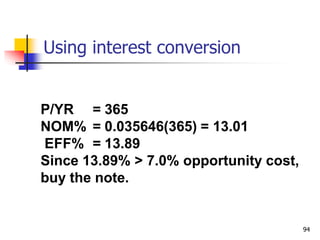

This document discusses time value of money concepts including future value, present value, interest rates, and amortization. It provides examples of calculating future and present values using formulas, financial calculators, and spreadsheets. It also covers topics such as nominal versus effective interest rates, and the impact of more frequent compounding which results in higher future values.