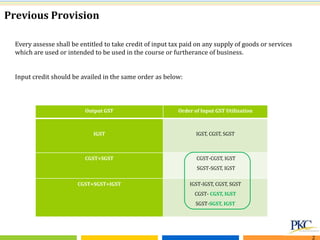

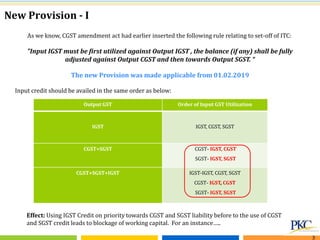

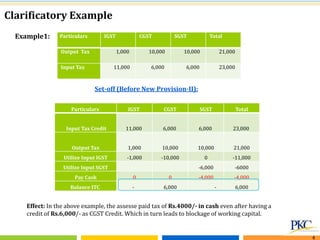

The document outlines the changes in the GST input tax credit (ITC) set-off rules, emphasizing the new order of utilization that prioritizes IGST against output taxes and allows flexibility in utilizing CGST and SGST. There are examples provided to illustrate the impact of these changes, showing improvements in cash flow for taxpayers post-amendment. Additionally, it highlights current issues with the GST portal not supporting the revised set-off rules and the need for future updates on functionality.