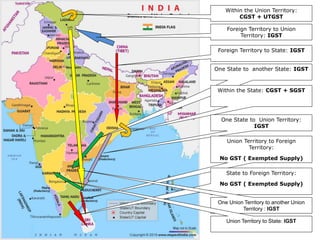

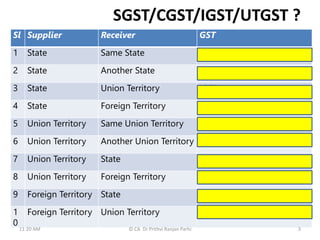

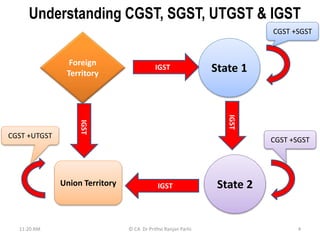

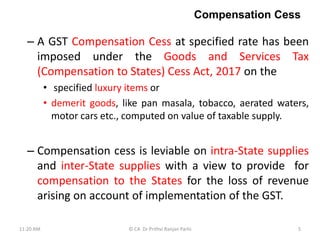

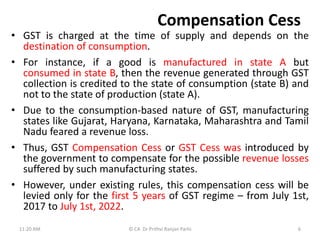

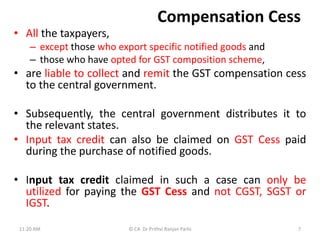

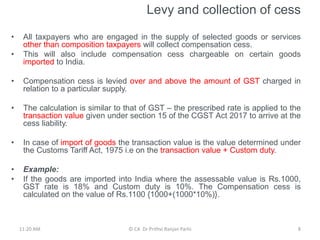

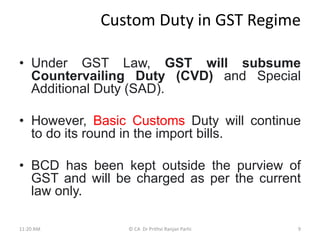

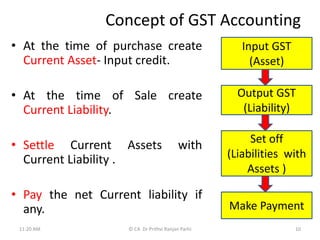

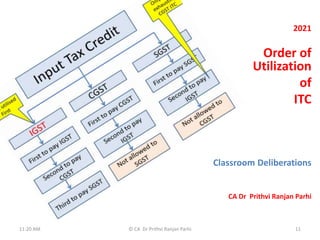

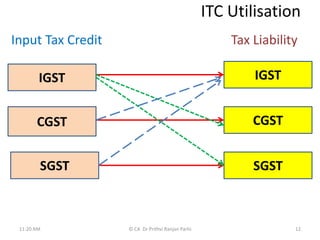

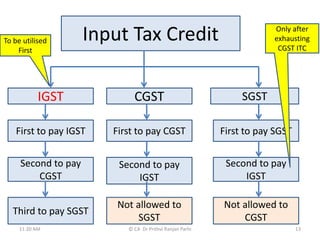

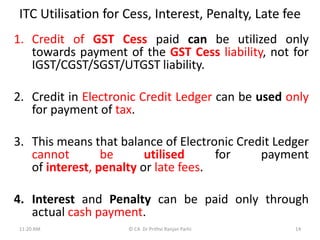

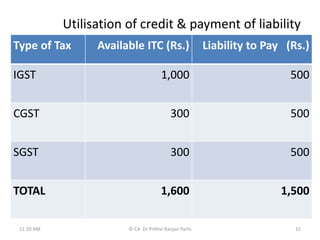

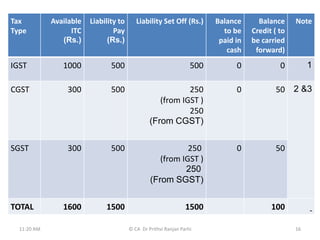

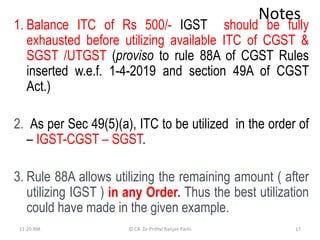

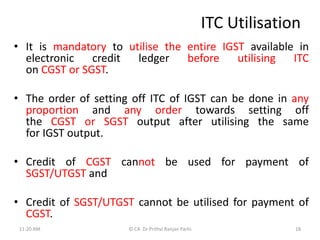

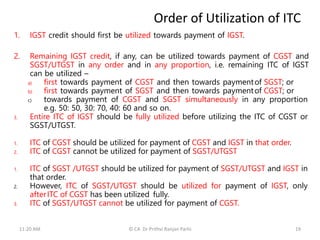

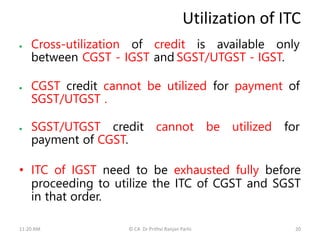

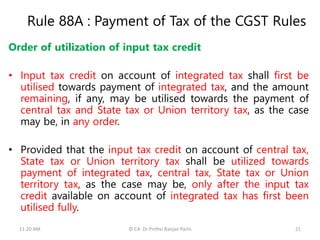

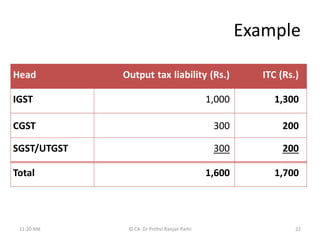

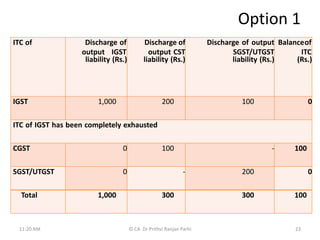

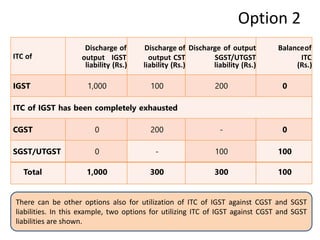

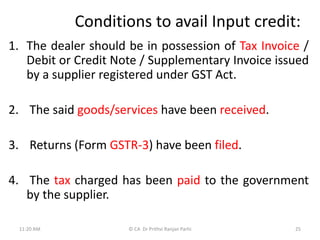

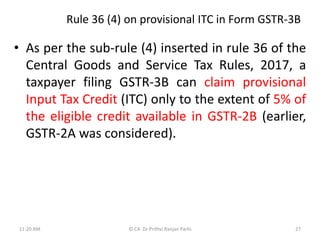

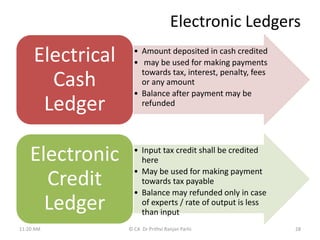

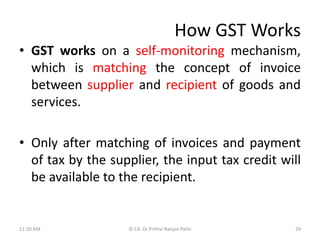

This document discusses the payment of GST (Goods and Services Tax) in India. It provides examples of the different types of GST (CGST, SGST, UTGST, IGST) that are applicable in various situations like inter-state supplies, intra-state supplies, and supplies between states and union territories. It also discusses the concept of input tax credit, the order in which input tax credit must be utilized (IGST first, then CGST, then SGST), and provides an example to illustrate this. Additionally, it briefly explains the compensation cess that is levied on luxury and demerit goods to compensate states for potential loss of revenue under GST.

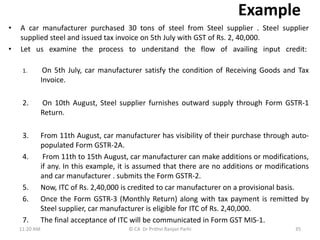

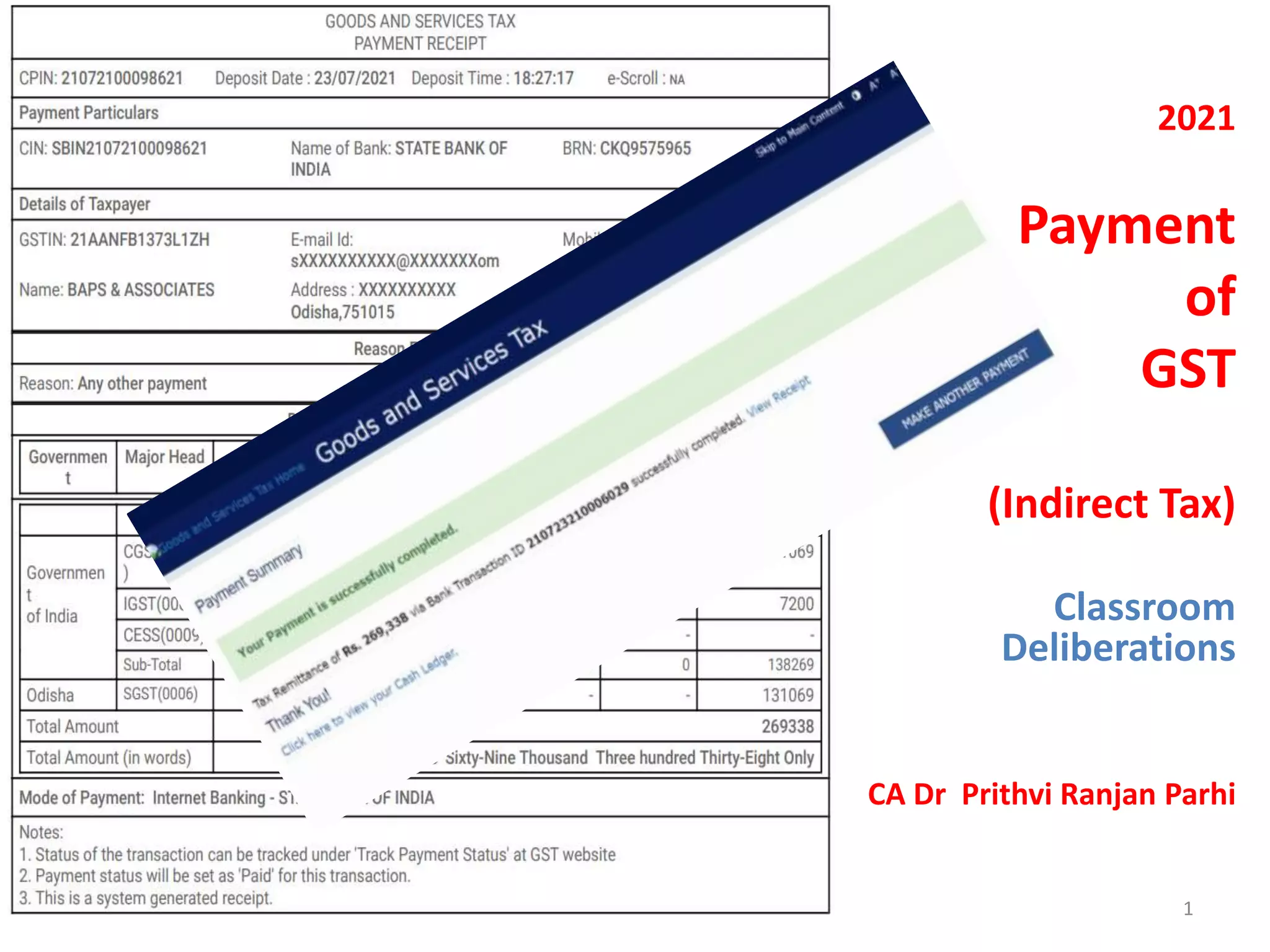

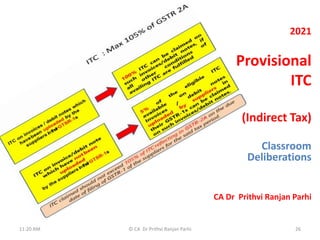

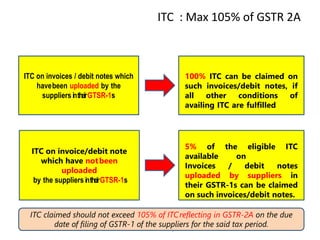

![Example

Amount of ITC

involved in the

invoices (Rs.)

Amount of ITC that

can beavailed (Rs.)

85 invoices uploaded in

GSTR-1

9.5 lakh 9.5 lakh

[Refer Note 1]

15 invoices not uploaded inGSTR-1 0.45 lakh 0.45 lakh

[Refer Note 2]

Total 10 lakh 9.95 lakh

11:20 AM © CA Dr Prithvi Ranjan Parhi 31

Notes:

(1) 100% ITC can be availed on invoices uploaded by the suppliers in their GSTR-1.

(2) As per rule 36(4), the ITC in respect of invoices not uploaded by the suppliers in

their GSTR-1s is restricted to 5% of eligible ITC in respect of invoices uploaded in

GSTR-1s. 5% of the eligible ITC in respect of invoices uploaded in GSTR-1s [Rs.0.

475 lakh (5% of Rs. 9.5 lakh)] . ITC availed should be limited to Rs.0.475 Lakh. As

ITC involved is Rs.0.45 Lakh the entre ITC is allowed.](https://image.slidesharecdn.com/paymentofgst-210928112001/85/Payment-of-GST-31-320.jpg)