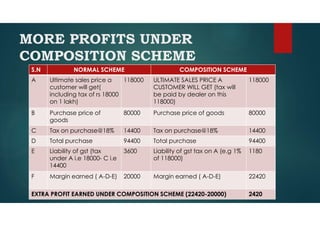

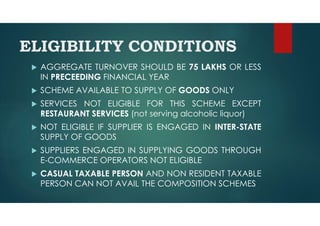

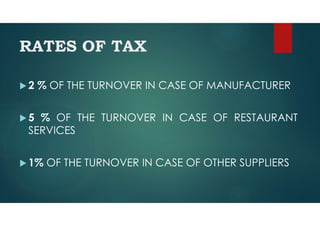

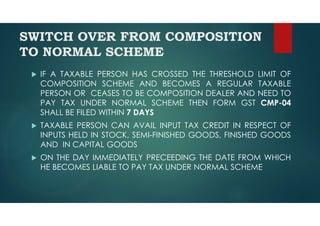

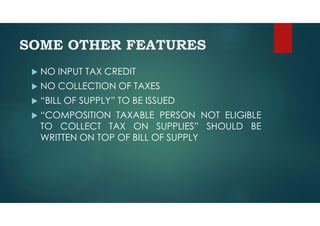

The document provides an overview of the GST composition scheme aimed at simplifying compliance for small businesses like shopkeepers and manufacturers with benefits such as quarterly returns, reduced paperwork, and competitive pricing. Eligibility is limited to entities with a turnover of 75 lakhs or less, primarily for goods supply, with specific exclusions and tax rates depending on the type of business. Key features include no input tax credit or tax collection, necessitating a specific format for invoices issued under this scheme.