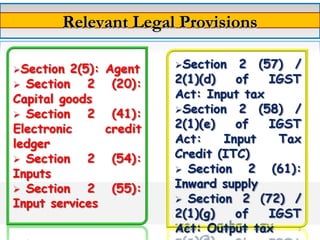

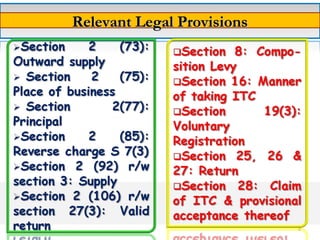

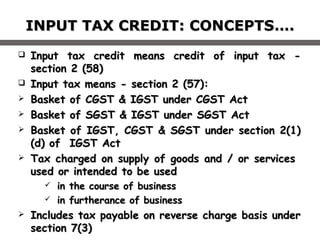

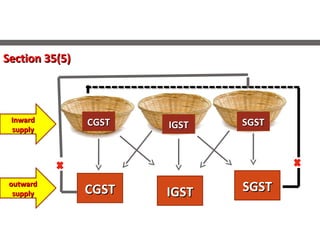

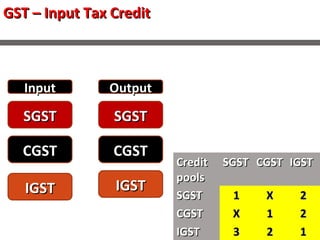

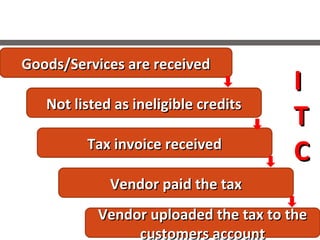

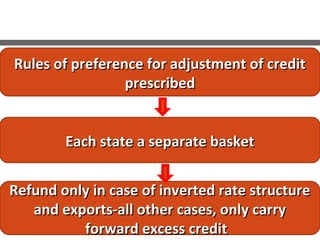

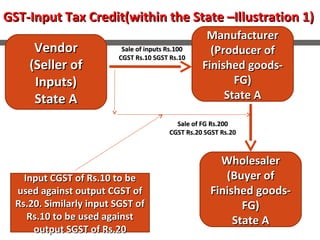

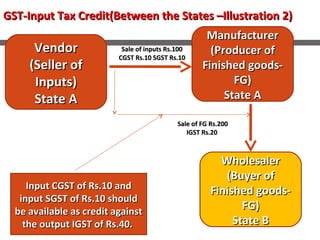

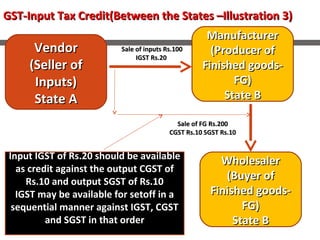

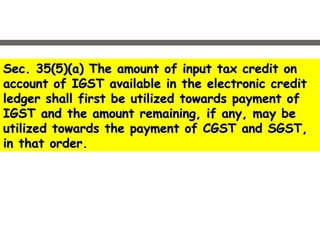

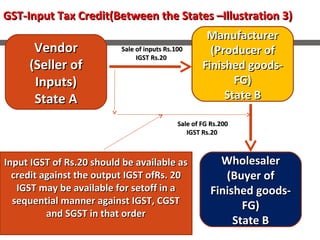

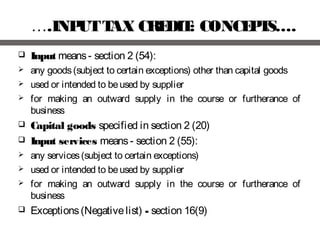

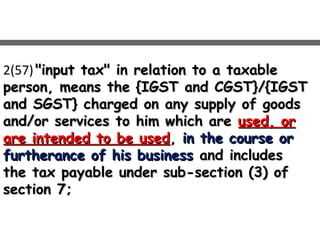

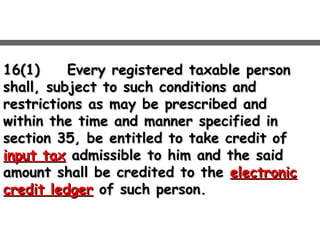

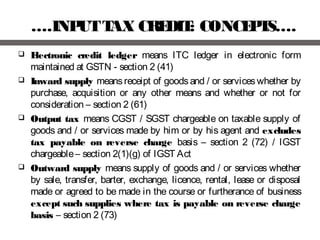

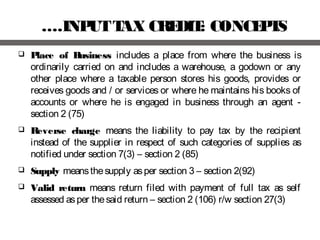

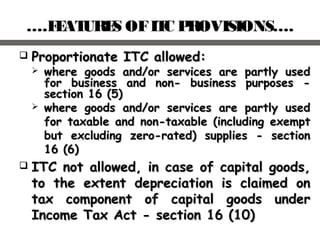

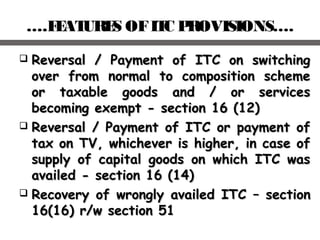

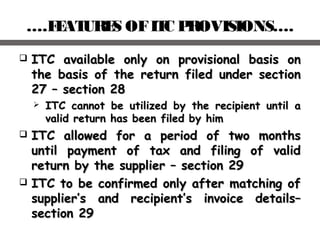

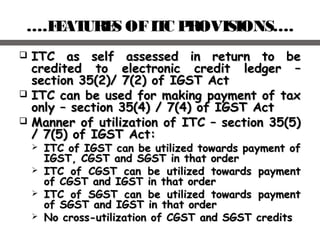

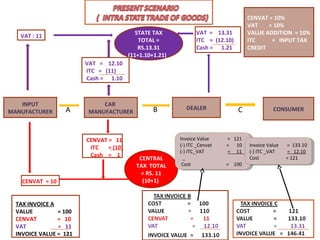

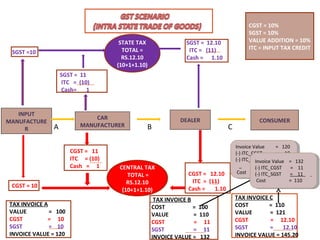

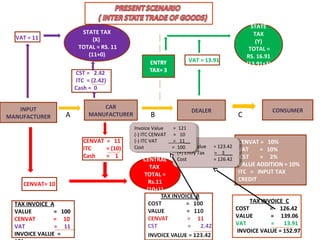

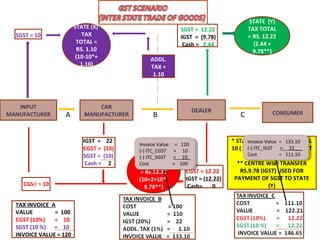

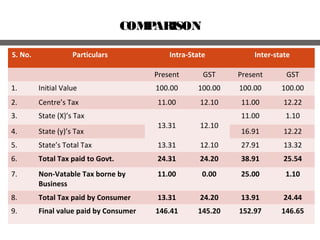

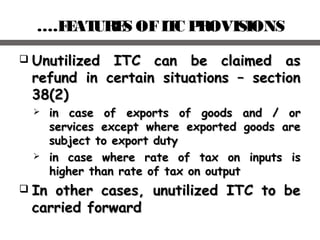

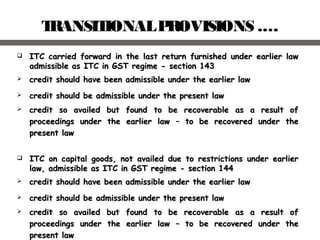

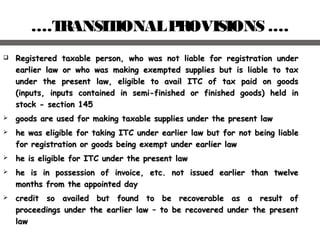

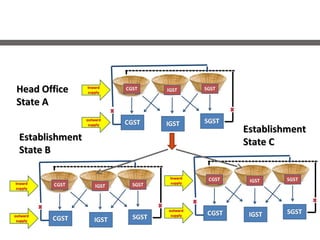

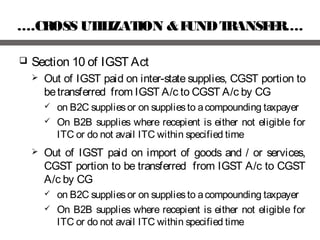

The document discusses concepts related to input tax credit under GST including definitions of key terms, eligibility criteria for availing input tax credit, utilization of input tax credits across states, and restrictions on availing input tax credit for certain goods and services. It provides illustrations of availment and utilization of input tax credit for intra-state and inter-state transactions. It also discusses special provisions related to capital goods and transition provisions for availment of credits.

![IGST Act (An overview)

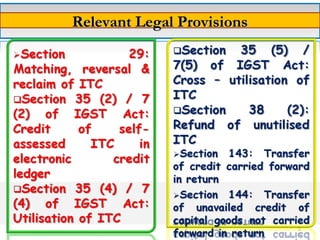

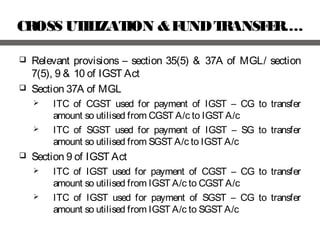

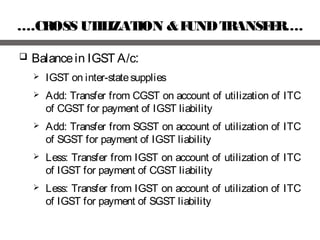

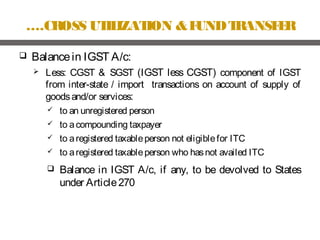

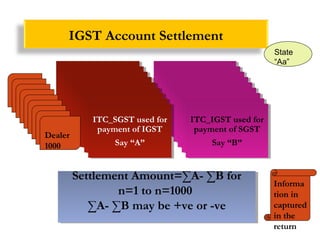

ITC claims and transferof funds

Claim of ITC, provisional acceptance, matching, reversal,

reclaim [Sec 8]

Transfer of input tax credit [Sect 9]

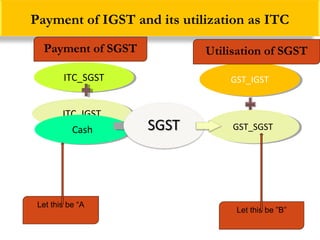

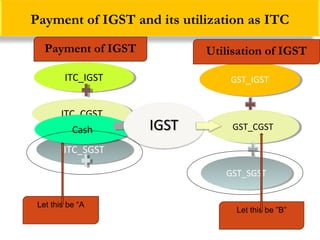

ITC_IGST used for payment of

CGST

Transfer of such amount to

CGST

ITC_IGST used for payment of

SGST

Transfer of amount to

appropriate State

70](https://image.slidesharecdn.com/inputtaxcreditsn-160923160715/85/Input-tax-credit-in-GST-70-320.jpg)

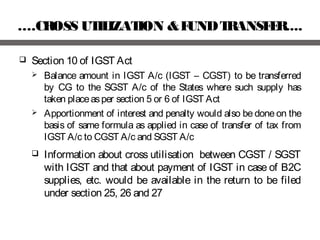

![IGST Act (An overview)

Apportionment of Tax

To Central Government-Amount equivalent to CGST

o On the supplies to unregistered person or to a composition

taxpayer [Sec 10(1)]

o On the supplies to a registered person who could not take ITC [

Sec 10(2)]

o On imports by an unregistered person or by a composition

taxpayer [Sec 10(3)]

o On imports by a registered person who could not take ITC [Sec

10 (4)]

To the State Government

o The balance IGST, in above four categories, to the POS State

[Sec 10(5) ] 71](https://image.slidesharecdn.com/inputtaxcreditsn-160923160715/85/Input-tax-credit-in-GST-71-320.jpg)