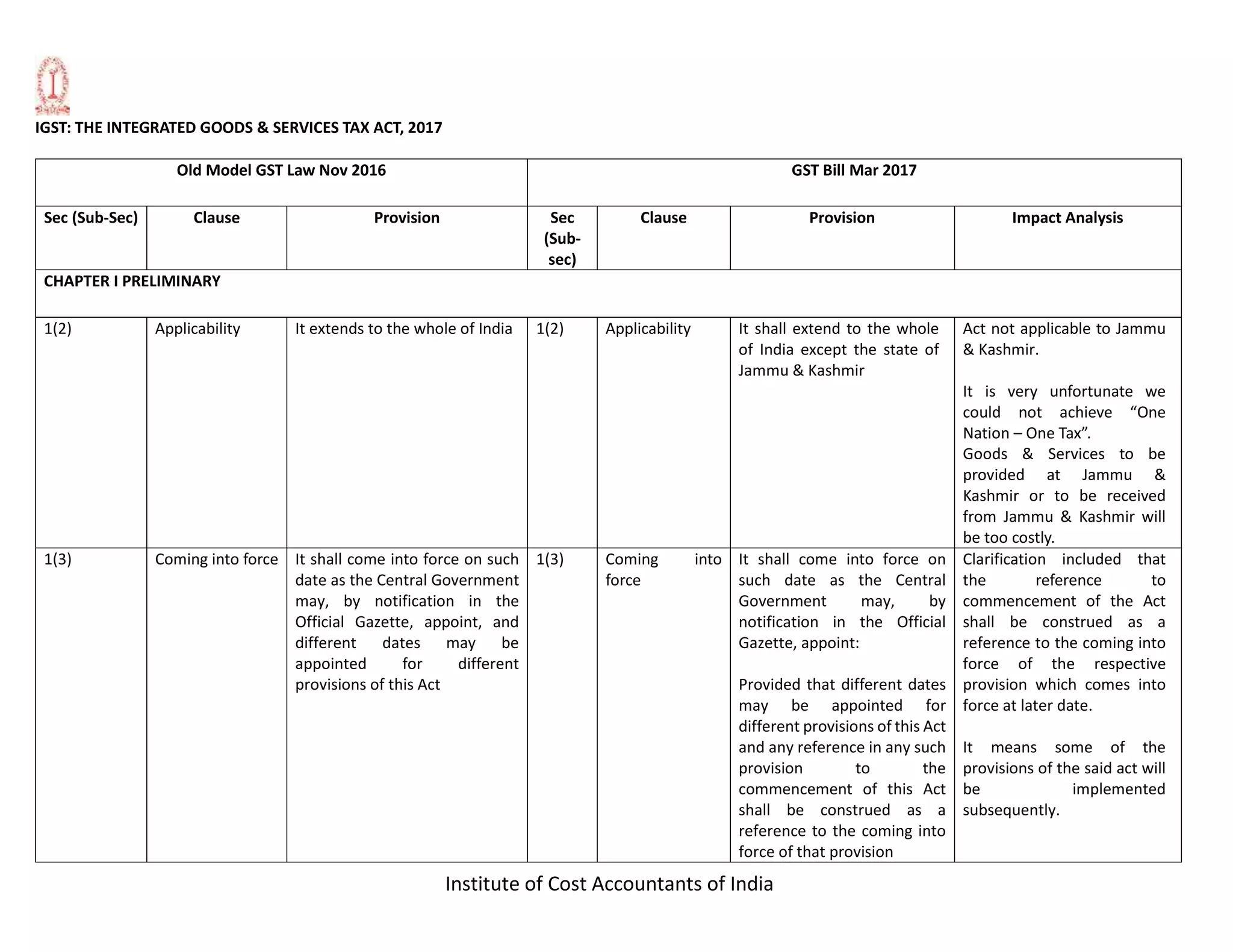

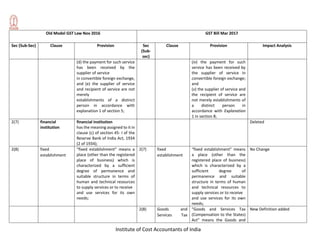

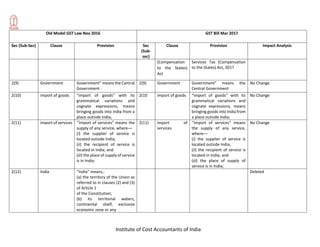

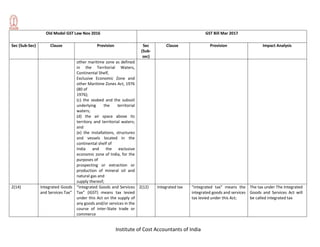

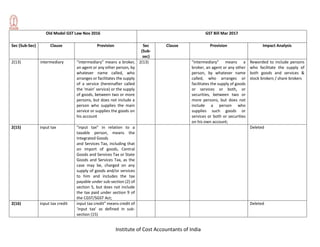

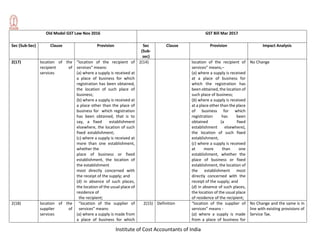

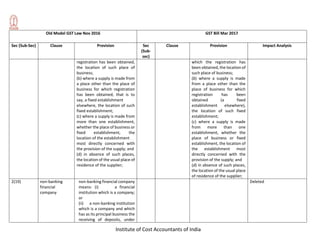

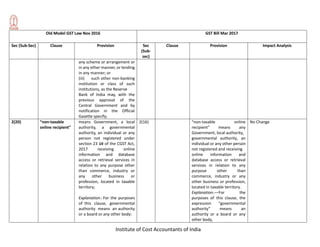

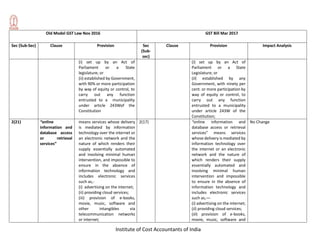

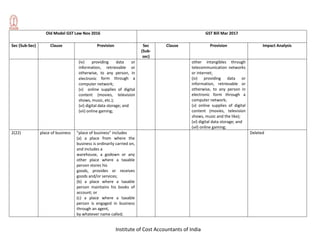

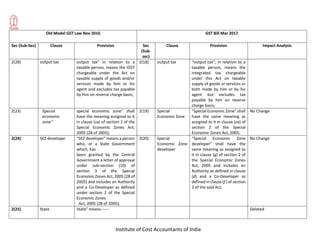

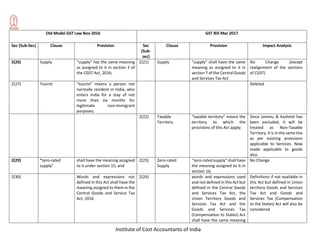

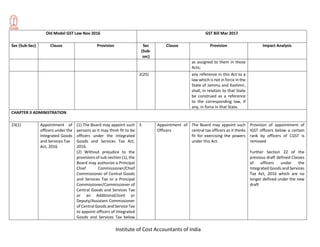

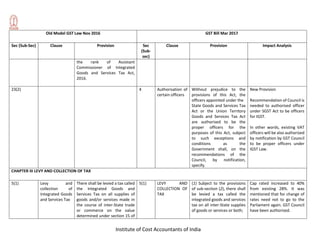

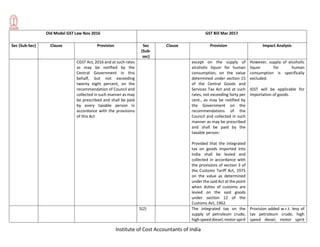

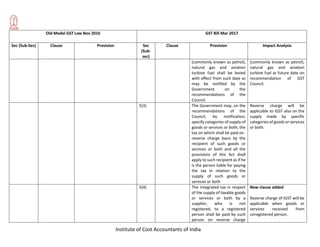

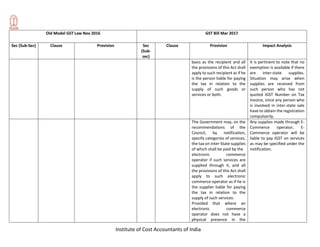

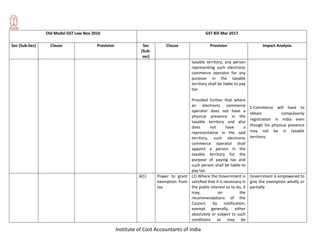

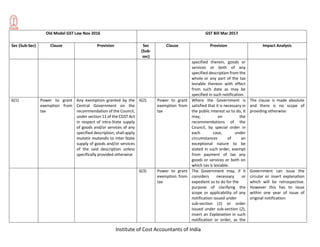

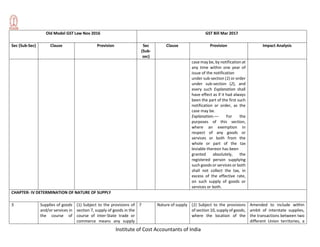

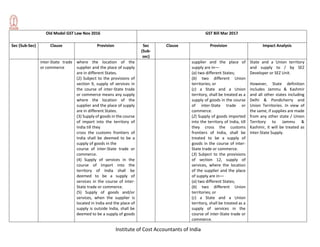

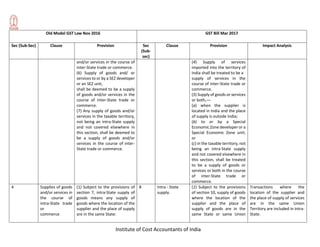

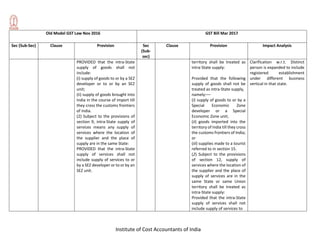

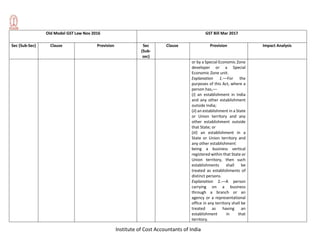

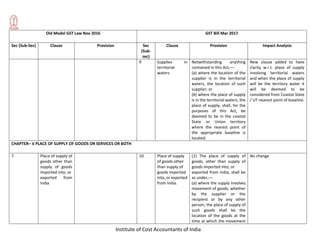

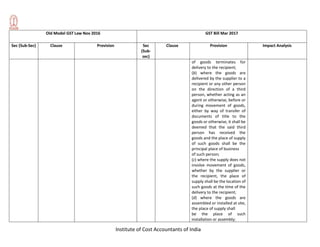

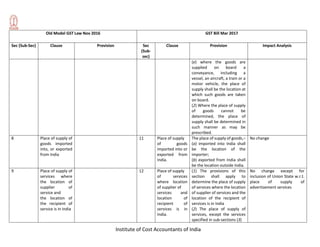

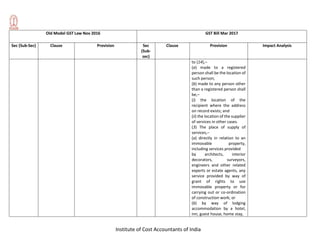

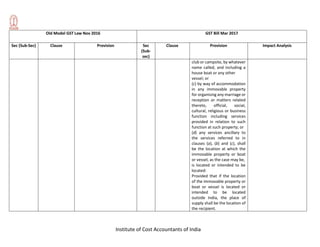

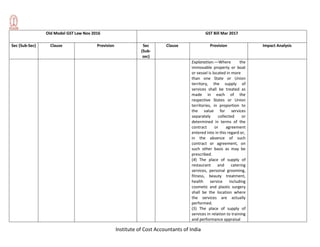

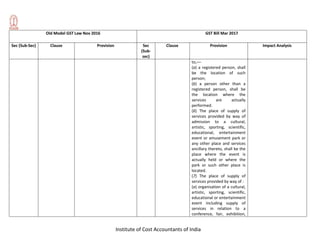

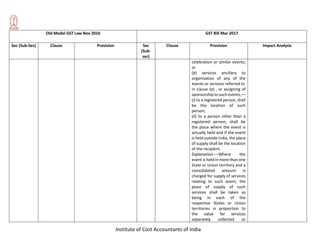

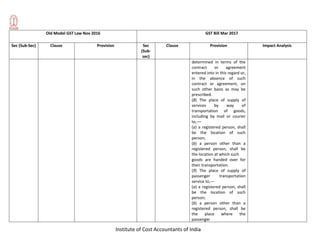

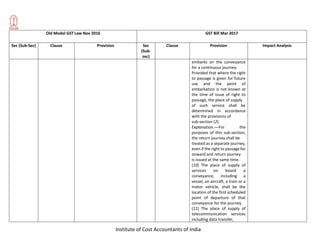

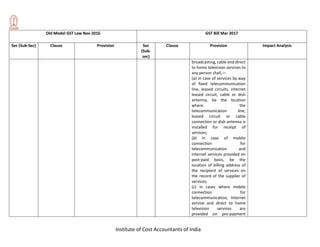

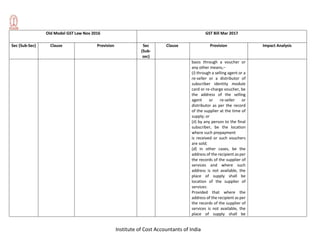

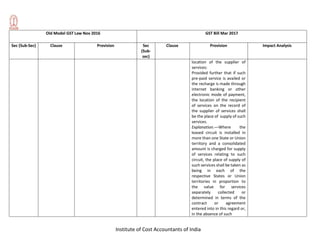

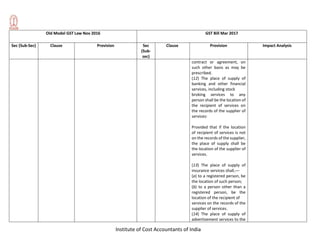

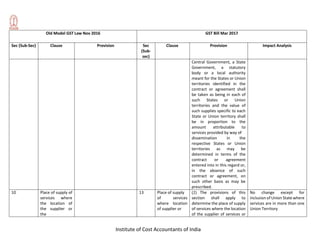

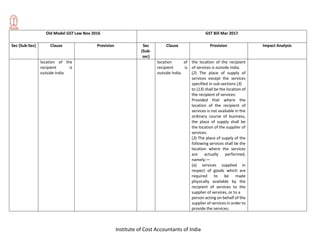

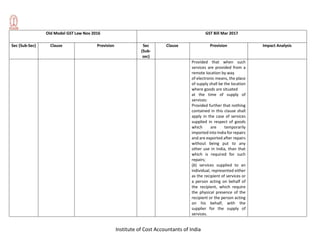

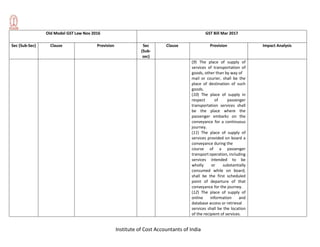

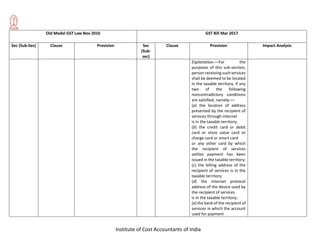

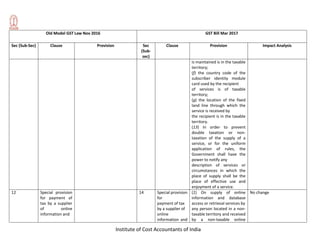

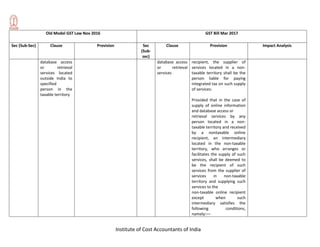

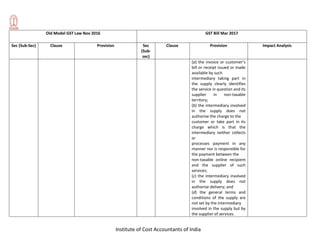

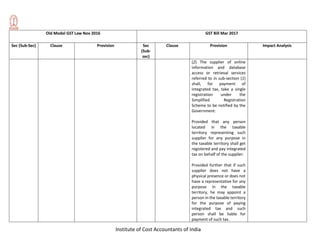

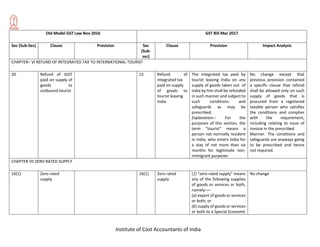

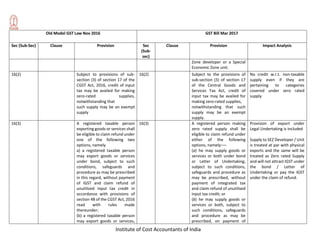

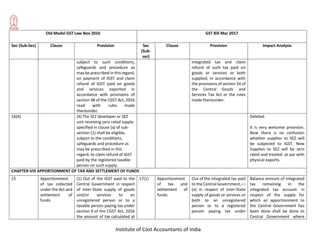

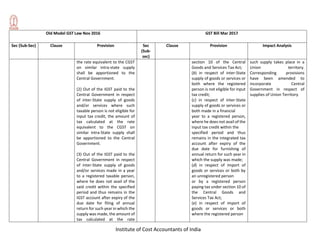

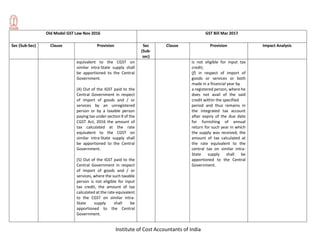

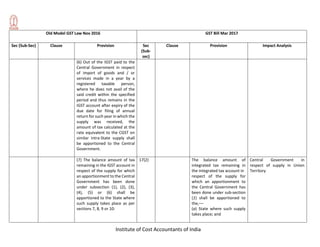

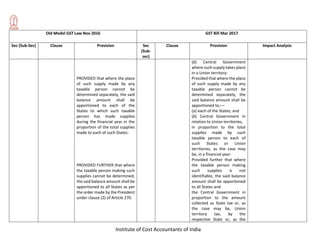

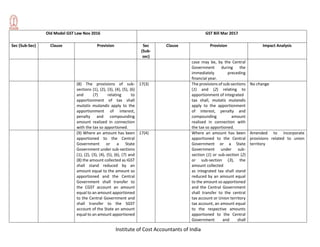

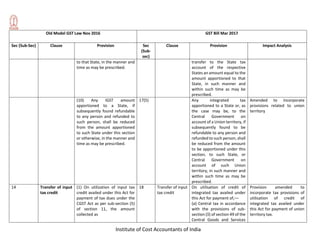

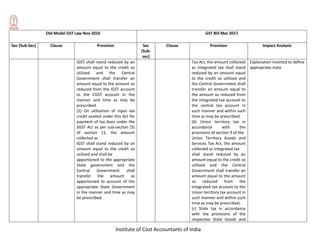

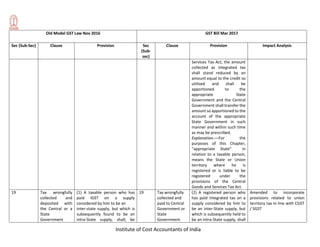

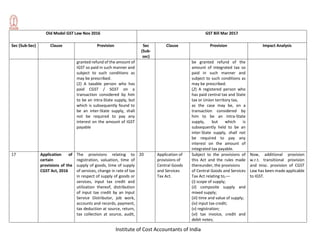

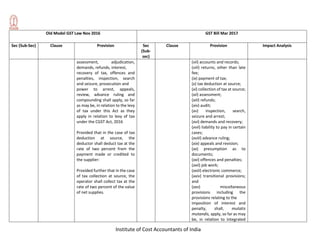

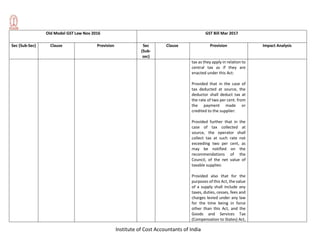

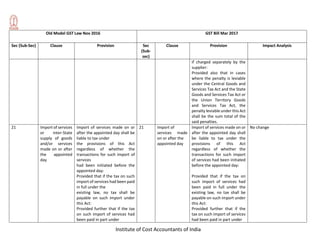

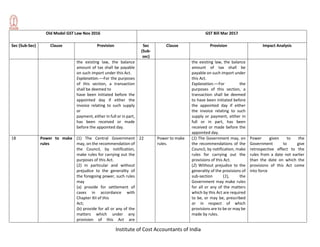

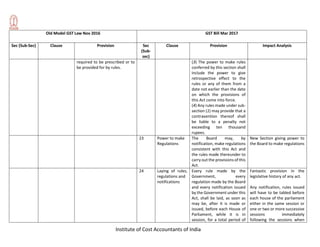

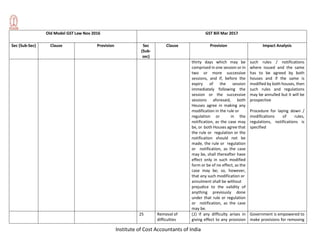

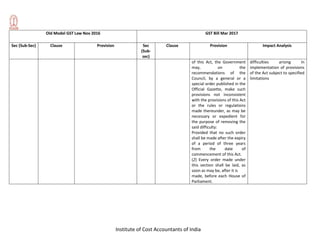

The document summarizes key changes between the old model GST law from November 2016 and the GST bill introduced in March 2017. Some key changes include:

1) The applicability of the act was extended to the whole of India except Jammu and Kashmir. Some provisions may be implemented at later dates.

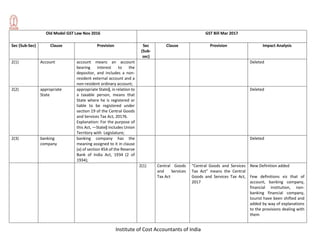

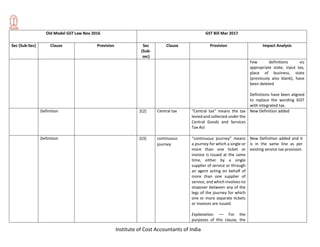

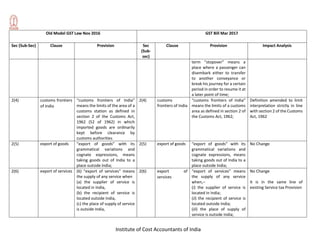

2) Definitions were aligned and some were deleted or added, such as for central goods and services tax act, continuous journey, and intermediary.

3) The tax under the Integrated Goods and Services Act will be called the "integrated tax".