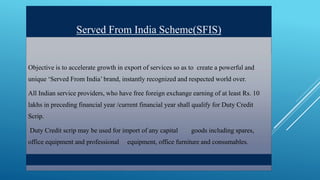

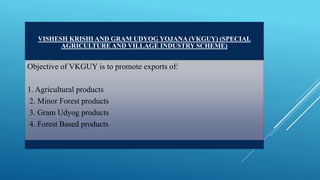

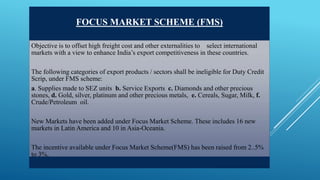

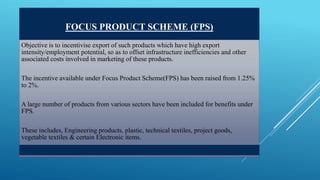

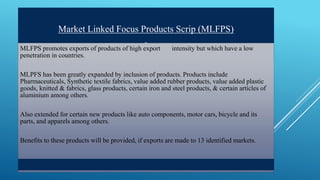

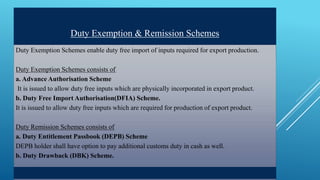

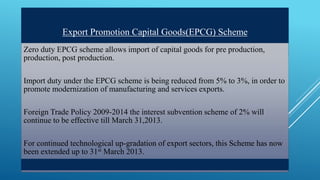

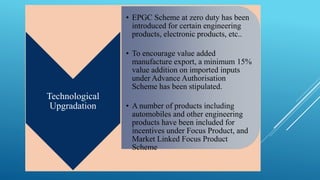

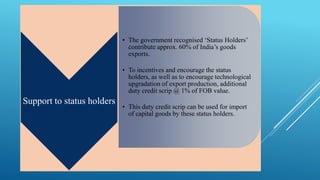

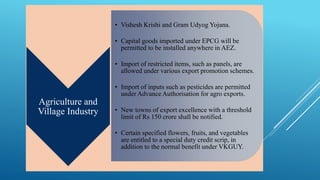

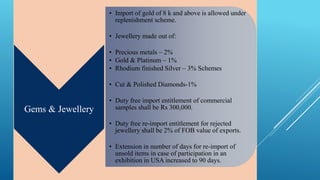

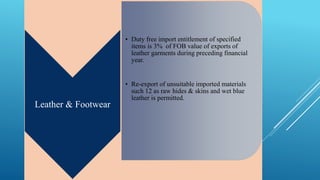

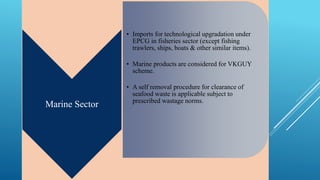

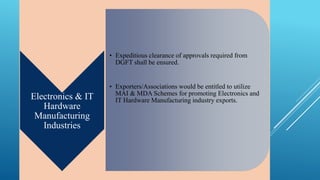

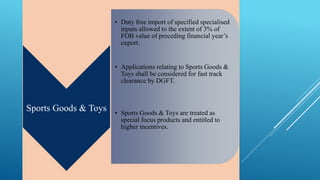

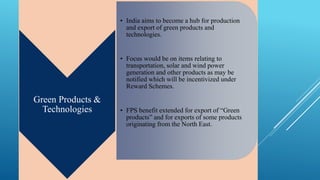

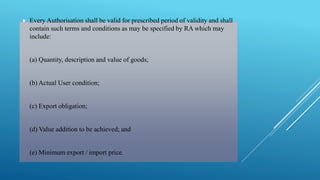

The document outlines several Indian government export promotion schemes. It discusses schemes that provide duty credits or exemptions for exports of goods and services. These include the Served From India Scheme for service exports, Vishesh Krishi and Gram Udyog Yojana for agricultural and village industry exports, and Focus Market Scheme, Focus Product Scheme, and Market Linked Focus Products Scrip for specific export products and markets. It also describes Duty Exemption and Remission Schemes as well as the Export Promotion Capital Goods Scheme. Special focus is given to initiatives supporting market diversification, technological upgrading, status holders, and sectors like agriculture, handlooms, gems and jewelry, and electronics.