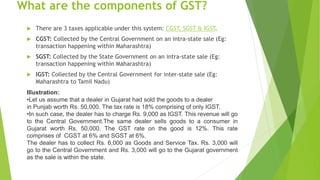

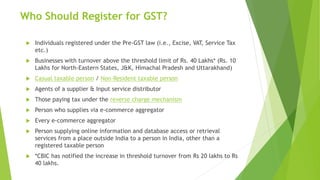

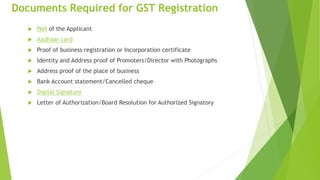

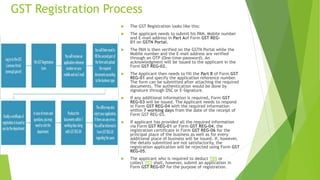

GST is an indirect tax implemented in India on July 1, 2017 that replaced multiple indirect taxes. It is a comprehensive multi-stage tax applied on the supply of goods and services. GST is levied as CGST by the central government, SGST by state governments, and IGST on inter-state supplies. Businesses with over Rs. 40 lakh turnover must register for GST by submitting required documents online through the GST portal. Failure to register can result in penalties for non-compliance with the law.