Here are the key tax rates for Mahindra Holidays & Resorts India Ltd before GST:

- Corporate tax rate: 30%

- Dividend distribution tax: 15% on dividends paid to shareholders

- Service tax: 15% on services provided

- VAT rates varied between states (typically around 12-14%)

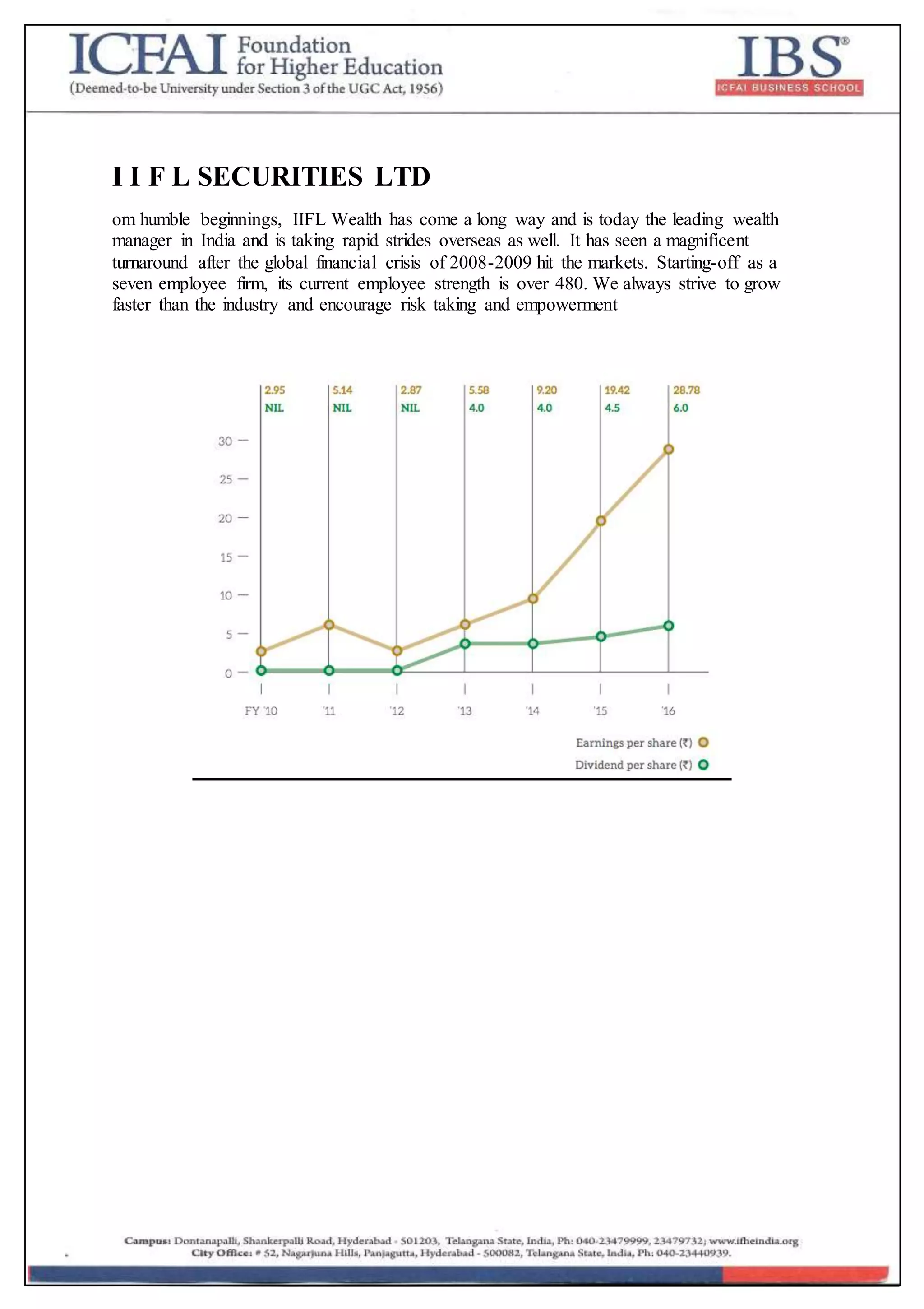

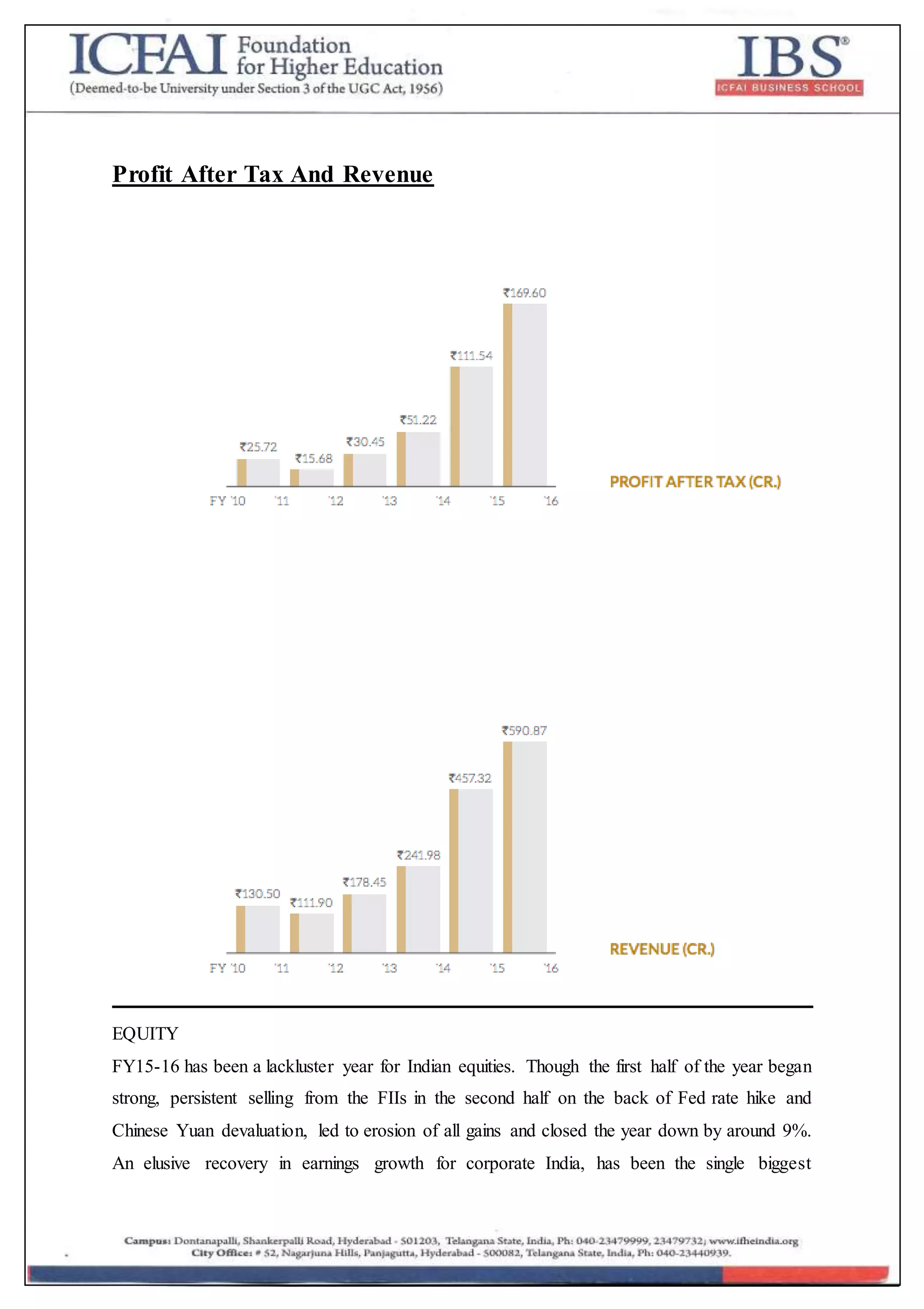

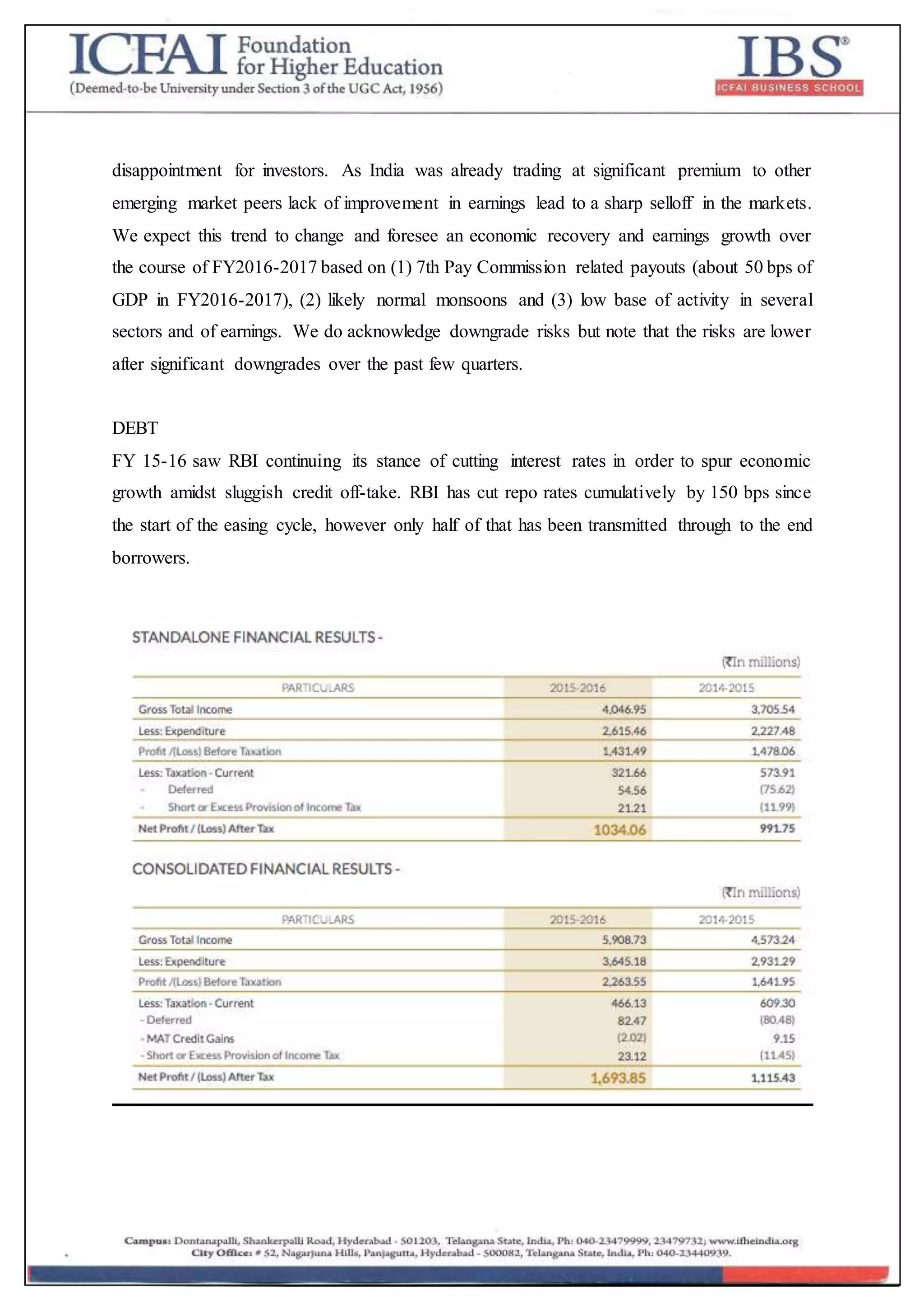

IIFL Securities Ltd

Prior to GST, IIFL Securities Ltd was subject to the following key taxes:

- Corporate tax rate: 30%

- Securities transaction tax (STT): Payable on taxable securities transactions. Rates ranged from 0.001-0.2% depending on the type of transaction.

- Service tax: 15%