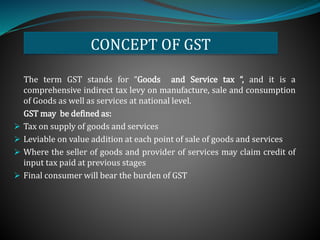

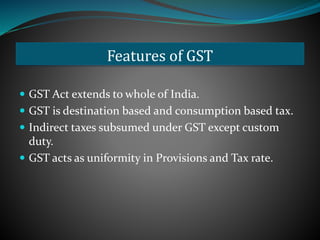

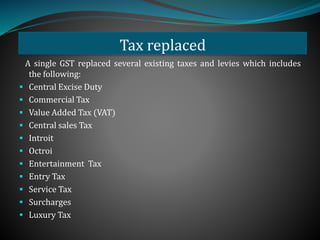

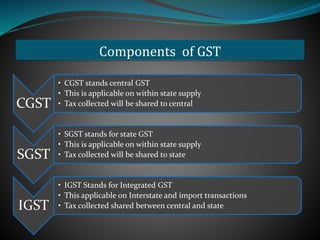

GST is an indirect tax levied on the supply of goods and services. It replaced multiple taxes and aimed to create a single, unified Indian market. Key features include being levied at each stage of supply, providing input tax credit, and having different rates for CGST, SGST, and IGST. Registration is required if certain turnover thresholds are exceeded. Taxpayers must follow procedures for registration, cancellation, and amendments. Input tax credit can only be claimed within prescribed time limits and by following invoice requirements.

![Time limit of claiming ITC

A taxable person shall not be entitled to take input tax credit in respect of

any invoice or debit note for supply of goods and service

A. After furnishing of the return for the month of September following

the end of financial year to which such invoice pertains or

B. Furnishing of the relevant annual return,

whichever is earlier. [section 16(4)]

The reason for this restriction is that no change in return is permitted

after September of next financial year. If the annual return is filed

before September then no change can be made after filing of annual

return.](https://image.slidesharecdn.com/whatisgst-170714105600/85/What-is-gst-20-320.jpg)