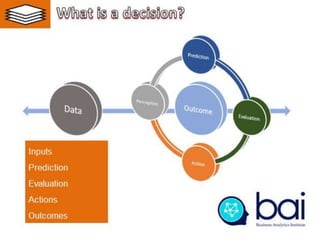

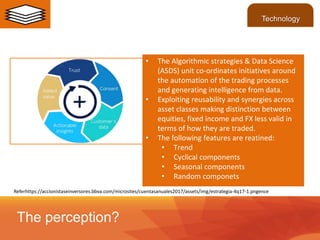

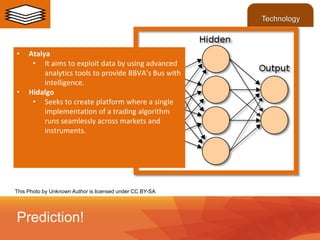

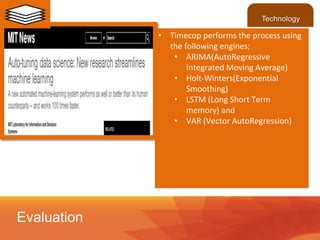

BBVA underwent a transformation process focused on digitalization and improving the customer experience. It developed new data analytics capabilities including algorithms and machine learning models to gain insights from customer data and optimize processes like trading. This allows BBVA to better predict trends, evaluate outcomes, and take actionable steps to create opportunities for customers.