BBVA is a global financial services group founded in 1857 with the purpose of bringing the age of opportunity to everyone. In 2018, BBVA posted strong financial results with net attributable profit of €5,324 million, up 51% from 2017. The diversified business model proved resilient despite volatility in some countries. BBVA remains committed to sustainable development and digital transformation to provide the best customer experience.

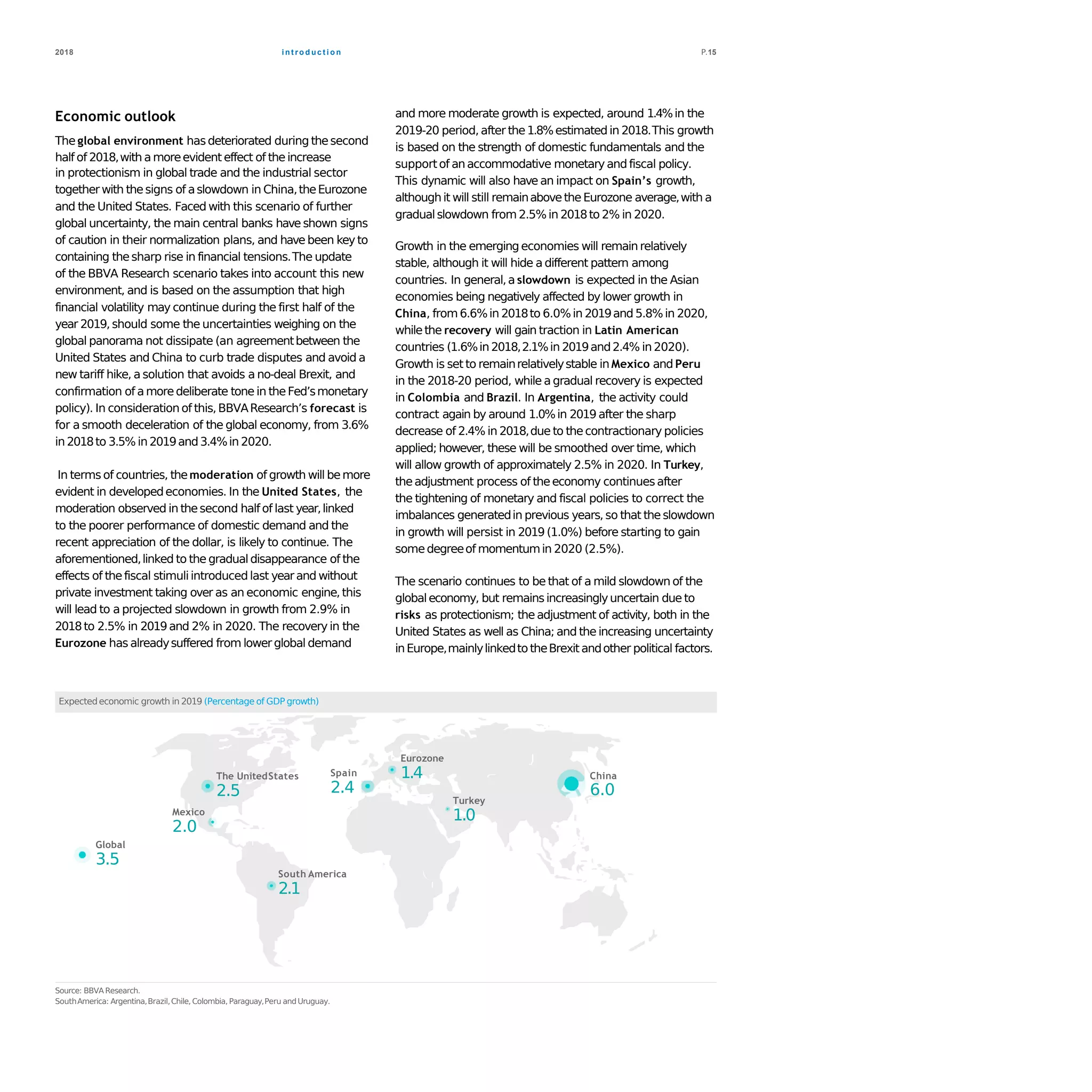

![peopLe manaGement2018 P.96

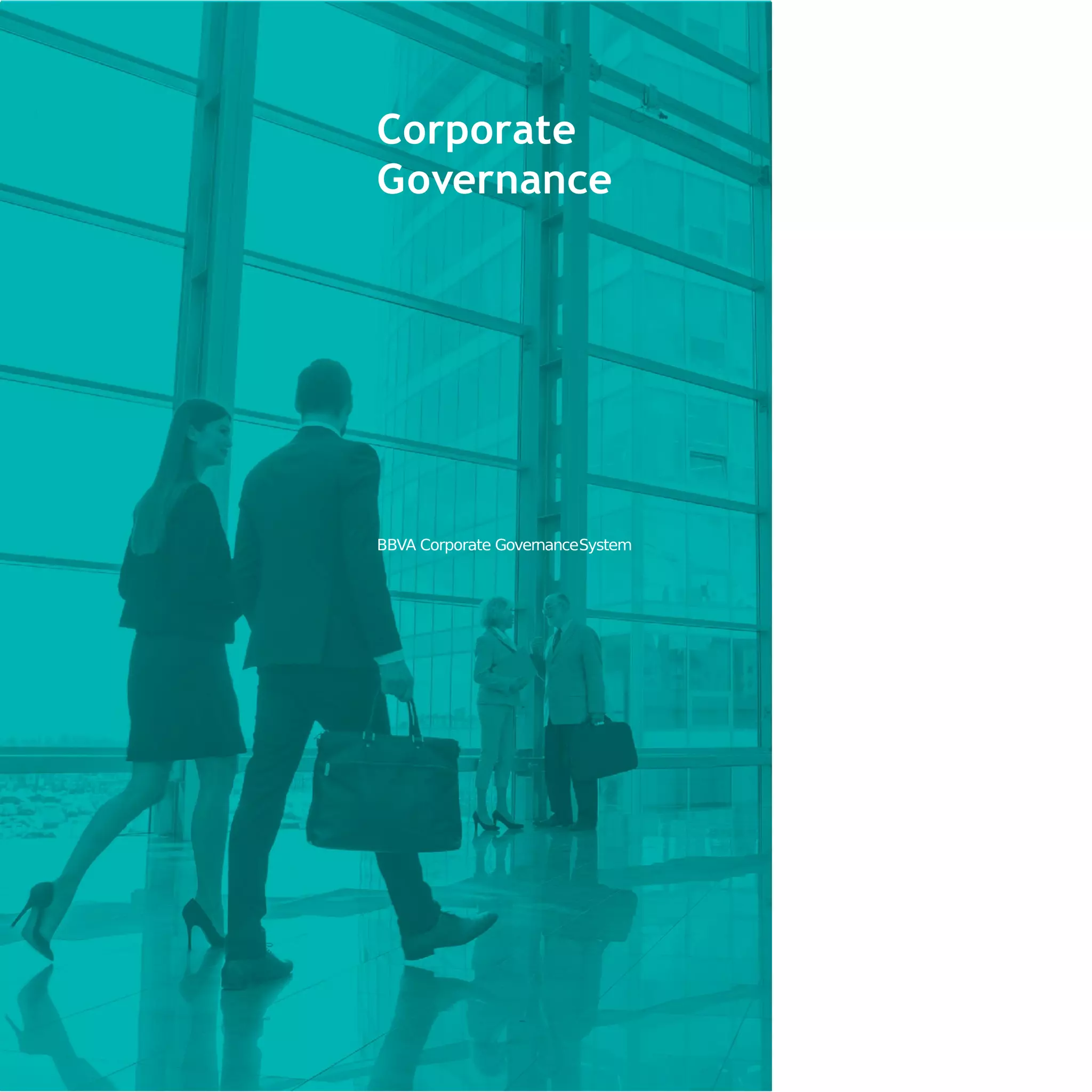

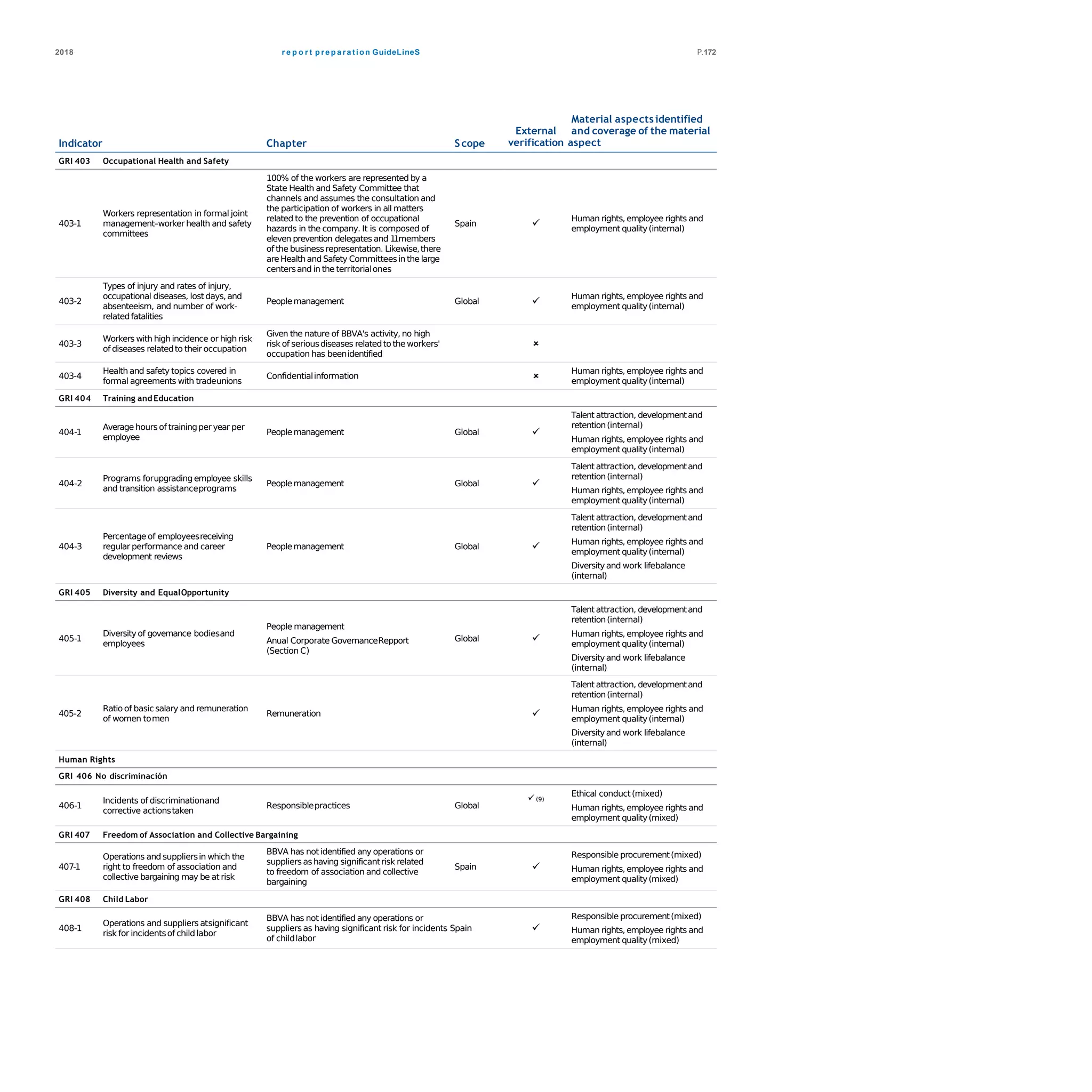

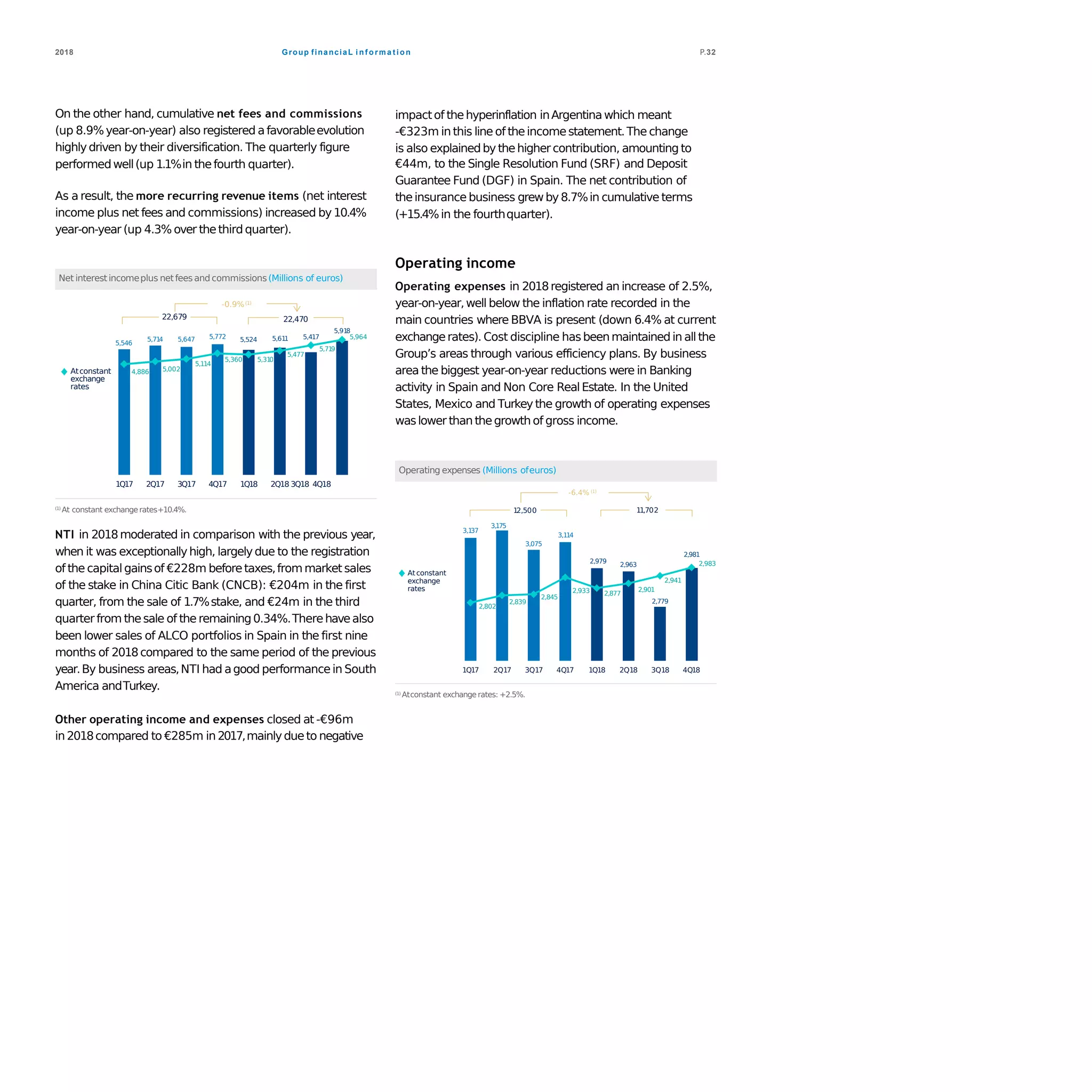

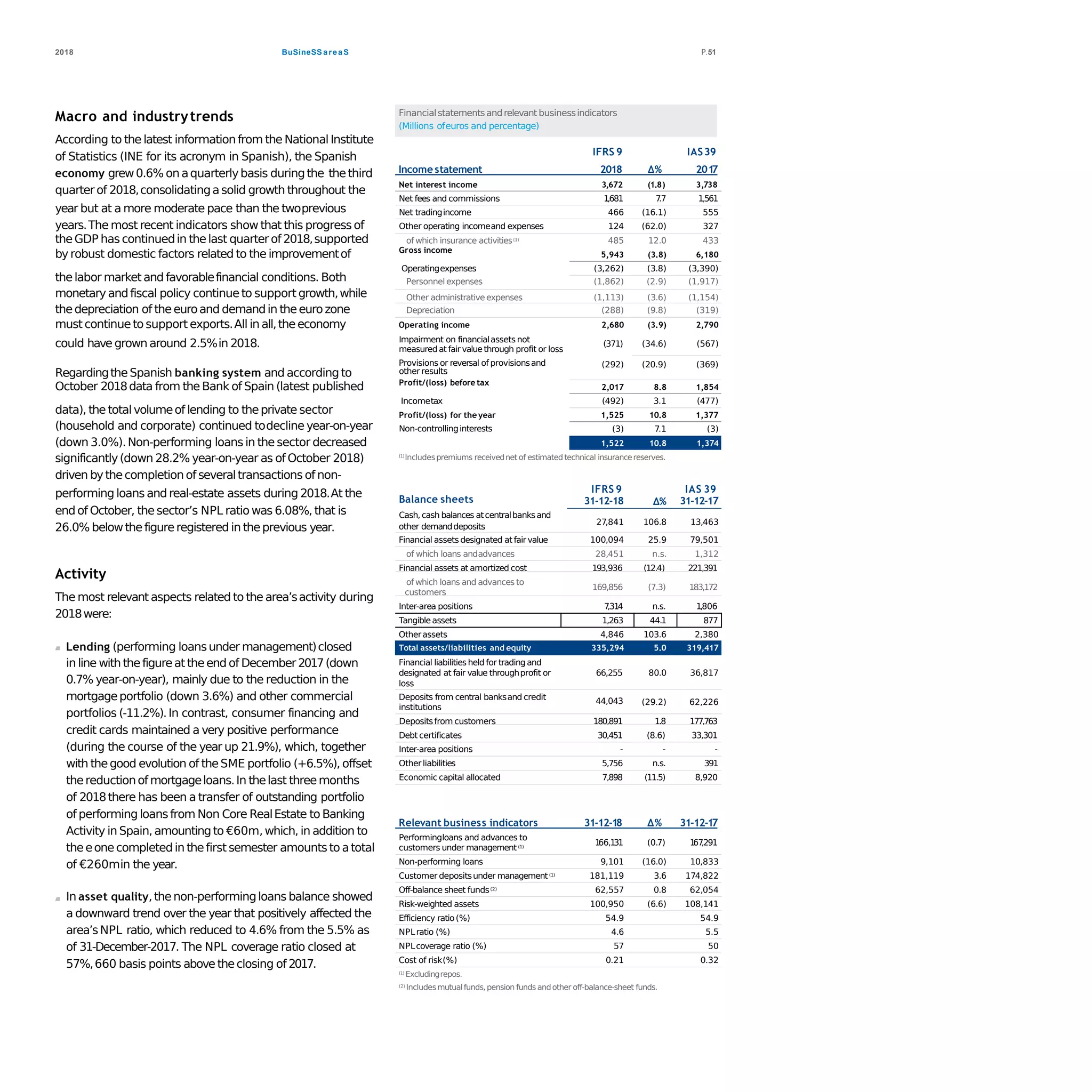

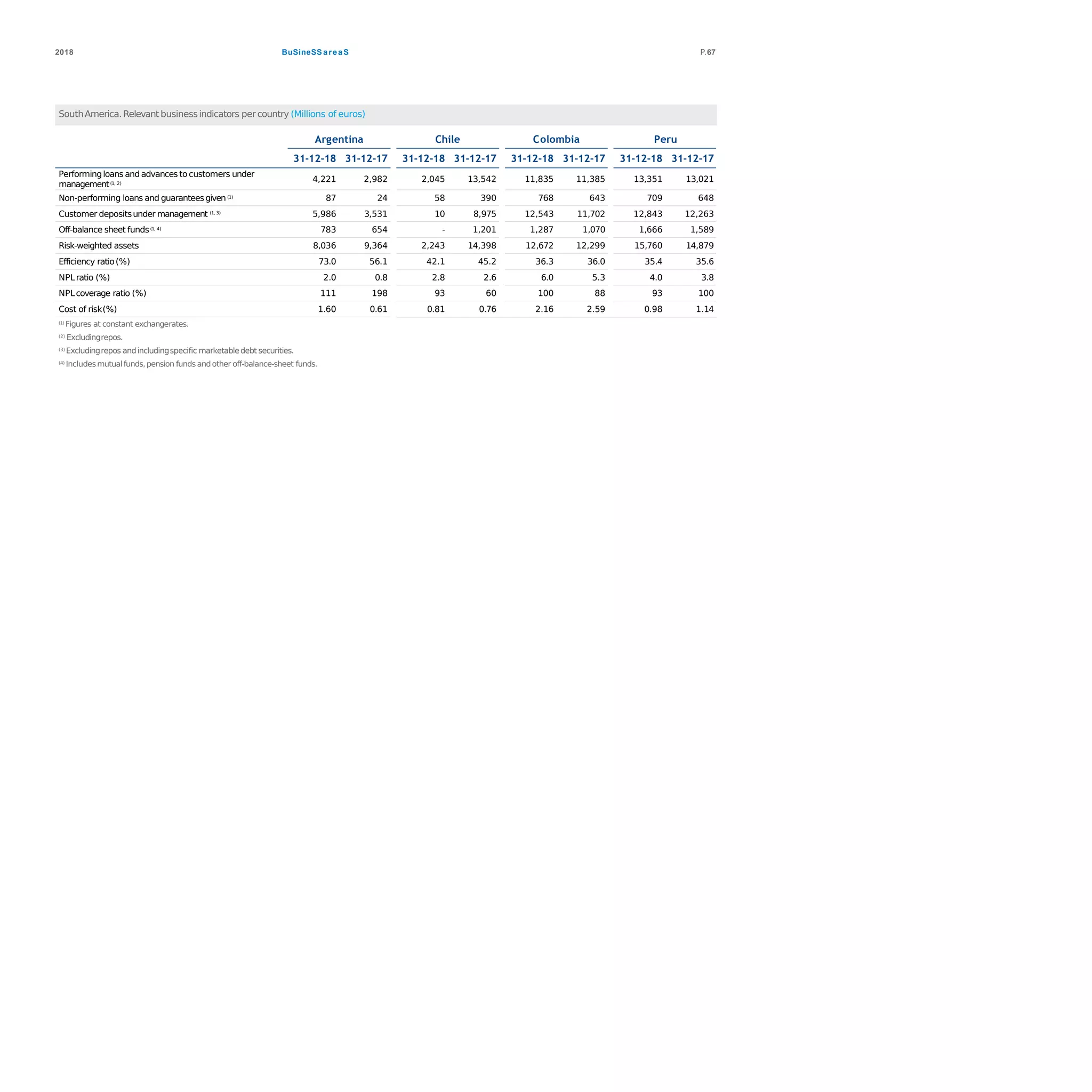

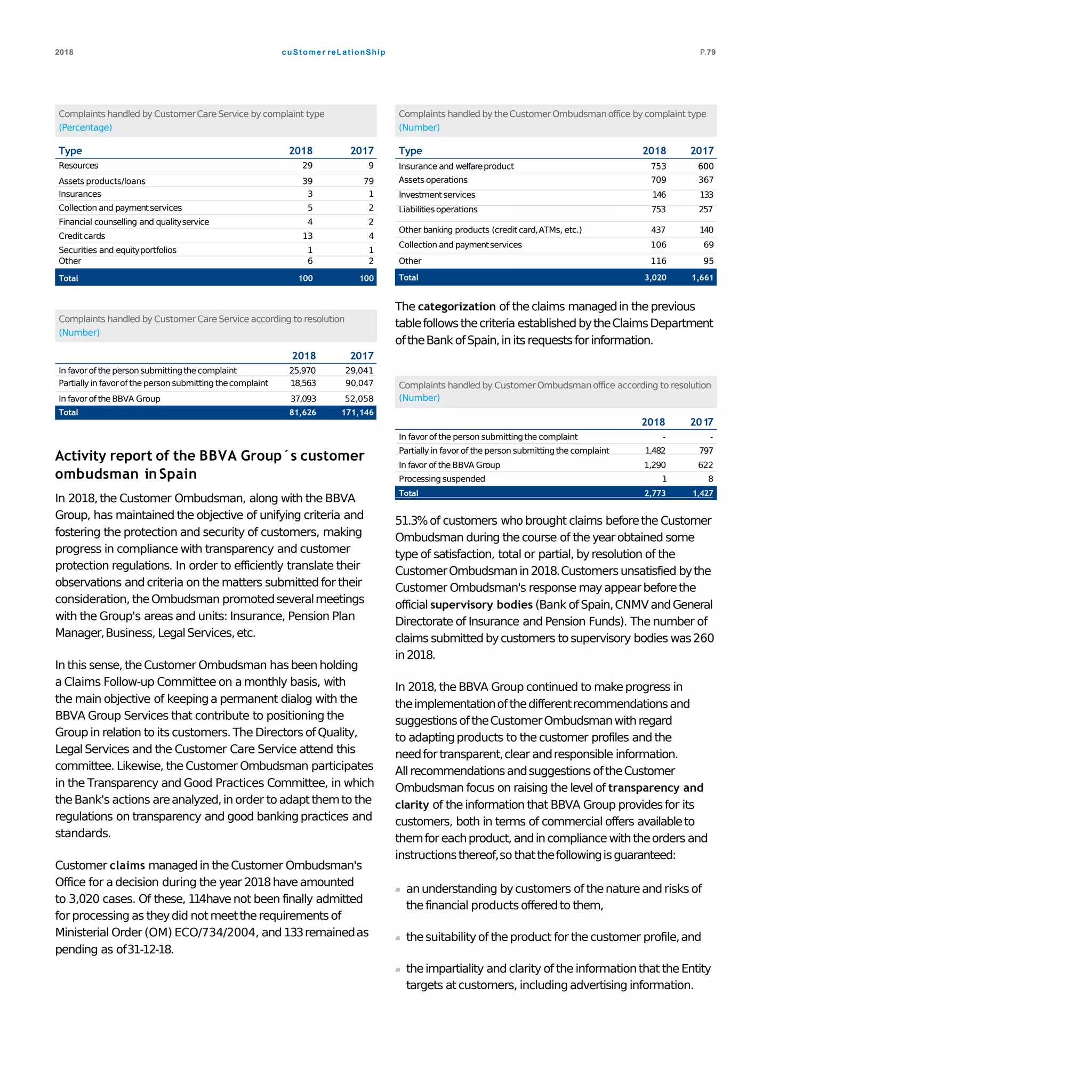

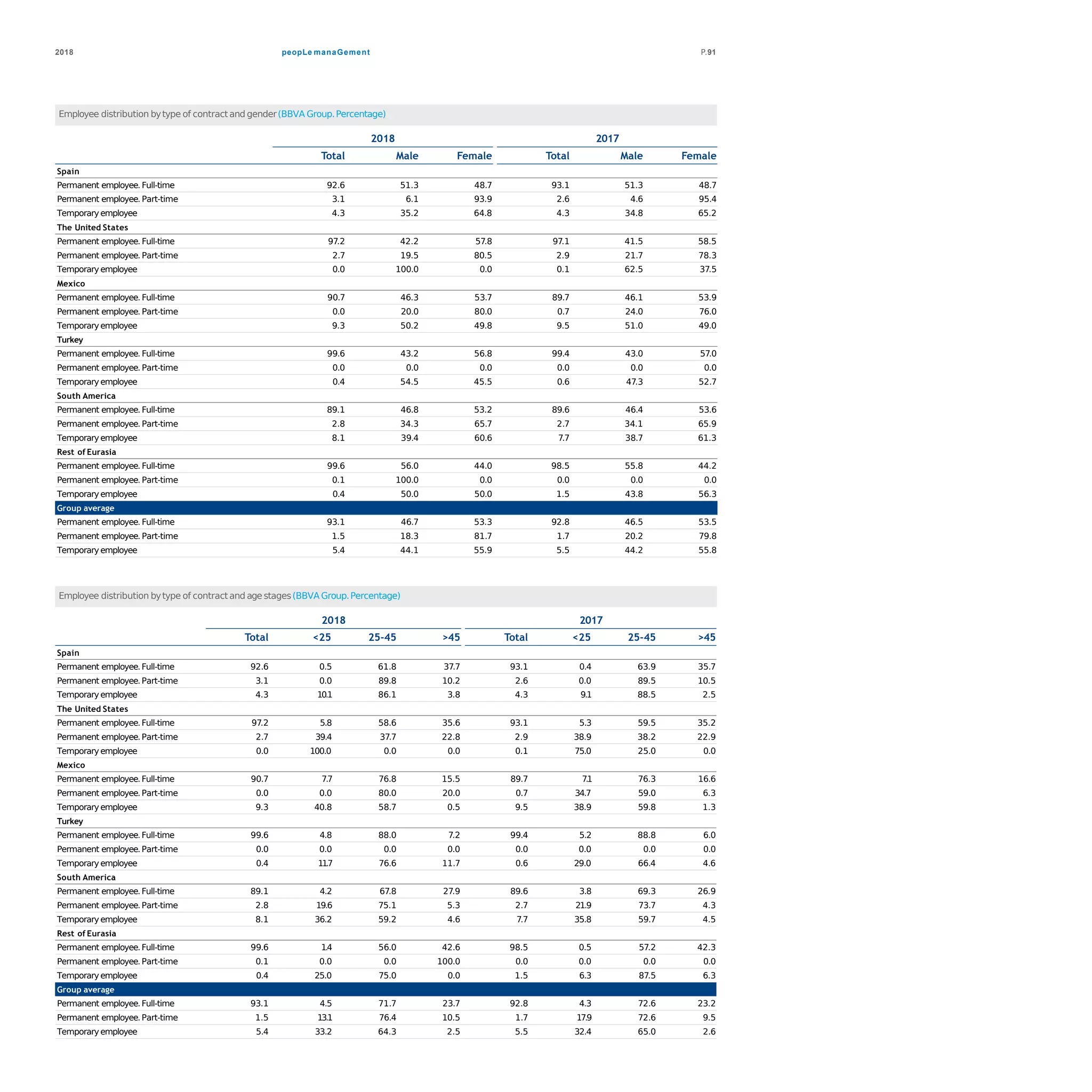

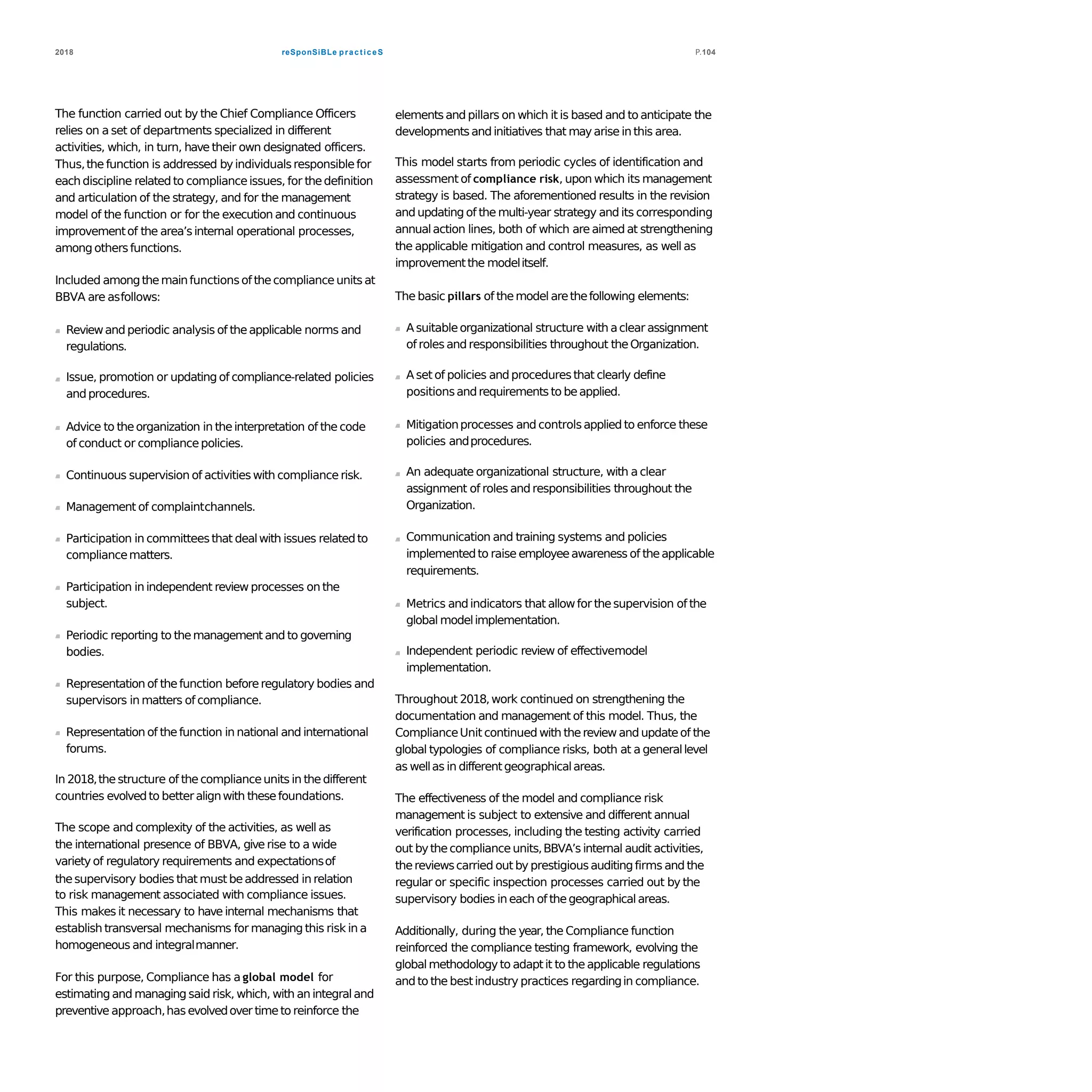

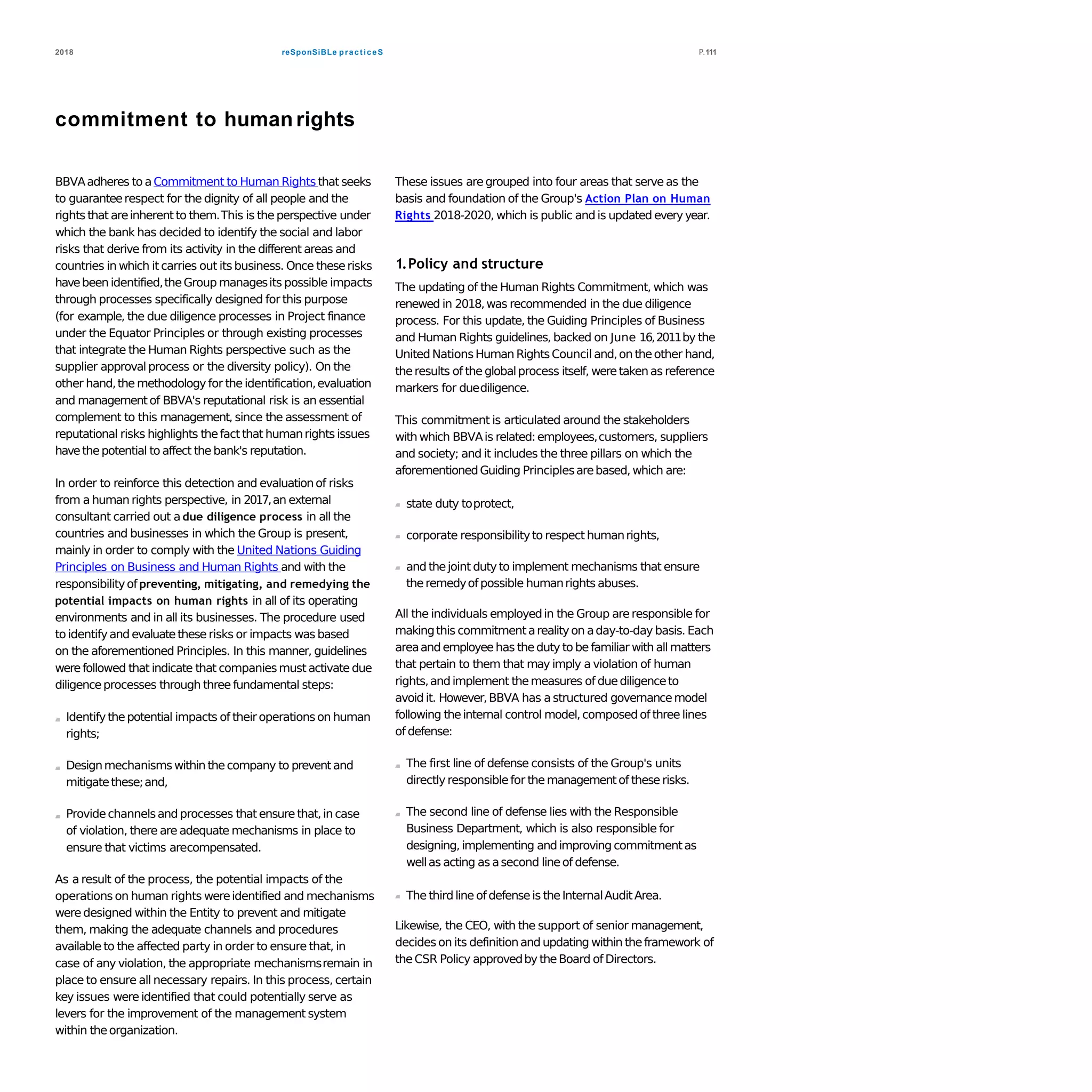

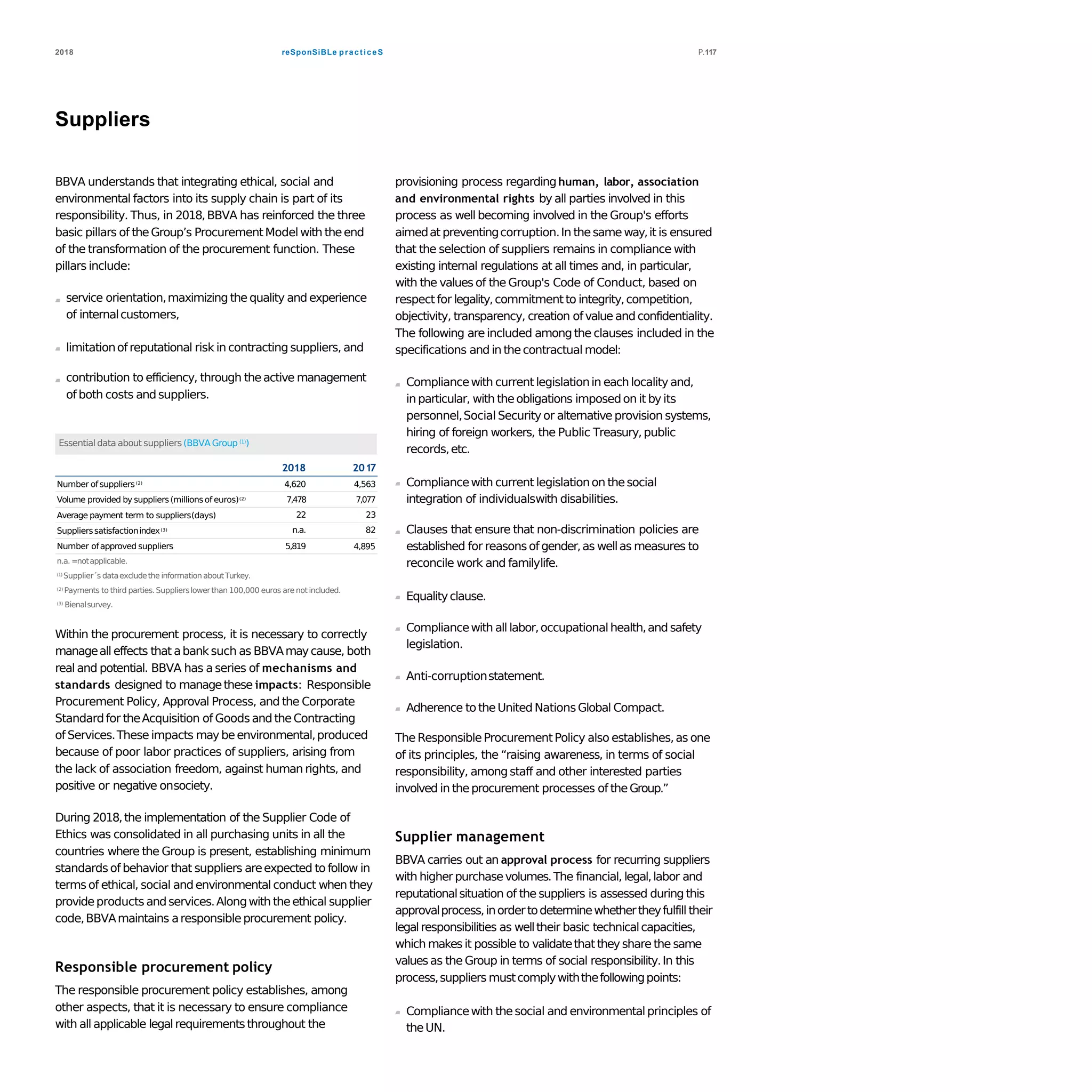

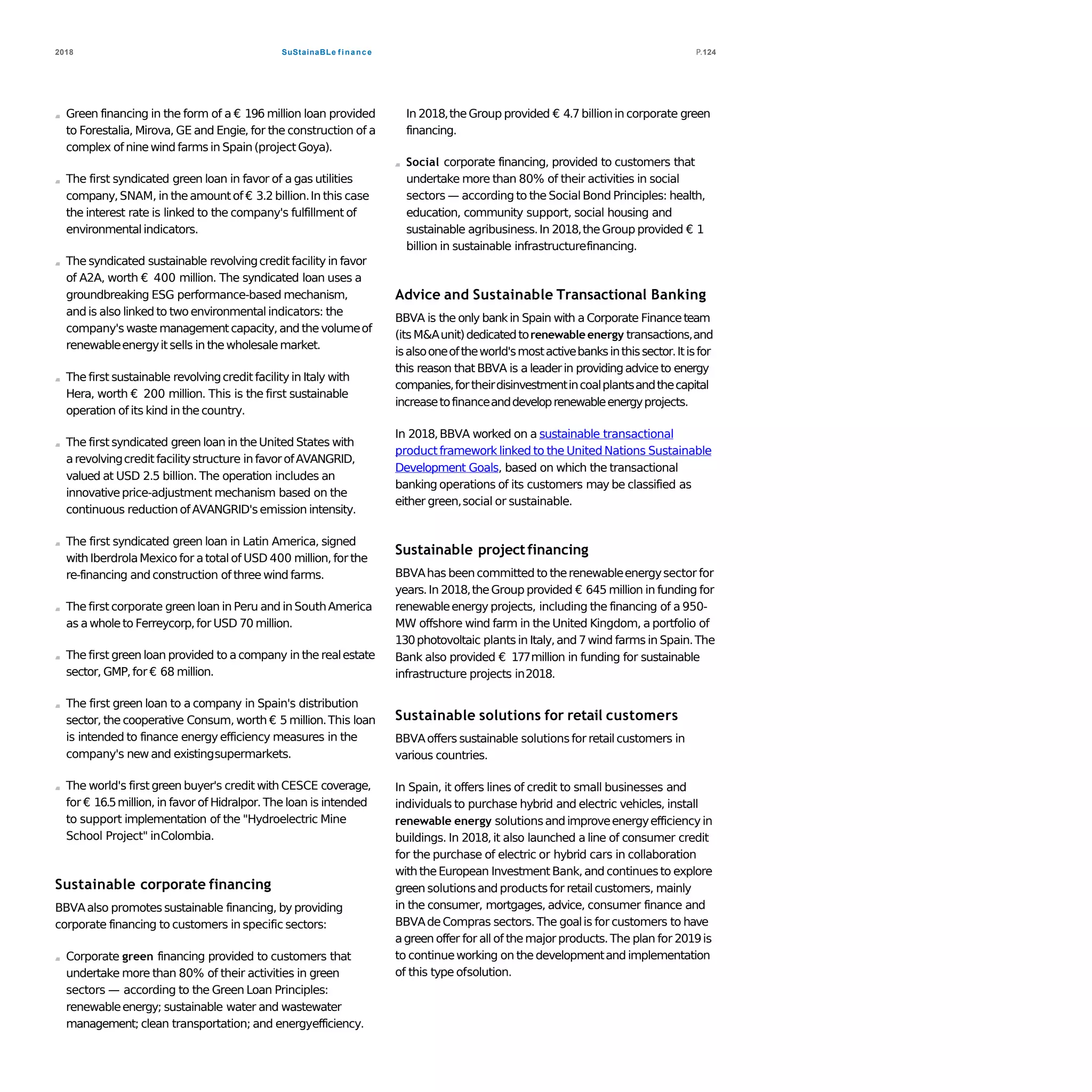

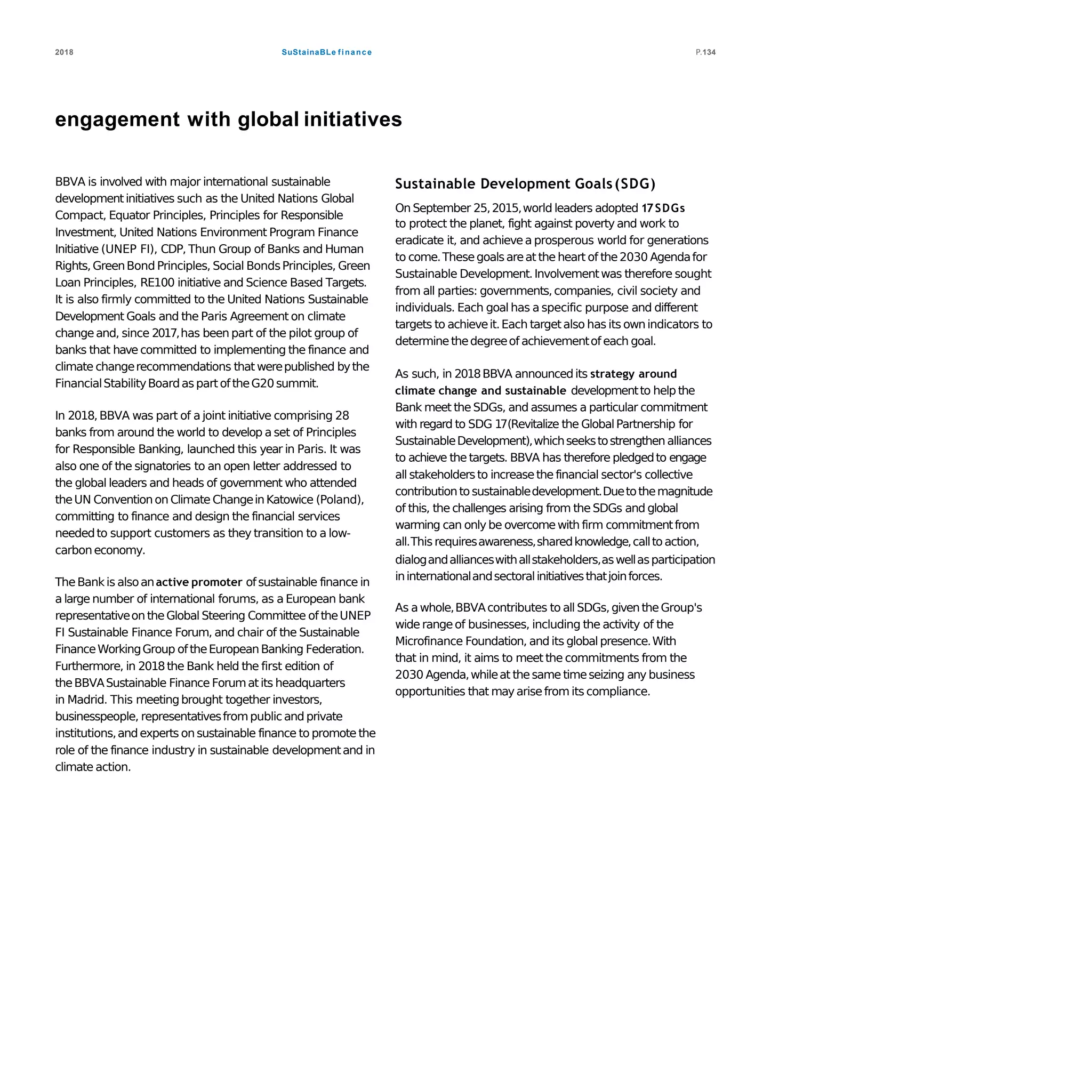

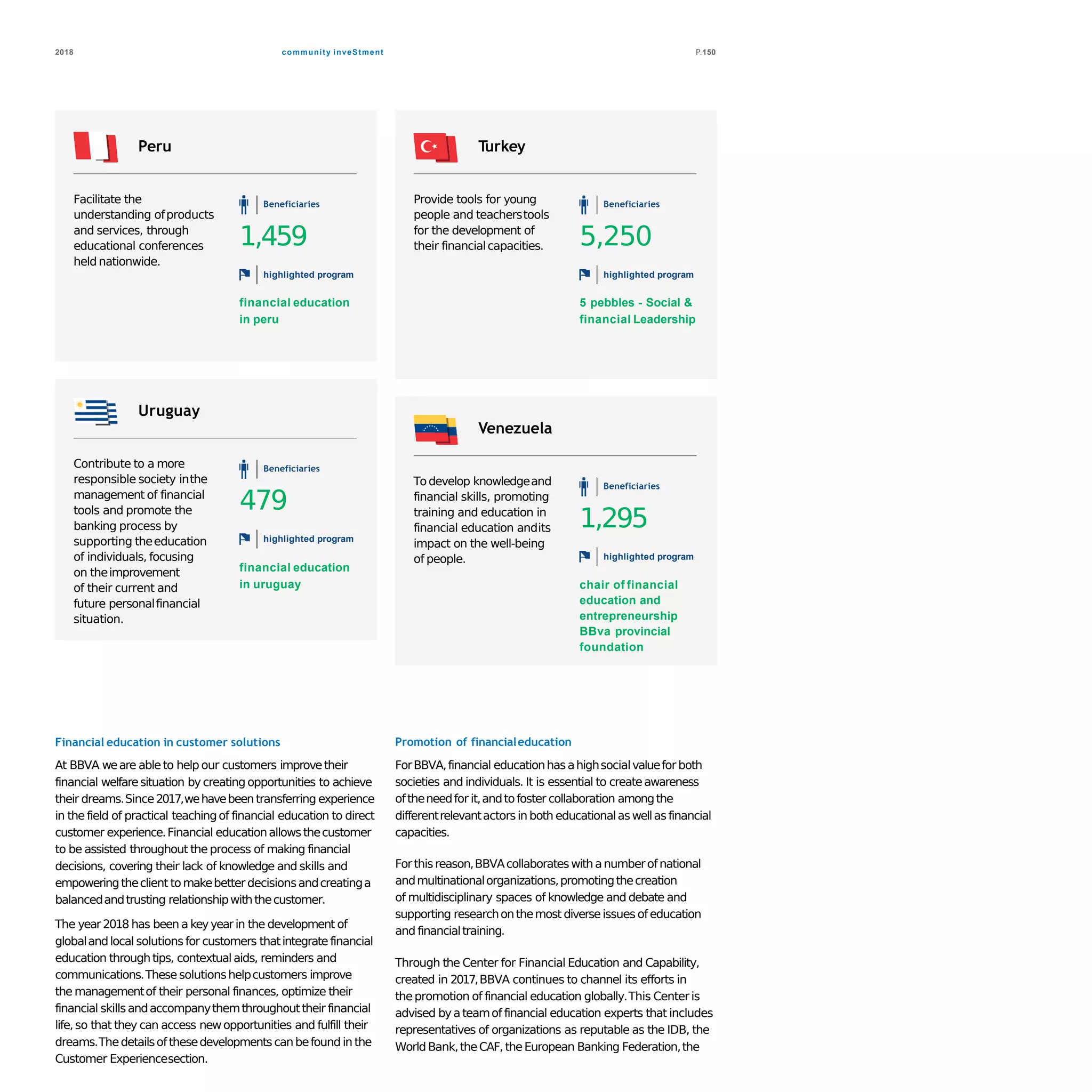

Voluntaryresignations (turn over) (1)

and breakdown bygender (BBVA Group.Percentage)

2018 2017

Totalworkforce

turnover Male Female

Totalworkforce

turnover Male Female

Spain 1.3 62.6 37.4 1.0 66.3 33.7

The UnitedStates 13.0 41.2 58.8 14.0 39.1 60.9

Mexico 13.3 50.7 49.3 12.9 51.3 48.7

Turkey 3.9 41.2 58.8 3.4 36.8 63.2

South America 7.7 42.7 57.3 7.6 45.6 54.4

Rest ofEurasia 4.5 46.0 54.0 5.4 63.1 36.9

Total 7.6 47.1 52.9 7.3 47.5 52.5

(1) Turn-over=[Resignations (excludingearly retirement)/Number of employeesat start of period]x100

Recruitment of employees by gender(BBVA Group.Number)

2018 2017

Total Male Female Total Male Female

Spain 3,242 1,494 1,748 2,714 1,175 1,539

The UnitedStates 2,657 1,184 1,473 2,987 1,373 1,614

Mexico 8,133 4,184 3,949 7,664 4,024 3,640

Turkey 2,223 987 1,236 1,931 827 1,104

South America 3,386 1,569 1,817 3,787 1,708 2,079

Rest ofEurasia 155 96 59 68 36 32

Total 19,796 9,514 10,282 19,151 9,143 10,008

Ofwhich new hires are (1):

Spain 1,252 786 466 1,237 827 410

The UnitedStates 2,650 1,177 1,473 2,951 1,350 1,601

Mexico 5,951 2,997 2,954 6,468 3,314 3,154

Turkey 2,186 973 1,213 1,823 795 1,028

South America 2,521 1,213 1,308 2,765 1,427 1,338

Rest ofEurasia 142 88 54 55 30 25

Total 14,702 7,234 7,468 15,299 7,743 7,556

(1) Including hires throughconsolidations.](https://image.slidesharecdn.com/bbvain2018eng-convertido-190318163007/75/BBVA-in-2018-97-2048.jpg)

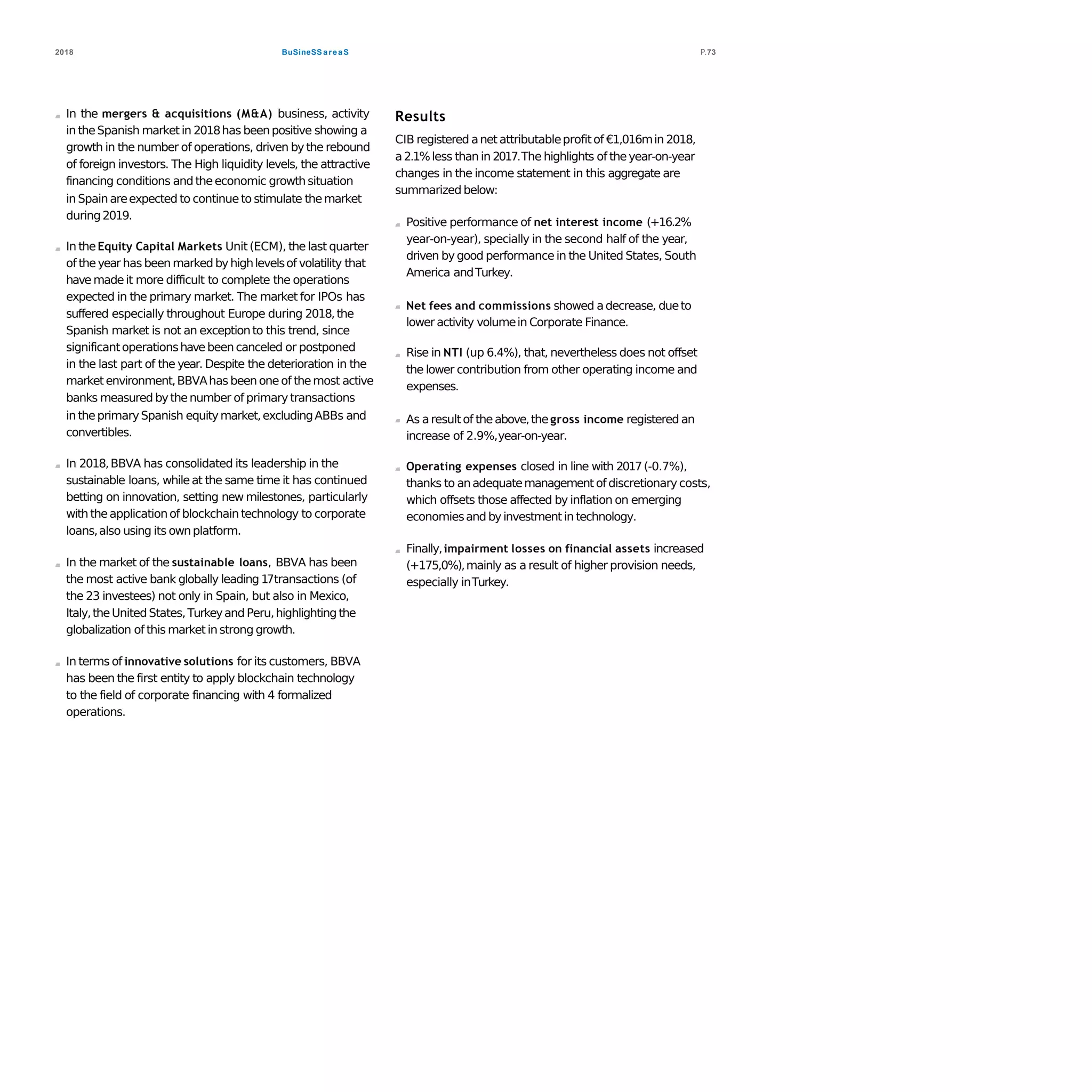

![community inveStment2018 P.156

The OpenMind initiative,https://www.bbvaopenmind.com/,

aims to contribute to the generation and dissemination of

knowledgeconcerning fundamental issues of our time, in an

open and free way. The project has taken shape in an online

community with fulldisclosure.

It seeks to help people understand the principal phenomena

around us that affect our lives; the opportunities and

challenges that weface in areas such as science, technology,

the humanities or the economy. The main objective of the

project is to analyze theimpactof scientific andtechnological

advances on the future of theeconomy,society and our daily

life, which always starts from the premise that a broader and

better collection of knowledgewill help us to make better

individual and collectivedecisions.

In 2018,the book “The Age of perplexity: Rethinking the

World WeKnew” was published (available free of charge

https://www.bbvaopenmind.com/en/books/the-age-of-

perplexity/ ), in which 23 world experts try, in 20 small,

independent tests, to throw light on certain hot topics such

as the rise of populism, the era of big data, the relationship

between globalization and new economy ... Faced with lack

of resolution, confusion, and doubt (as the dictionary of the

RoyalAcademy Spanish defines“perplejidad,”or perplexity),

thecure is knowledgeandreflection.

It is thetenth book in acollection promotedbyBBVAthat

is dedicated to thedissemination of knowledgeon current

fundamental issues. It was born as a strictly editorial

initiative and later becamepart of theBBVAOpenMind

project, anonline community for debateand generationand

dissemination of knowledgefor society as awhole.

Education

Education for society is an extremely important aspect of

BBVA's social investment as it continues to support access

to education, educational quality and the development of

21stcentury key competences as sources of opportunity.

It shares space with other initiatives of the Group, such as

the activities of the BBVA Foundation. In 2018, a total of

279.909 people have directly benefitted from the following

educational programs:

Access: Brief description: Scholarshipsto facilitate

access to education for children,young,and/or adults.

•Children: “Niños Adelante” [Moving Children

Forward] scholarship program in Colombia, Mexico,

Paraguay,Peru,Uruguay,Venezuela.

•Young:“Becas Adelante”(Forward Scholarships)in

Mexico, “Olimpiadas del Conocimiento” (Olympic

Knowledge) scholarships inMexico.

•Adults:

- Scholarships for Latin American students to study

the Interuniversity Master in Protection of Natural

Spaces

-“Becas Adelante”(AdelanteScholarships)with your

University inMexico

- ScholarshipsPontifical CatholicUniversity in Peru

- Higher education scholarshipsin theUnited States

- Research grants fromtheCenter for Education and

FinancialWorkatagloballevel

Educational quality: Brief description: Promotes

educational social innovation and talent among

teachers,which provides access totraining, knowledge,

visibility andnetworks, through avarietyof initiatives.

•“AcciónMagistral”[Magistral Action] Program in Spain

•TheTeachersAcademy Foundation inTurkey

•TheTeachforAmericain theUnited States

•“PremioNacional alDocente”(NationalTeacher’s

Prize) inColombia

•“Programa Papagayo”(PapagayoProgram) in

Venezuela

•Charter School Partnerships in the United States

•Programfor thestrengthening of public schools in

the UnitedStates

•“PremioGiner delos Ríos”(Giner delos Ríos Prize)

from the BBVAFoundation

XXI Century Skills: Facilitates the developmentof

important XXI century skills for children and young

people through inspiring audio-visual content and

freeanduniversal teaching methodsfor families and

teachers.

•“BBVAAprendemosJuntos” [LearnTogether]inSpain

•“Sociospor un día“[Partnersfor aDay]in Spain

•“Laboratorio de Robótica” (Robotic Lab) inParaguay

•Math-ScienceLearningwith FuninTurkey

•CodetheFutureinTurkey

•Proyecto Conectados (Connected Project) in Spain

Others: Partnerships with institutions in the academic

fieldto contribute to educational challenges in different

countries.](https://image.slidesharecdn.com/bbvain2018eng-convertido-190318163007/75/BBVA-in-2018-157-2048.jpg)

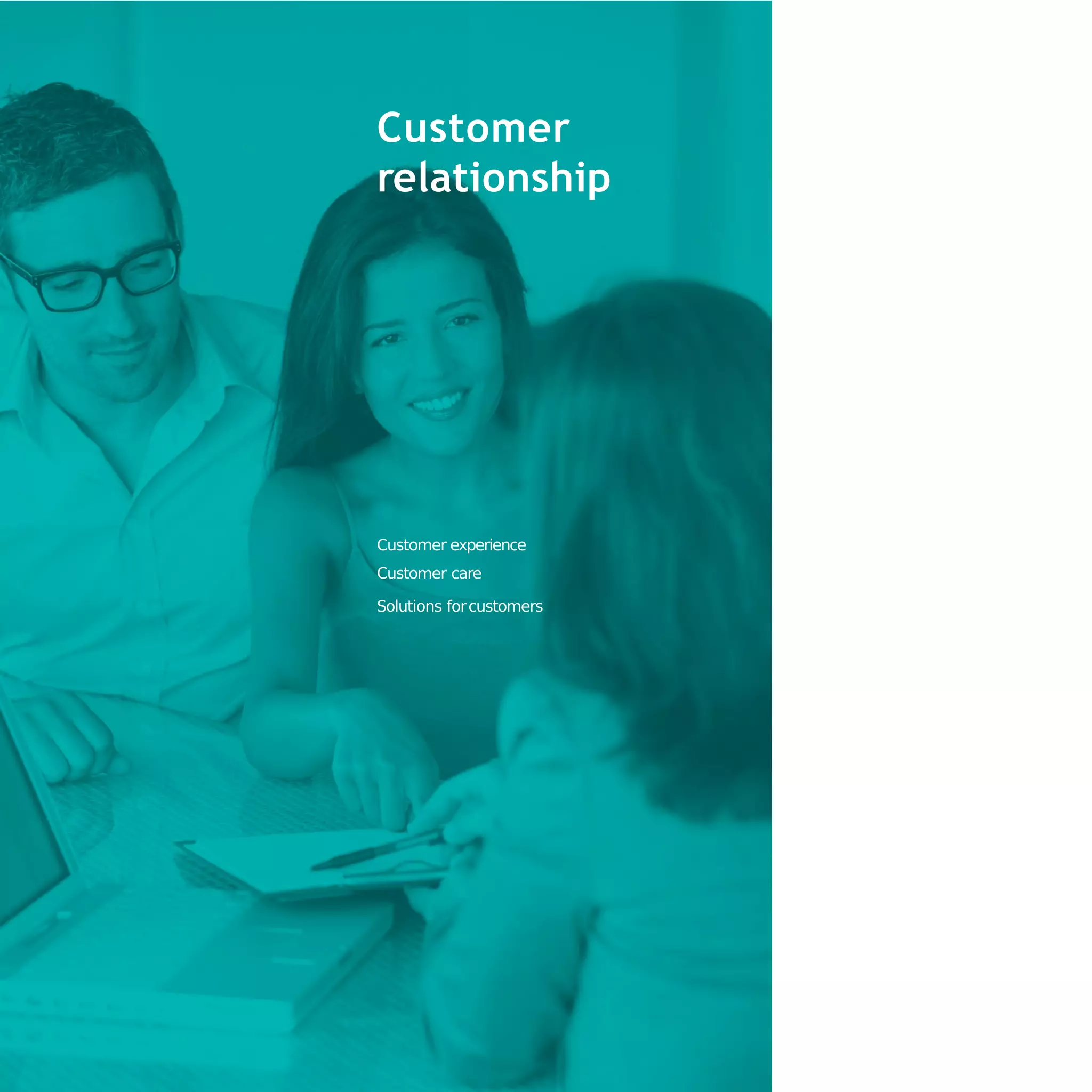

![community inveStment2018 P.157

Culture

The promotion of cultural creation of excellenceis another

lever of support of the BBVA Foundation to generate

knowledge.It focuses its support on classical music, with an

emphasis on contemporary music, visual arts, video art and

digital art, as wellas literature andtheater.In 2018,morethan

1.1million people have benefited from the culturalinitiatives

promoted by the BBVAFoundation.

Below arethe main culturalinitiatives promoted by theBBVA

Foundation in2018:

Support for the creation of culture:

•“Becas Leonardo" (Leonardoscholarships) to cultural

creators.

•“Becas Multiverso”(Multiverso Scholarships)for the

creation ofVideoArt fromtheBBVAFoundation.

Collaborations :

• With museums: thePradoMuseum,theGuggenheim

MuseumBilbao,theJoan Miró Foundation.

• Withtheaters:theTeatroReal,theGranTeatredelLiceu

• Others: Bilbao Association of Friends of the Opera,

theOrchestra andChoir of theCommunityof Madrid,

the Symphony Orchestra of Madrid, the ReinaSofía

School of Music for the training of interpreters, the

YoungNational Orchestra ofSpain

Prizes:

Composition Award Spanish Associationof Symphonic

Orchestras (AEOS) -BBVAFoundation.

BBVA continues to support culture in the countries where it

is present. In 2018,they have invested €5.4 million in cultural

initiatives. The following local cultural support initiatives

stand out:

Mexico:

• BiProgram:exchangeandcollaborationplatformforthe

generationanddisseminationofartandcultureinitiatives.

• Bancomer-CCD Immersion Laboratorywithin the Digital

CultureCenterof MexicoCity: first integralproject of

residences,creation,research,traininganddissemination

oftheimmersiveartsinthecountry.

• Hazlo [Do It] Short Film Contest

www.hazloencortometraje.com:it promotescreation

throughfilmandrecognizesthetalentofyoungpeoplewho

competeusingtopicalsubjects.

The United States:

Investment in culture is intended to ensure that people

fromlower and moderateincome communitieshaveaccess

to art and that there are spaces and opportunities available

to communities.

Peru:

Cusco Museum of Pre-Columbian Art: this year, it

implementedthe audioguideservice that puts it on the level

of themost friendlyand modern museums in theworld.

It is the first museumof pre-Columbianart in thecountry,

and uses these innovations to facilitate knowledgeof the

Andeancosmovision that governed ancient Peru.

• Encuentra tu Poema [FindYourPoem] (phrase)

Turkey:

Salt Foundation: created in 2011from the union of the

Garanti Contemporary Art Center Platform, the Ottoman

Bank Museumand theGaranti Gallery.It offers freeaccess

to exhibitions, archives,libraries,research facilities,etc.

Others

BBVA's community involvementactivity includes other lines

of action, such as volunteering, support for social entities,

and the promotion of corporate responsibility through its

participationin themainworking groups.

Apoyo a entidadessociales

BBVA maintains open channels of communication with

social entities in the various countries in which it operates.

It promotes community developmentthrough its Support

to Social Entities program. It channels its support through

contributions to non-governmental organizations, social

entities and other non-profit associations, in order to

contribute to the main social and/or environmental causes

facing society in the countries where it is present. Over the

course of 2018,it allocated more than €6 million to support

social entities.

Territorios Solidarios (Solidary Territories)

https://www.territoriosolidariobbva.com/ supported 176

social entitiesin Spain during2018.In its sixth edition,the

activeemployeesofBBVAinSpain hadtheopportunity to

propose and vote on the projects of non-profit entities of

nationalscope thattheywantedtopromote.

Partnerships with non-profit entities helping to cope with

natural disasters in theUnited States and Mexico.

"PremioIntegra"(The Integra Award) for promotion of jobs

for the disabled inSpain.

ProgramaEurosolidario”(Eurosolidarity) in Spain.](https://image.slidesharecdn.com/bbvain2018eng-convertido-190318163007/75/BBVA-in-2018-158-2048.jpg)