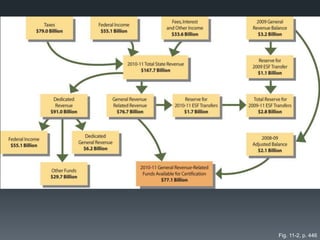

The document discusses fiscal policy in Texas. It notes that Texas has traditionally taken a low-tax approach to fiscal policy, with a commitment to balanced budgets through low spending levels. The state's tax policy emphasizes regressive sales taxes over income taxes. Business taxes include franchise taxes and selective taxes on industries like oil and gas. Texas ranks low in per capita government spending and tax burden compared to other states. Revenue also comes from selective sales taxes on items like cigarettes, alcohol, and fuel as well as lottery proceeds and federal grants.