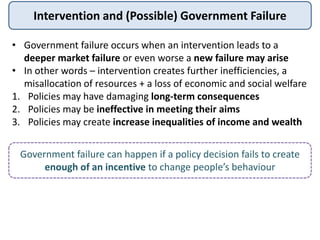

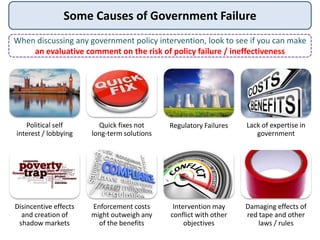

The document discusses government failure, which occurs when interventions create further inefficiencies, leading to deeper market failures and societal issues. It highlights the pitfalls of various policies such as emission regulations and taxation, where despite aiming to drive innovation and reduce emissions, they can lead to unintended consequences and ineffective outcomes. Factors contributing to government failure include political self-interest, poor value for money, and the inability to anticipate market reactions to regulations.