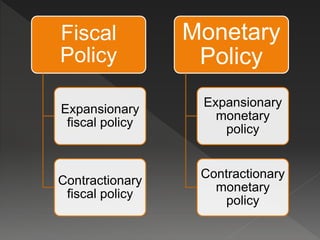

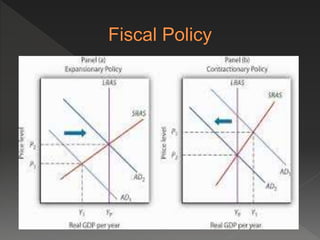

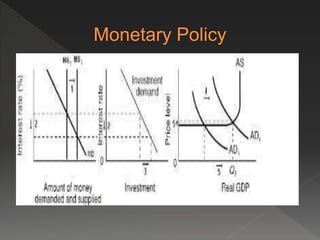

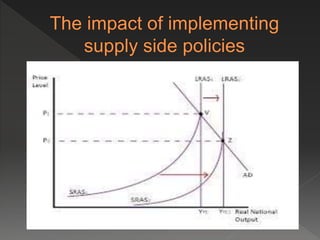

The document discusses macroeconomic policies used by governments to influence aggregate demand and supply. It explains that fiscal policy involves varying public expenditure and taxation to manage demand, while monetary policy changes interest rates and the money supply. Expansionary policies boost demand during recessions by cutting taxes or lowering interest rates. Contractionary policies reduce demand to curb inflation by raising taxes or interest rates. The document also discusses supply-side policies aimed at boosting productivity through incentives, education, deregulation, and other measures.