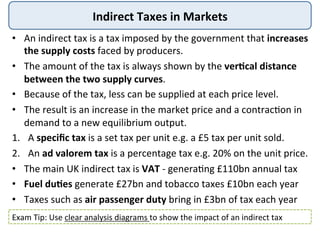

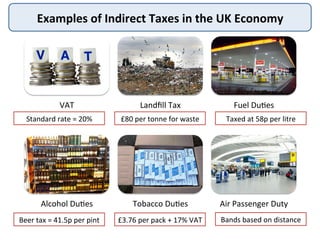

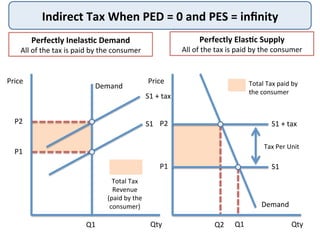

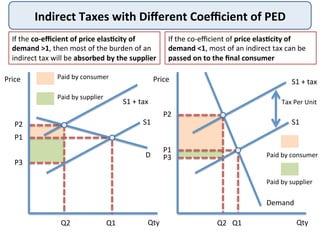

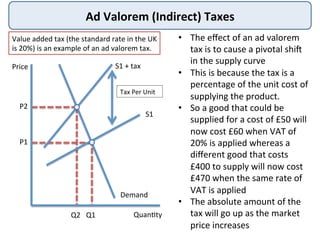

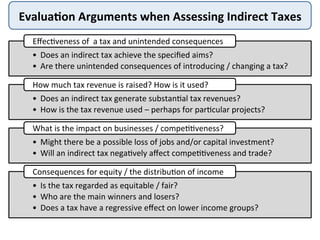

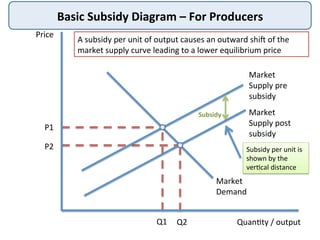

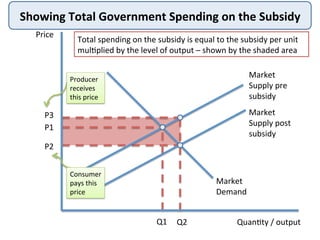

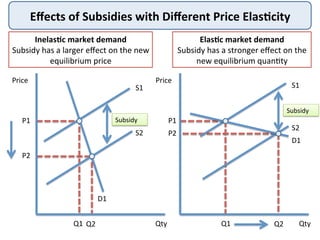

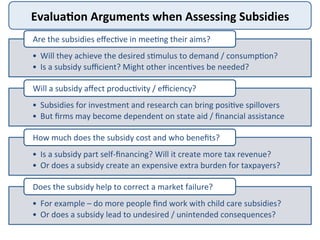

This document discusses indirect taxes and subsidies. It provides details on different types of indirect taxes, including VAT, fuel duties, and tobacco duties levied in the UK. It explains how indirect taxes increase producer costs and are passed onto consumers in the form of higher prices. The document also examines how the burden of an indirect tax is distributed between consumers and suppliers, depending on the price elasticity of demand. Finally, it discusses government subsidies to producers and consumers and some examples used in different markets.