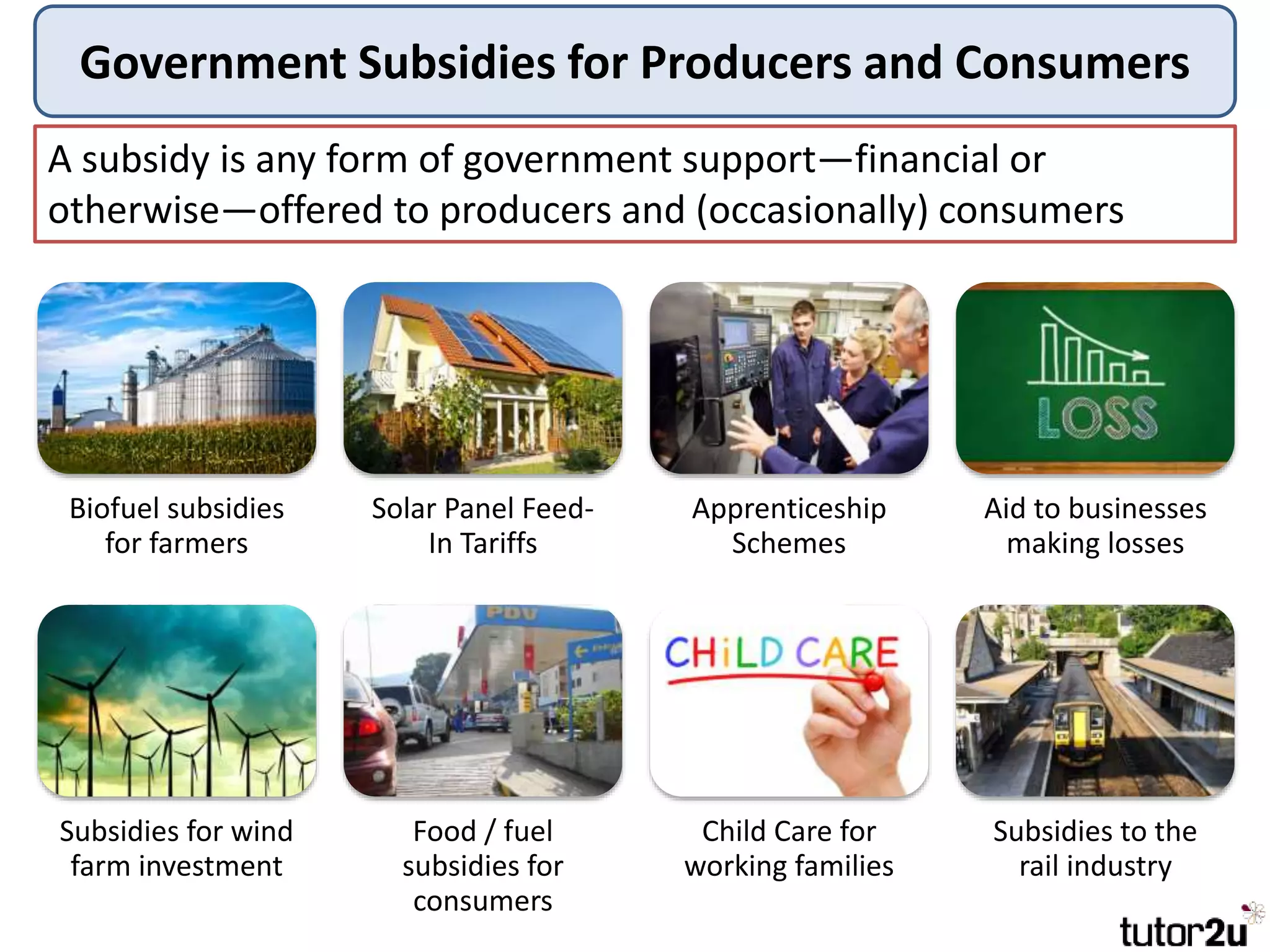

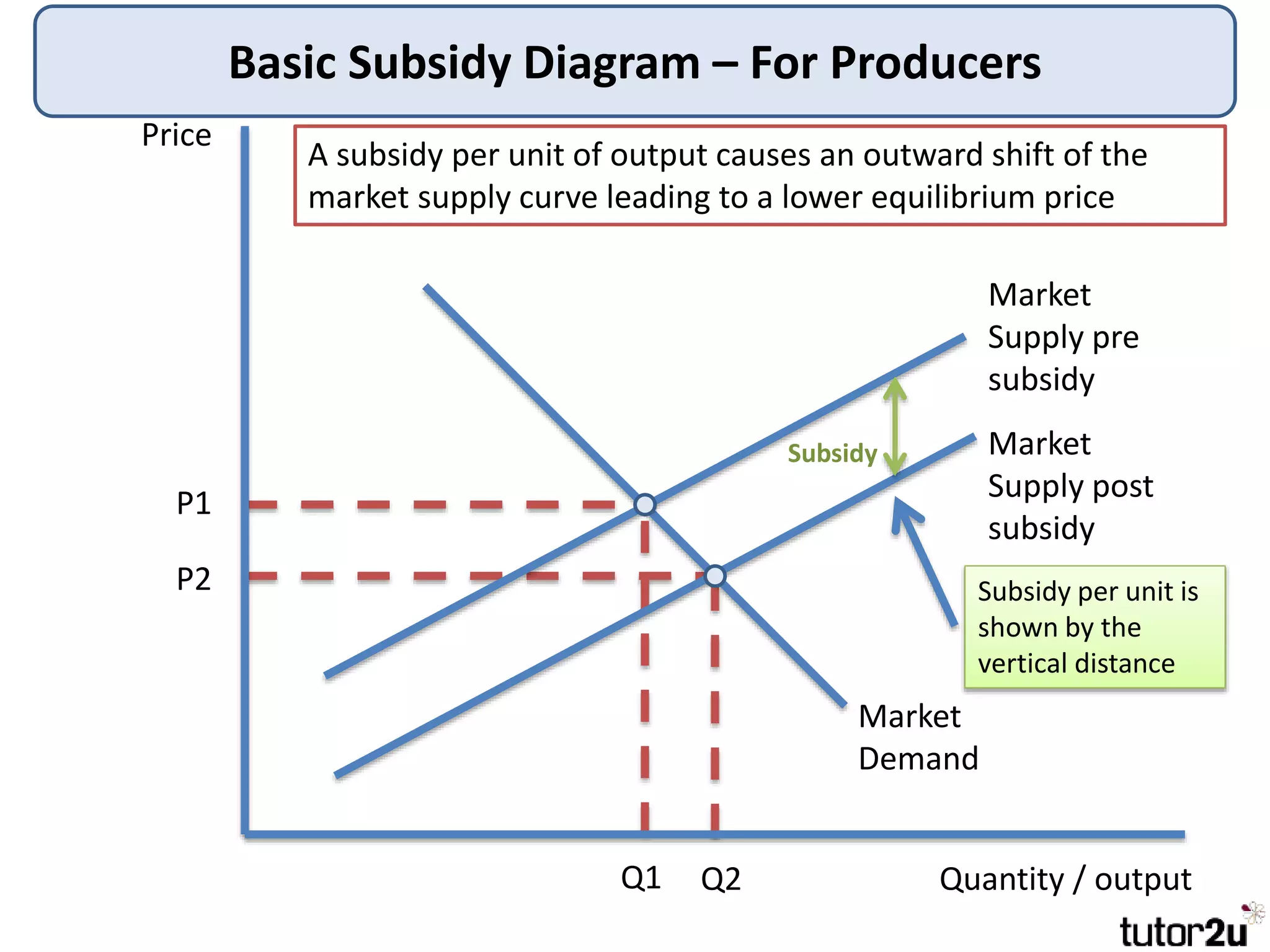

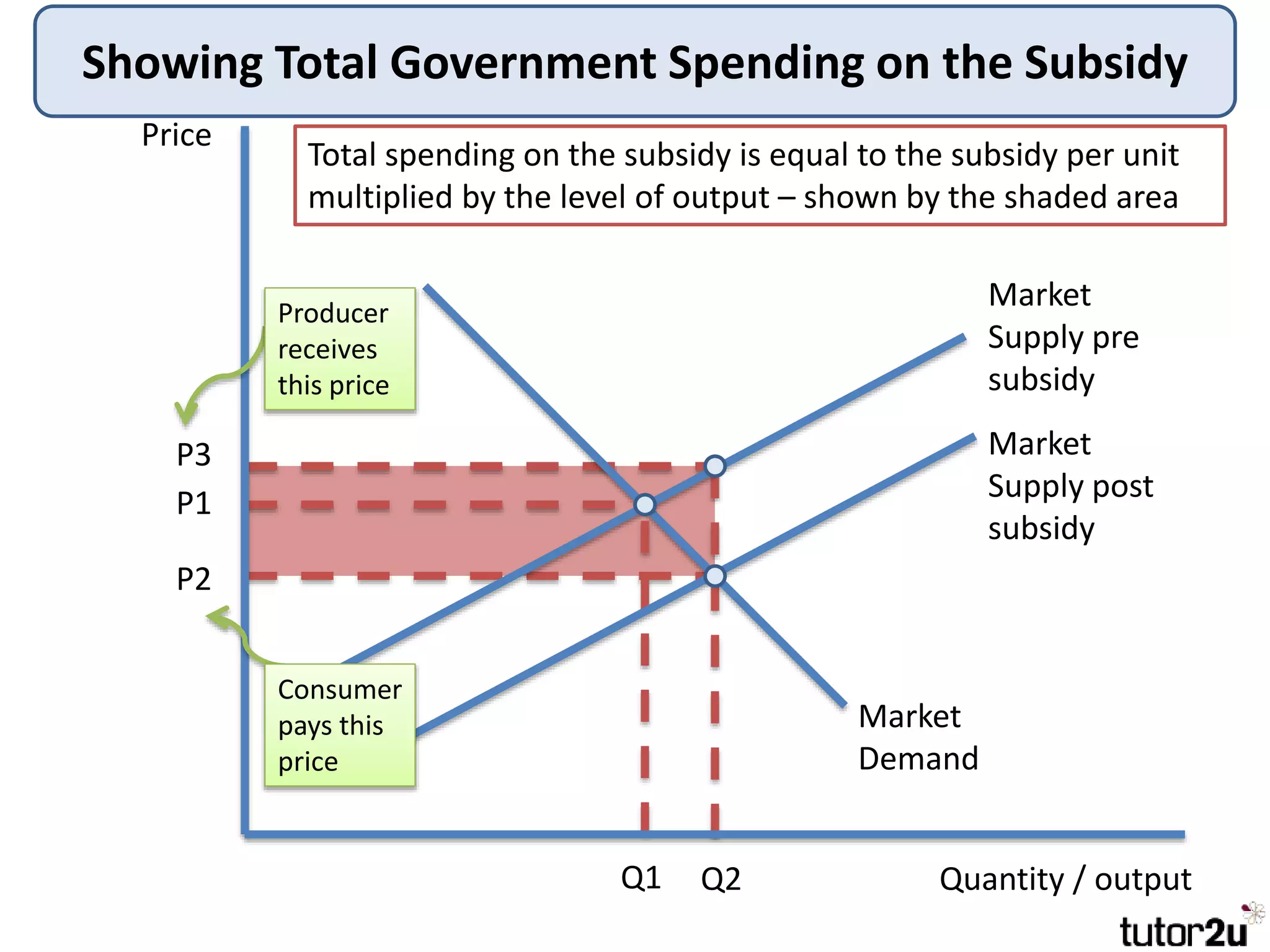

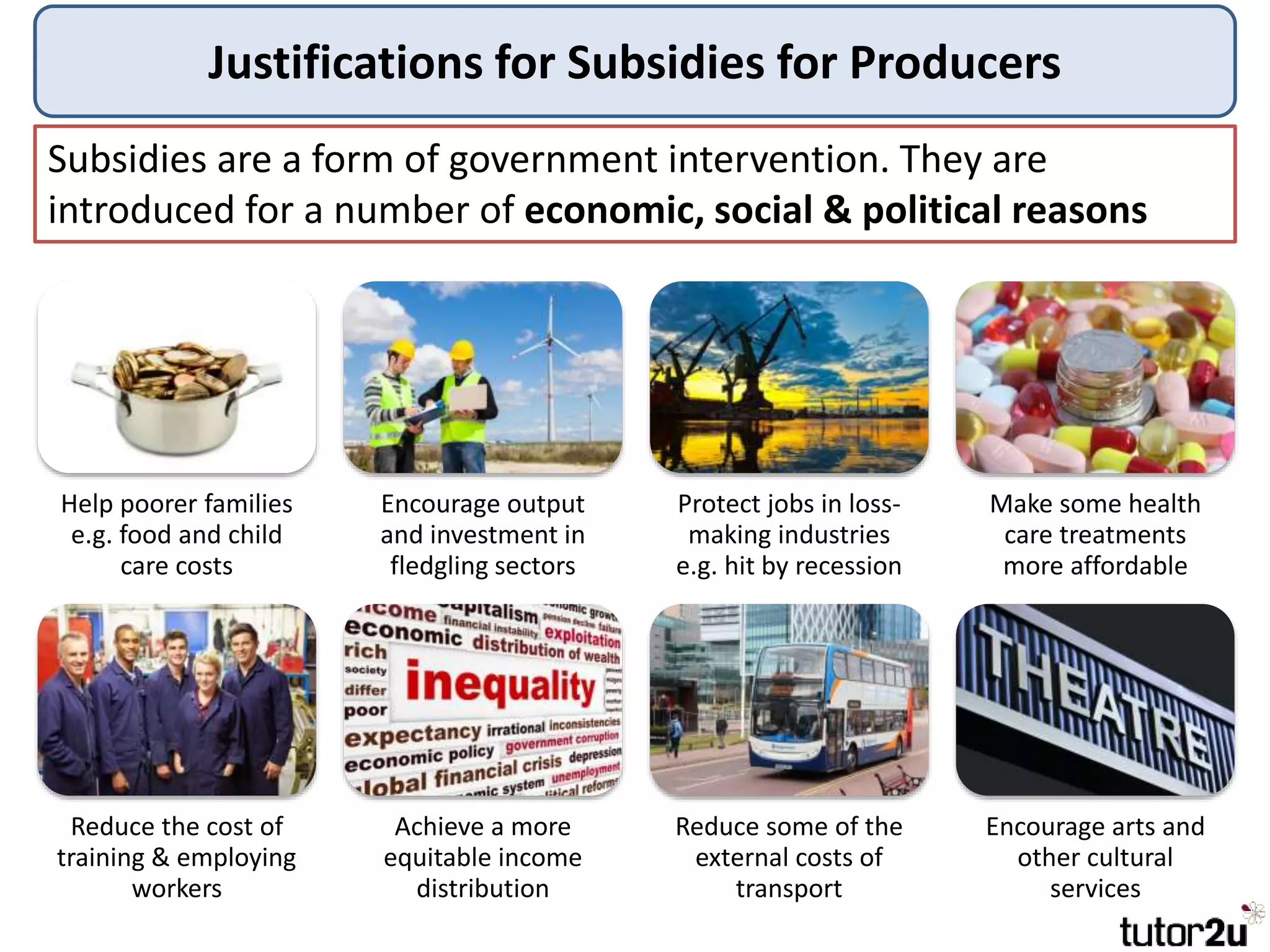

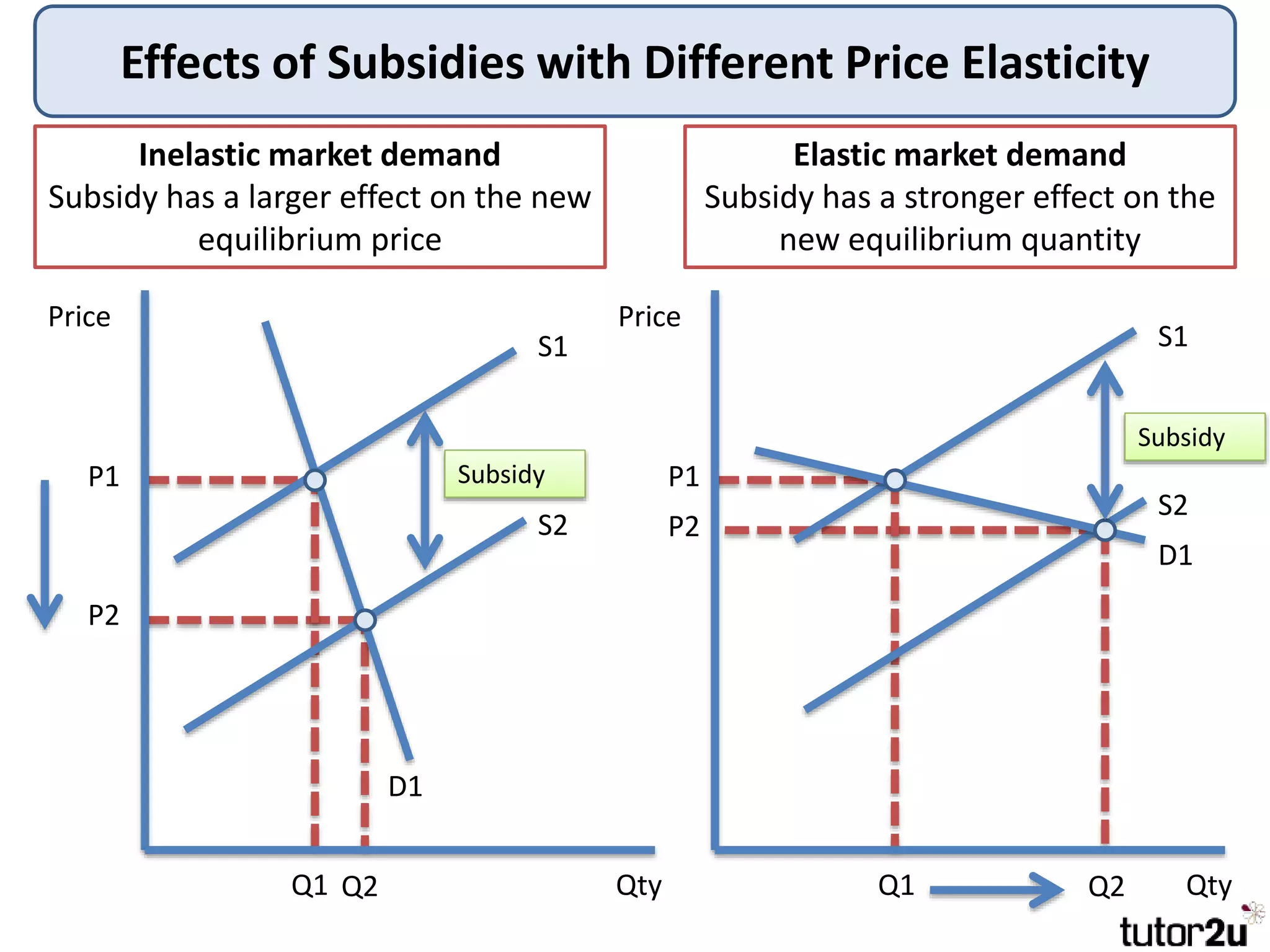

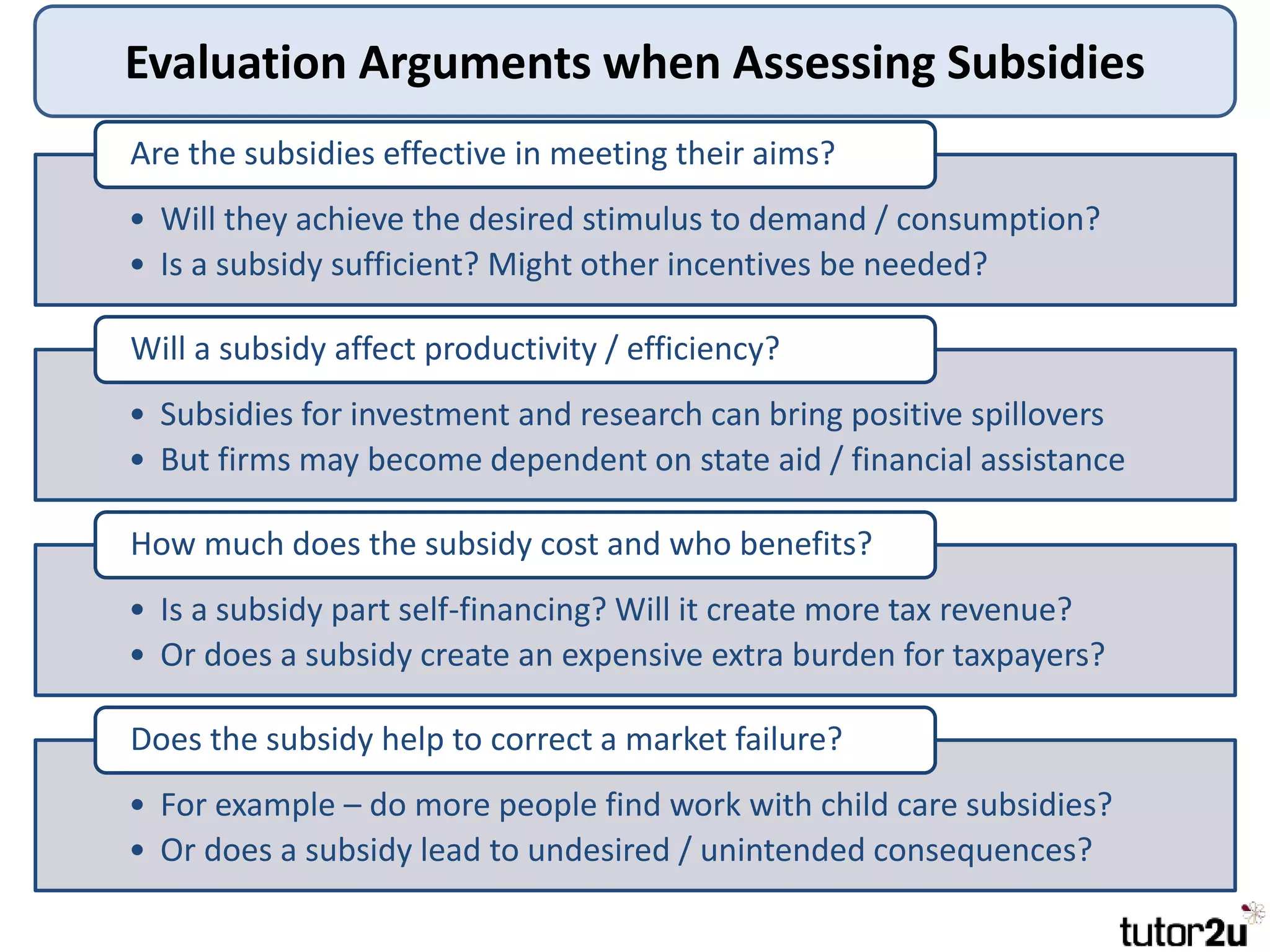

The document discusses government subsidies as a form of intervention in various markets, highlighting their purposes, such as supporting producers and consumers, promoting investment, and addressing social equity. It outlines the effects of subsidies on market supply and demand, as well as evaluations regarding their effectiveness and potential unintended consequences. The document also emphasizes the importance of understanding the cost of subsidies and who benefits from them.