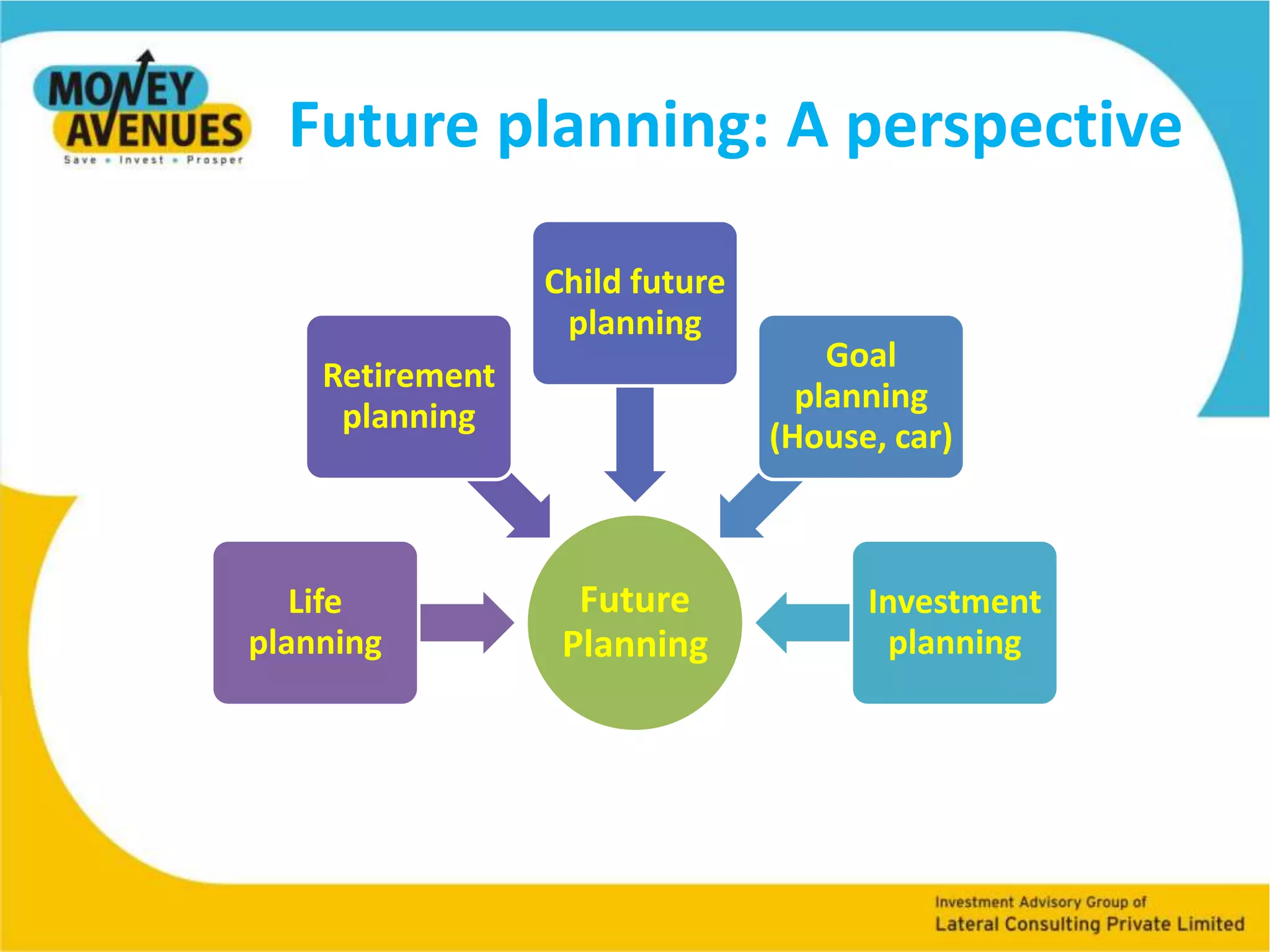

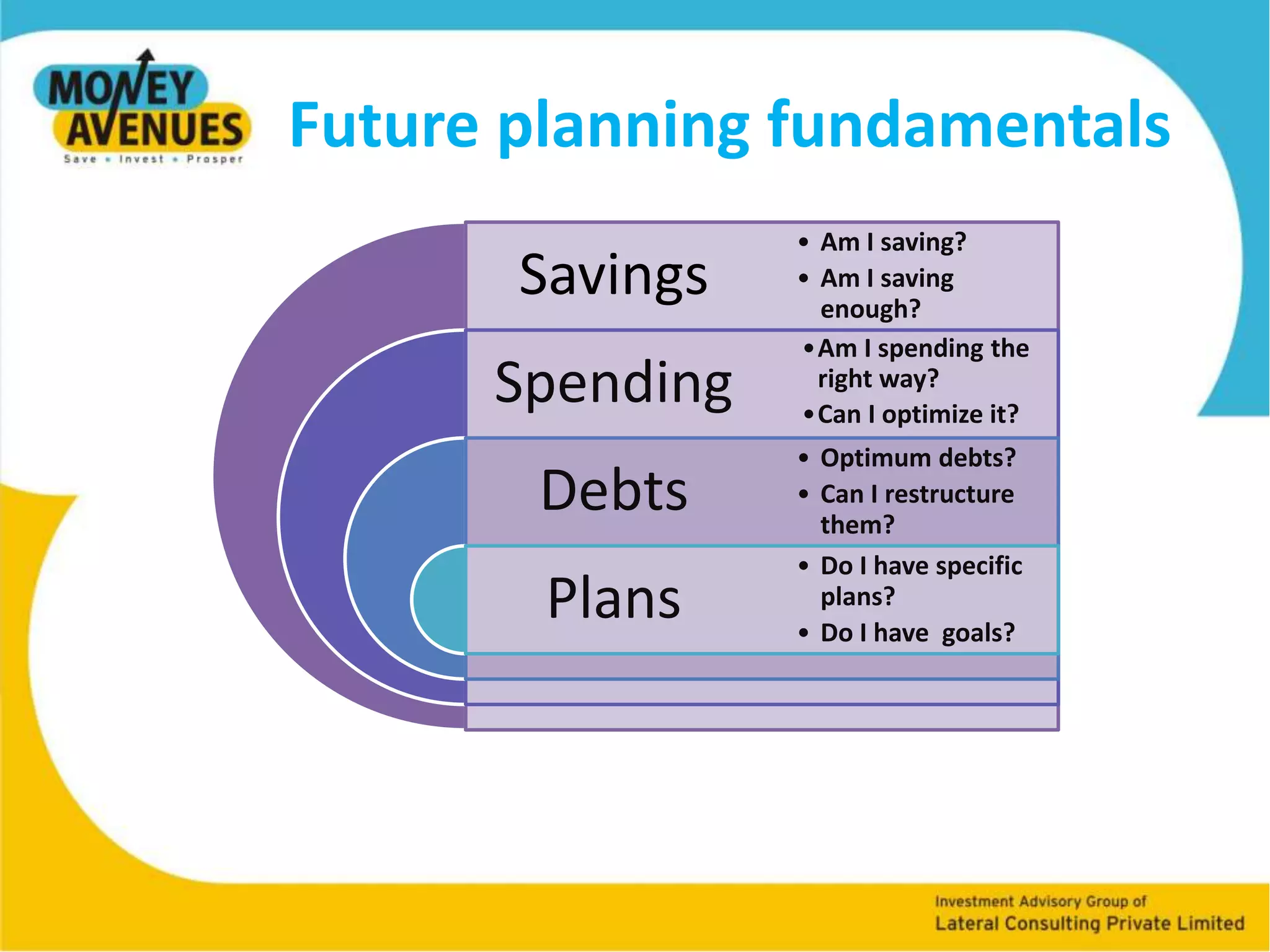

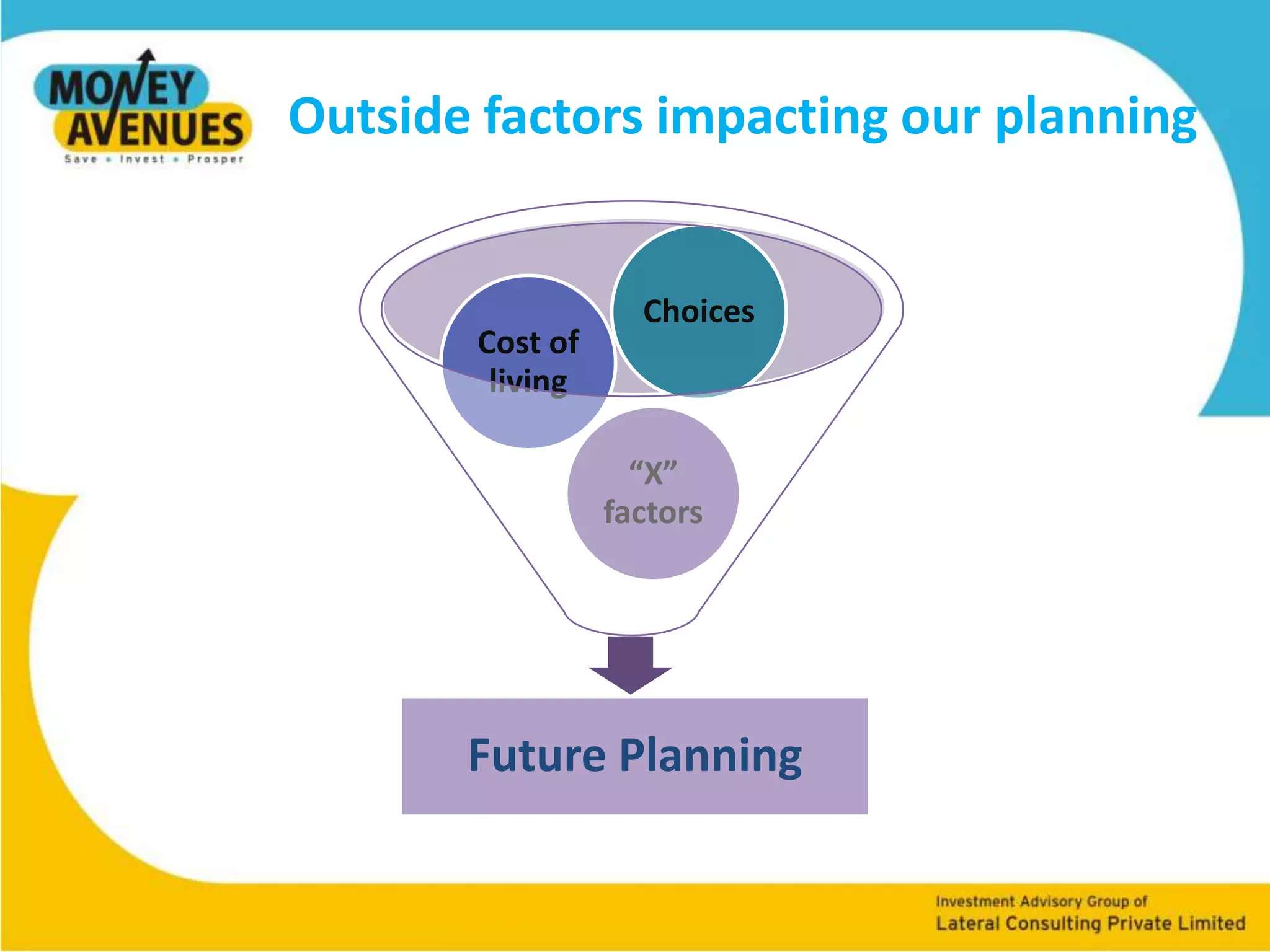

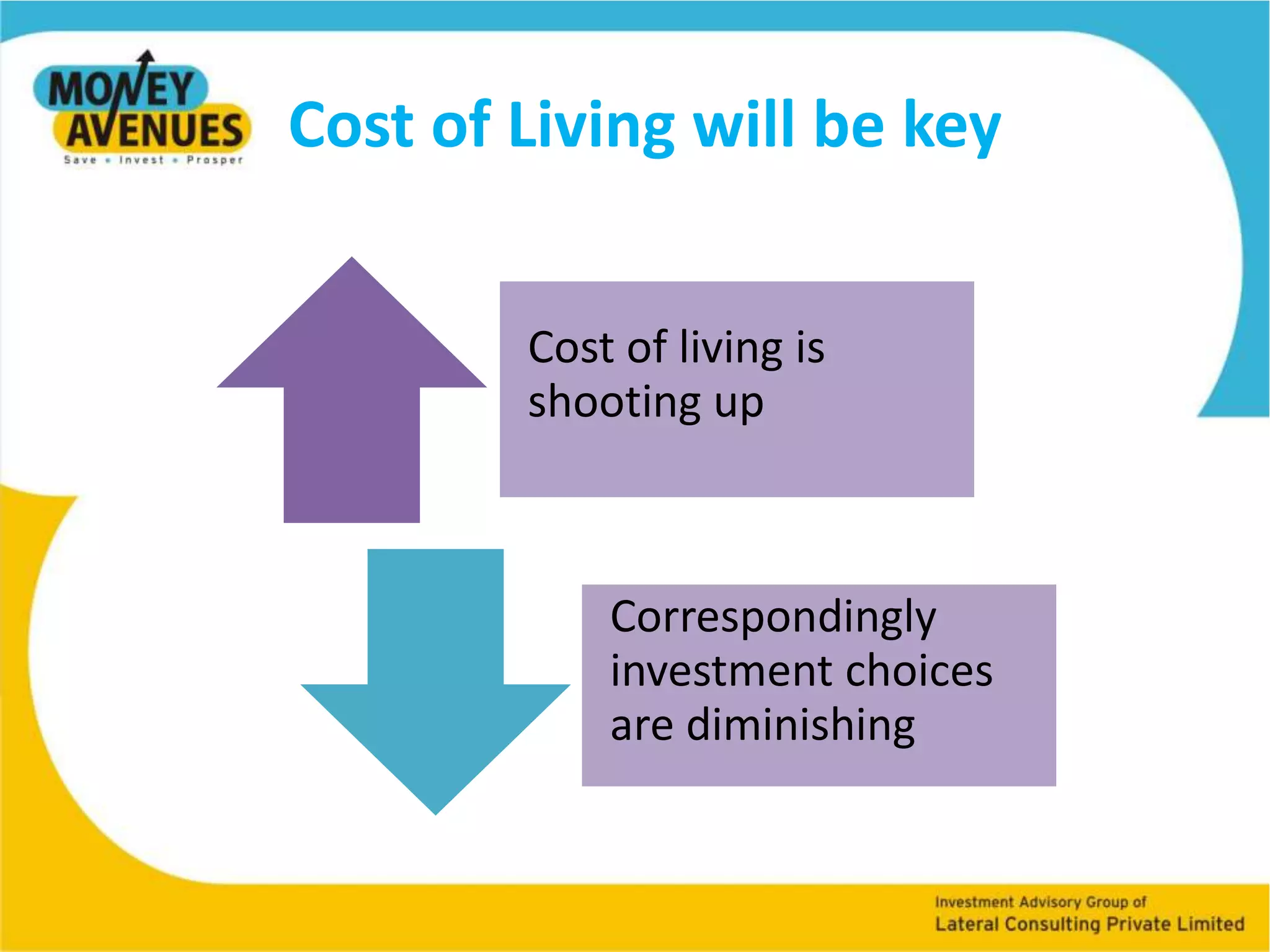

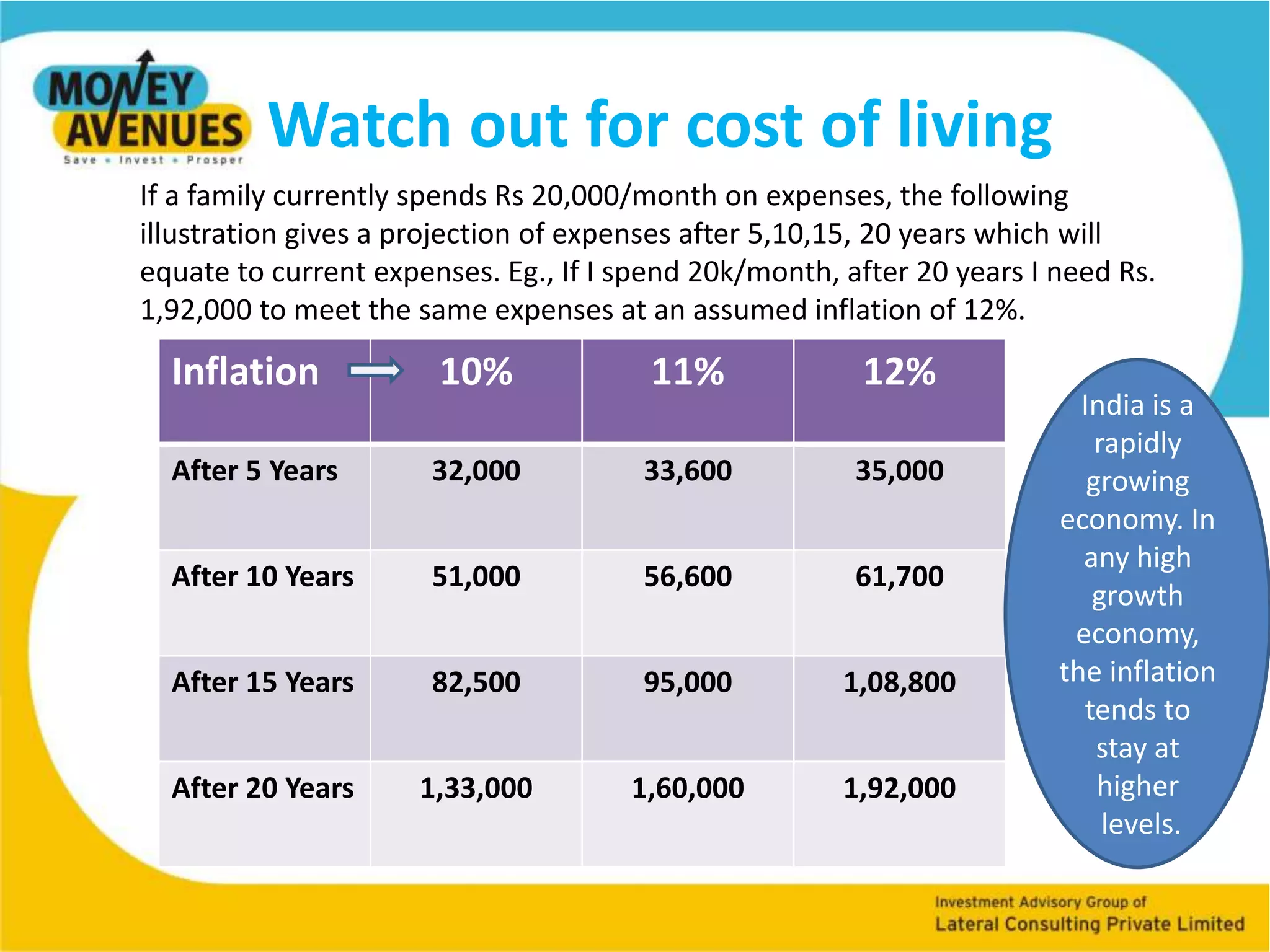

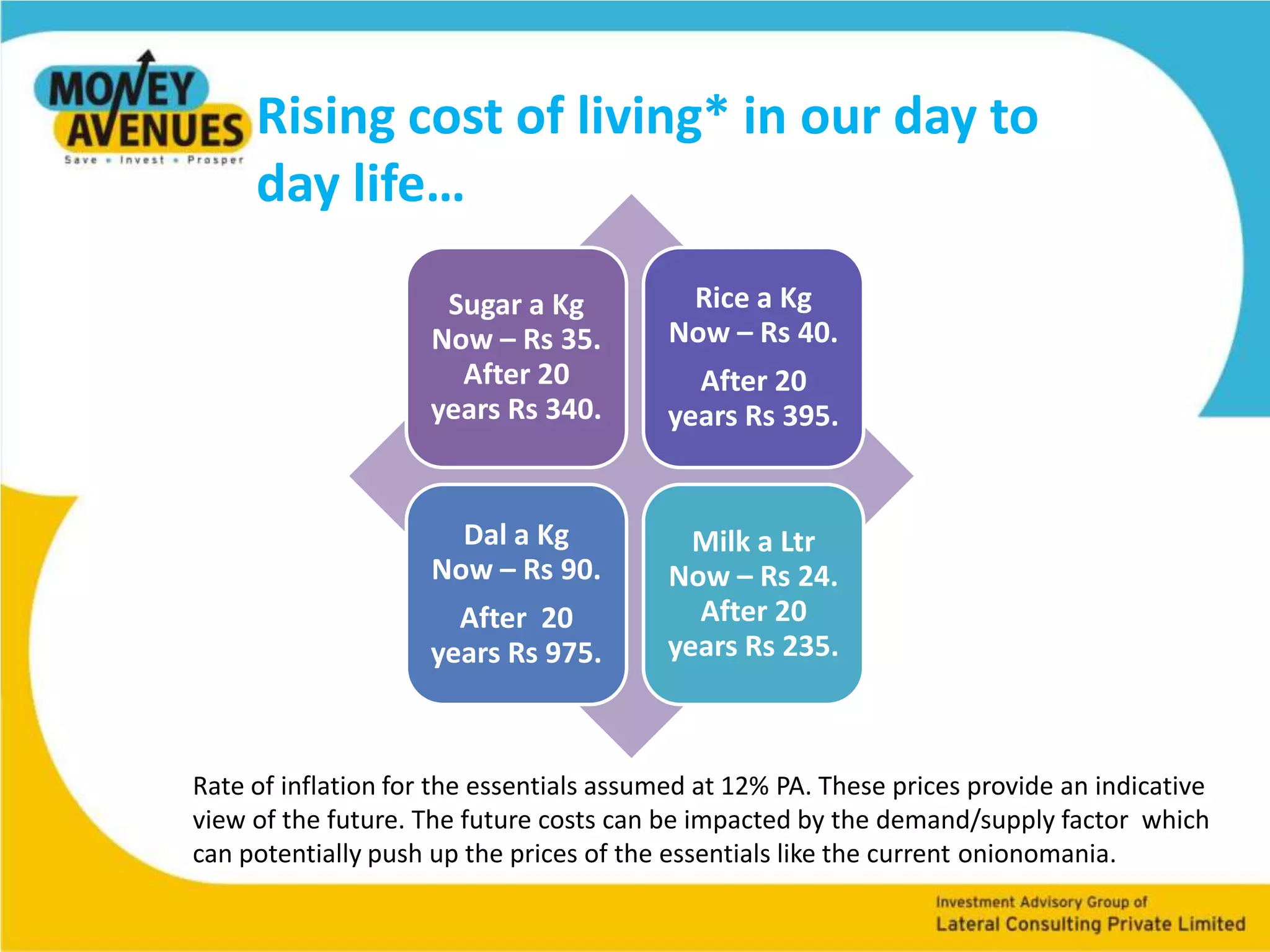

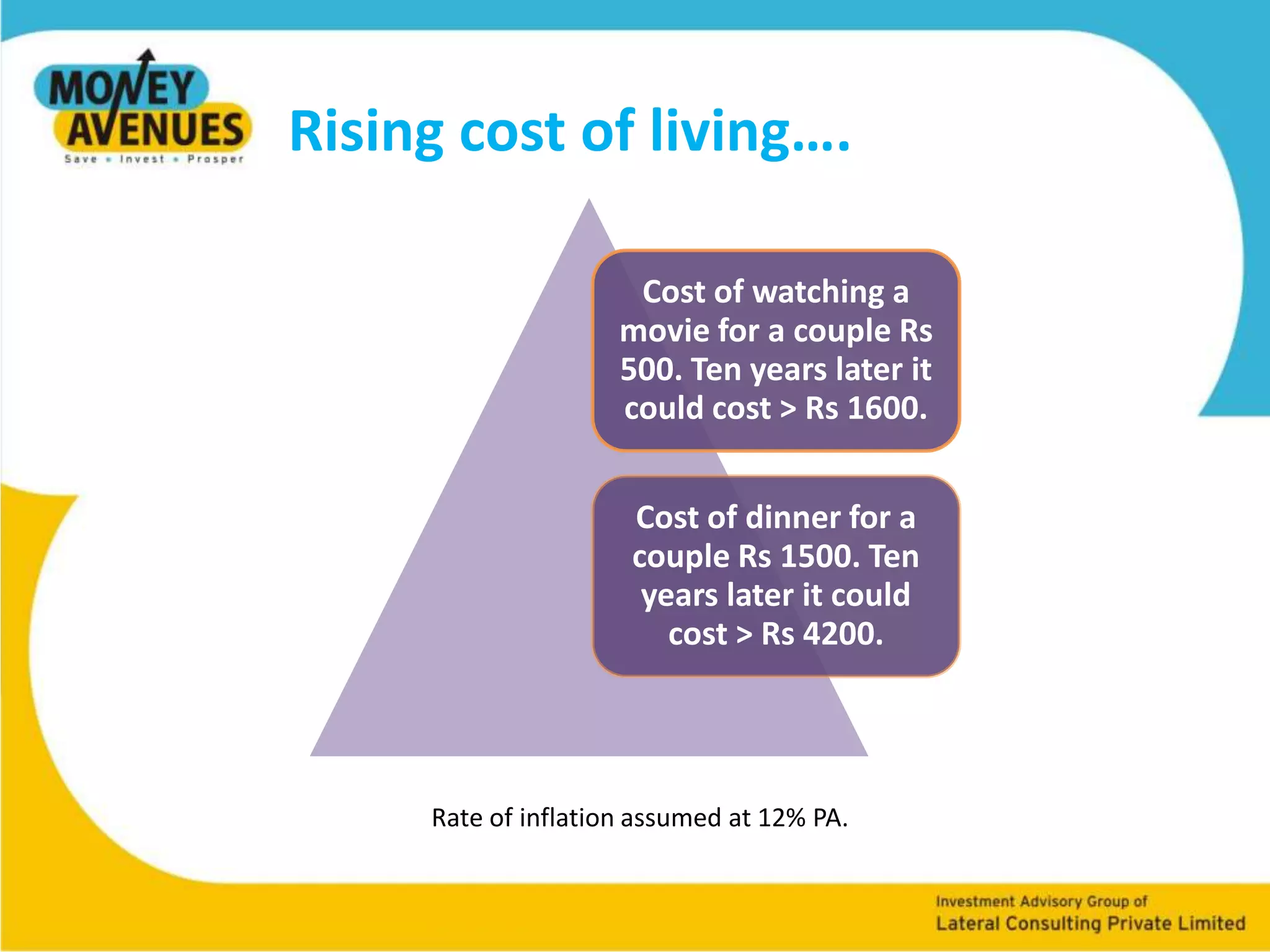

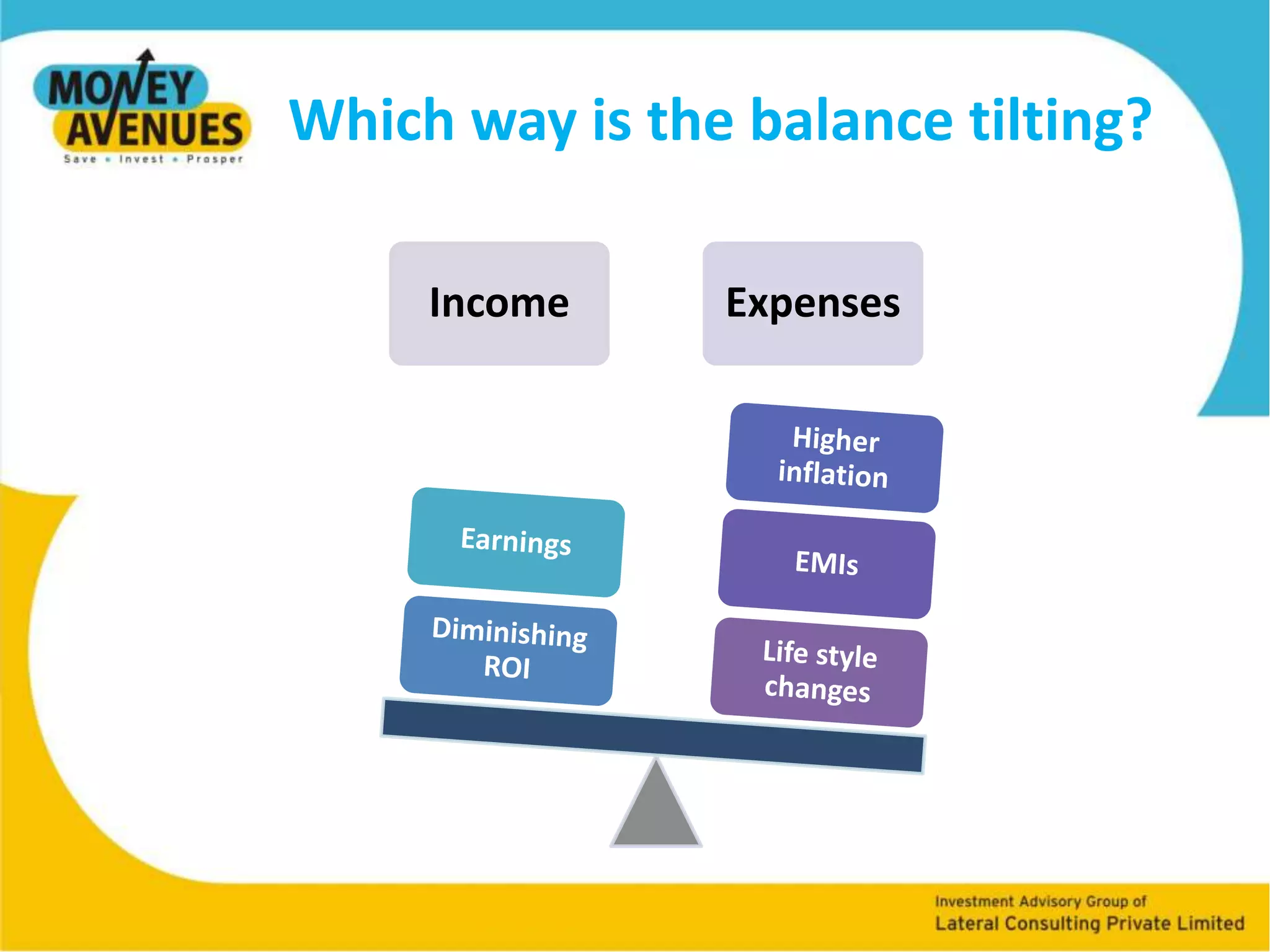

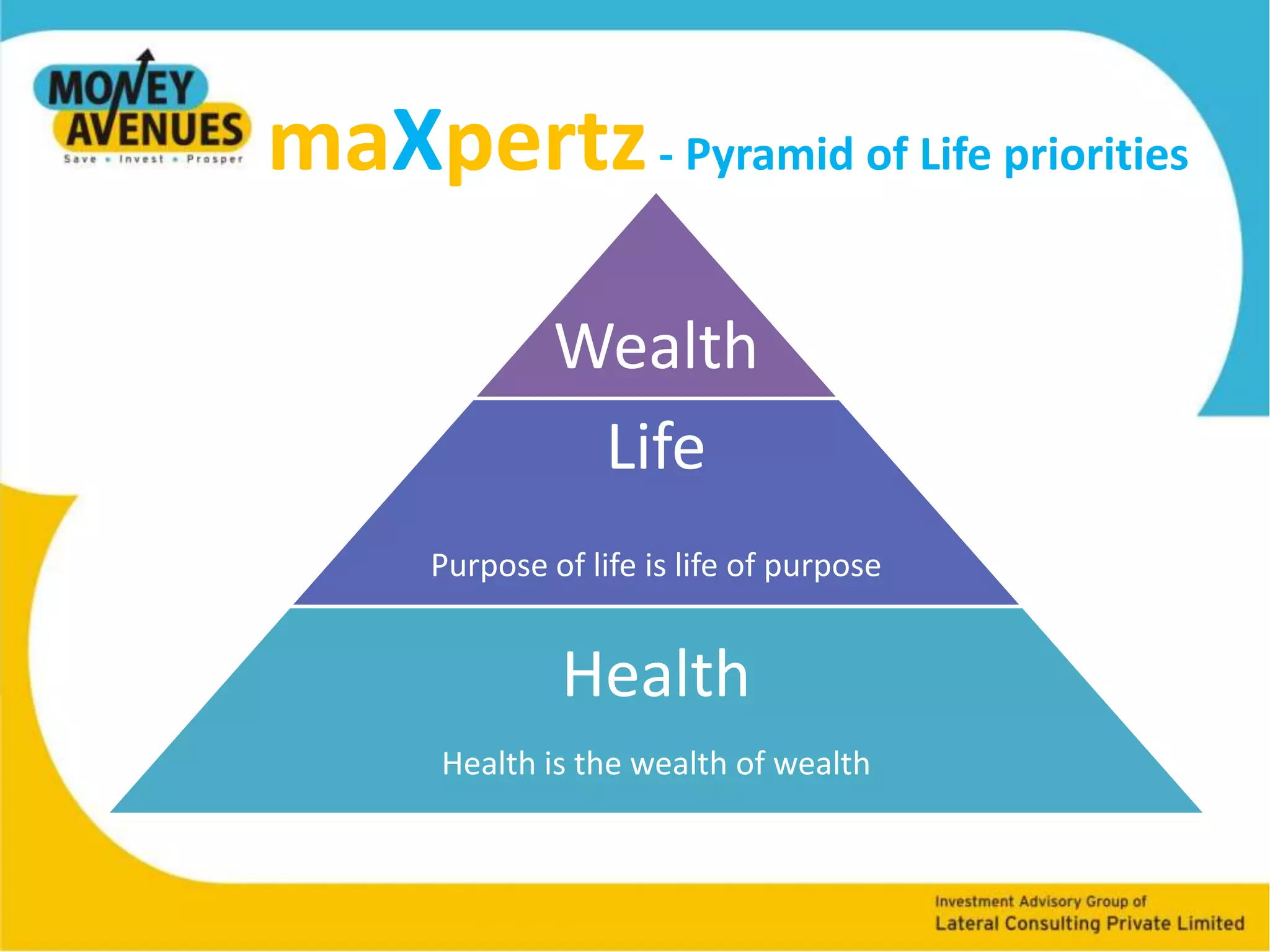

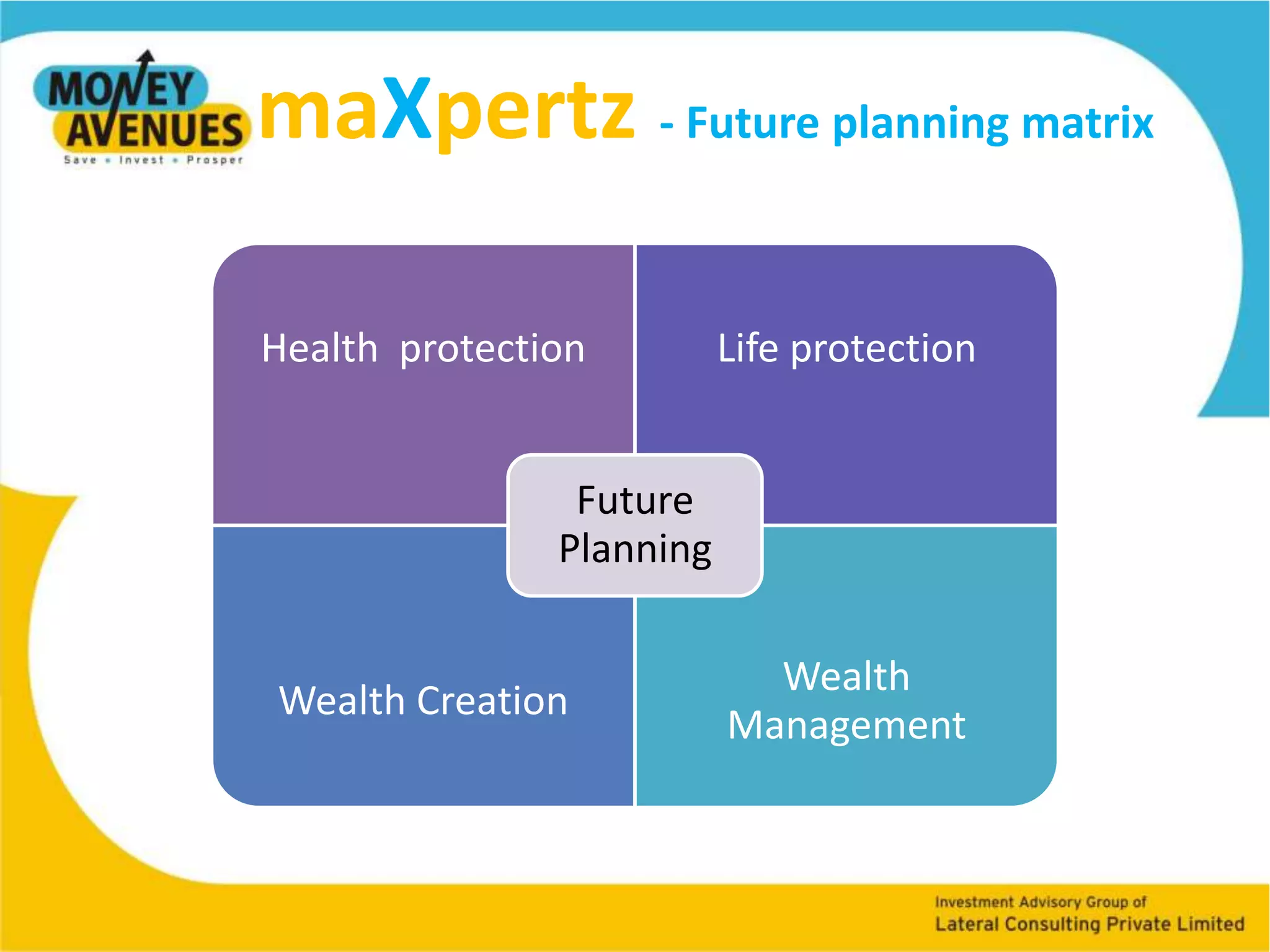

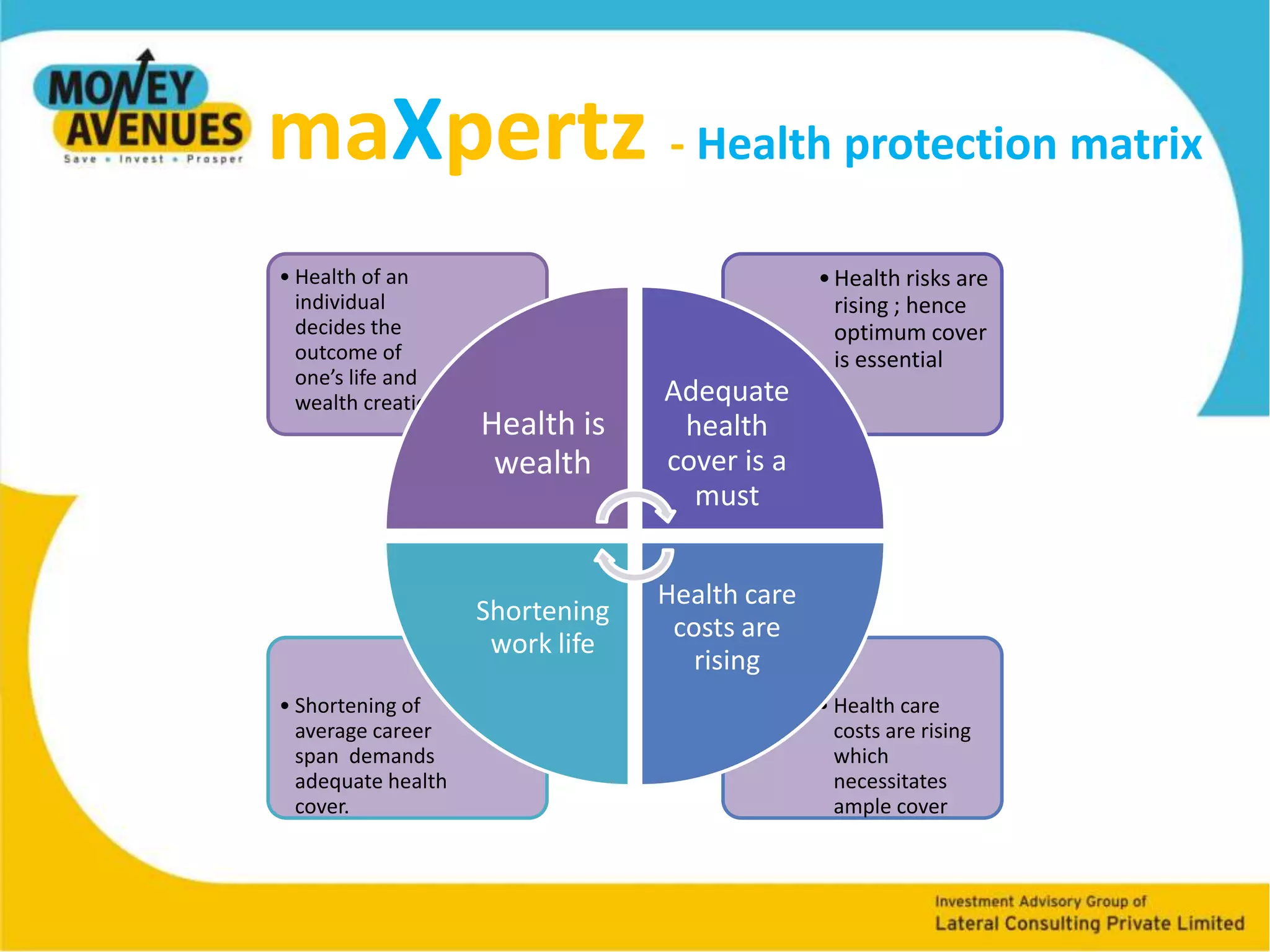

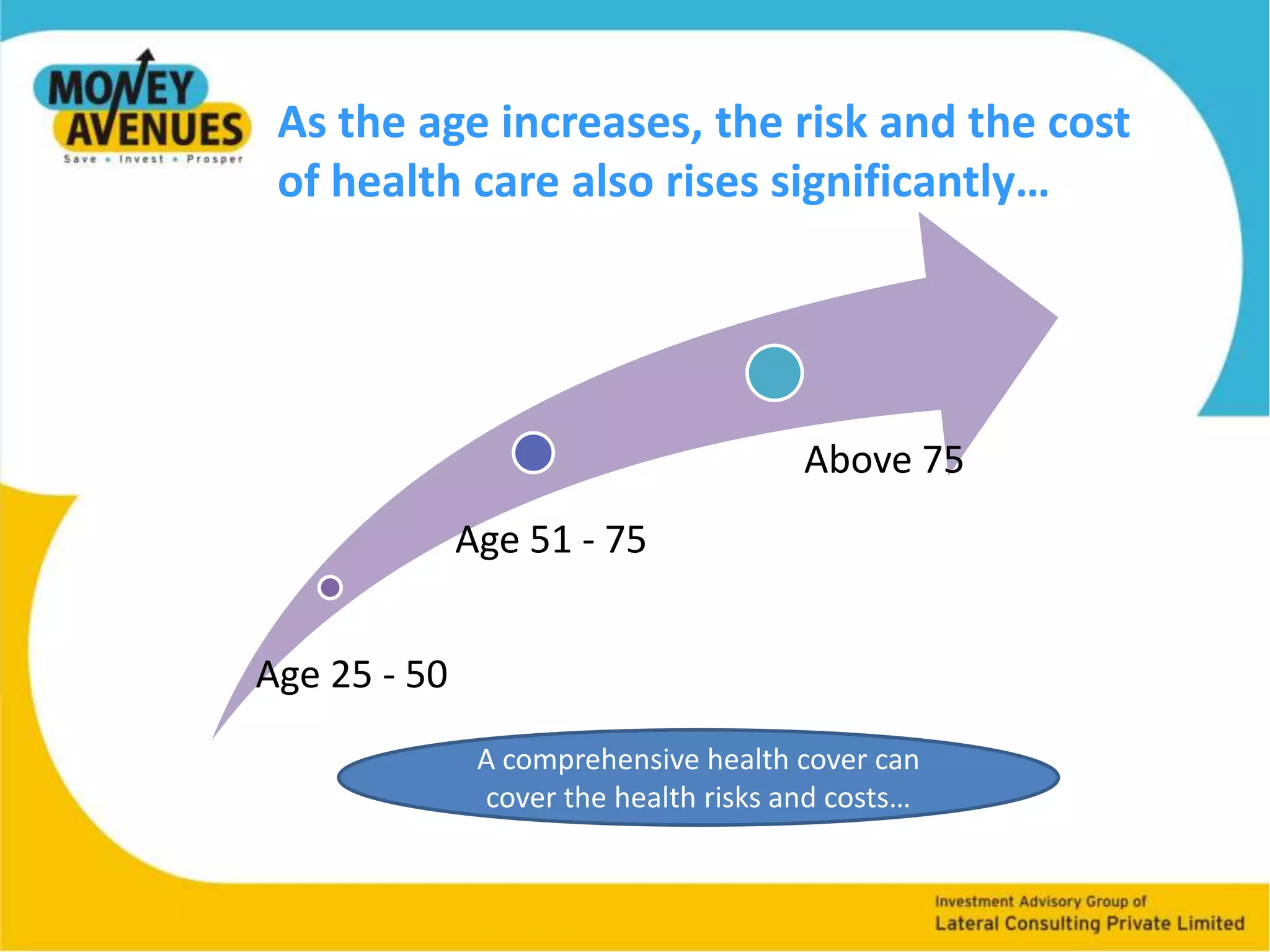

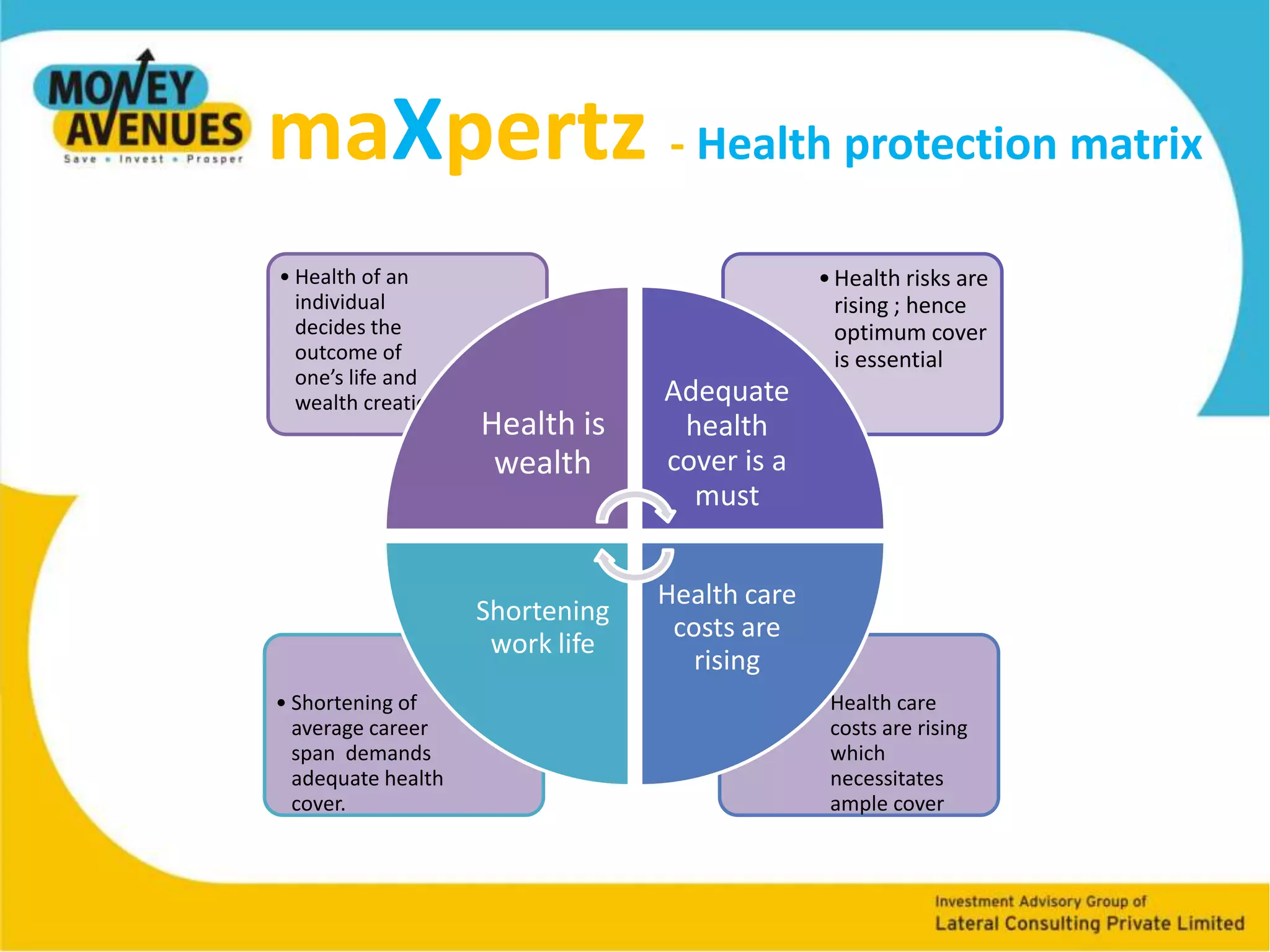

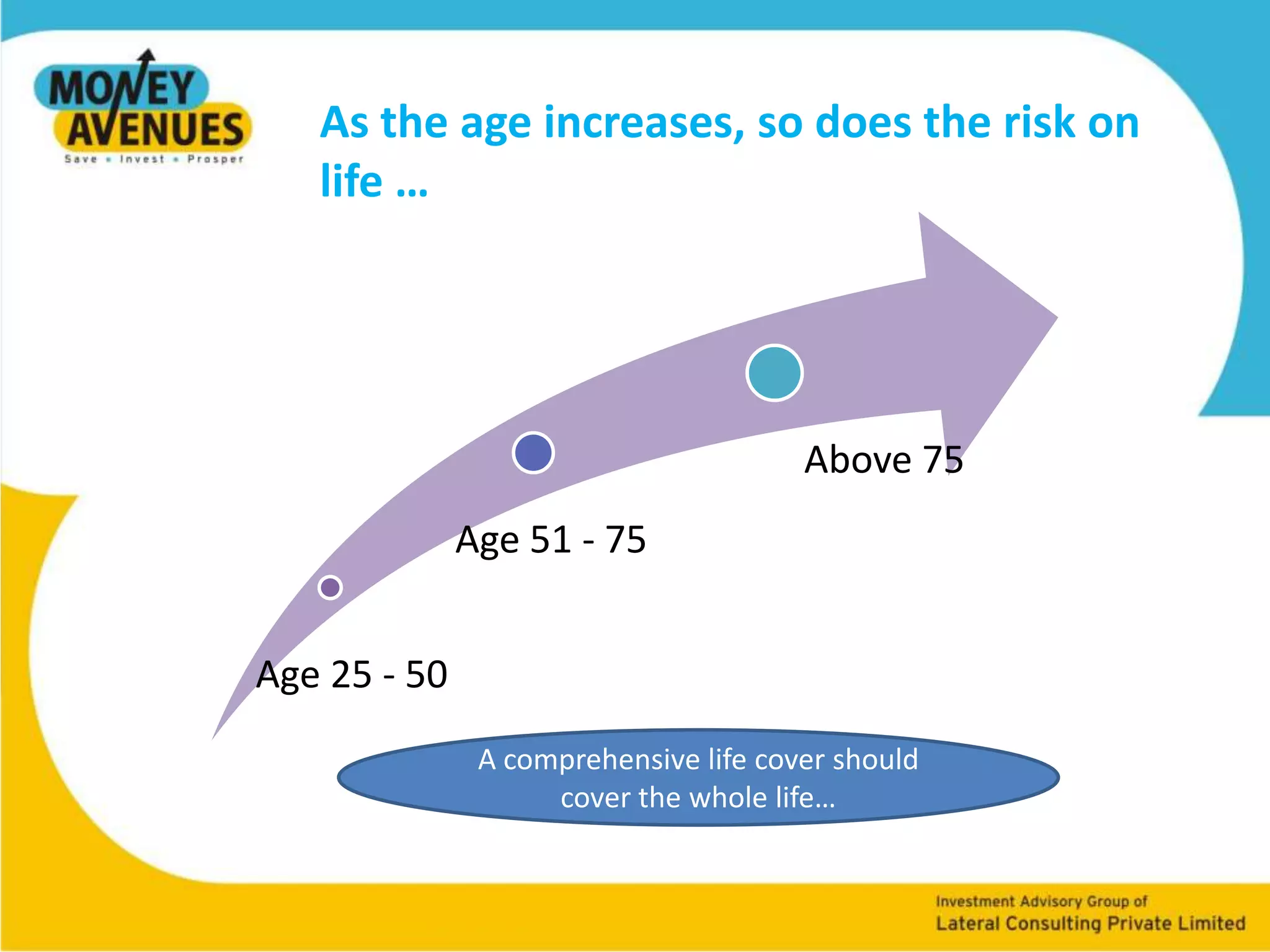

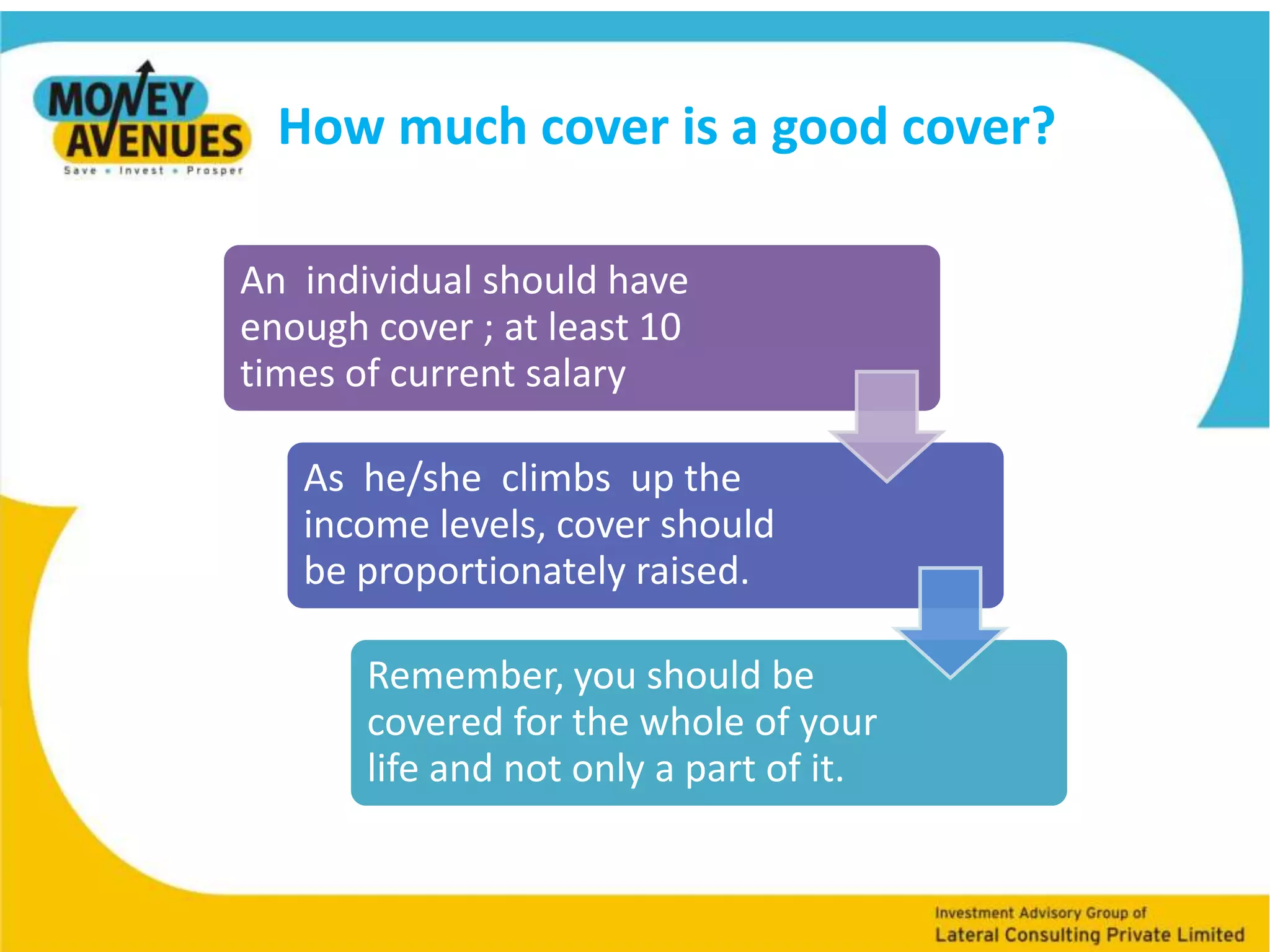

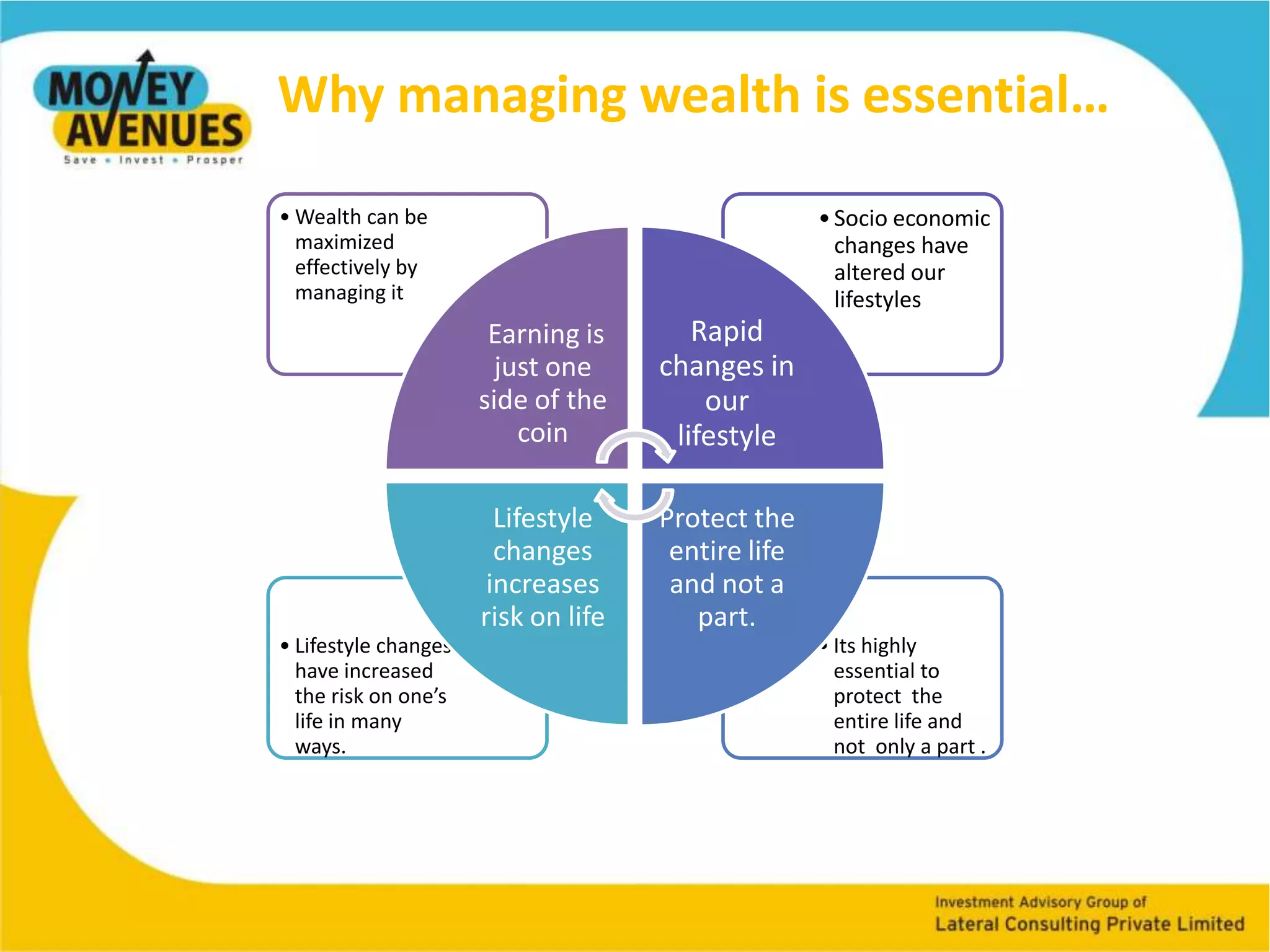

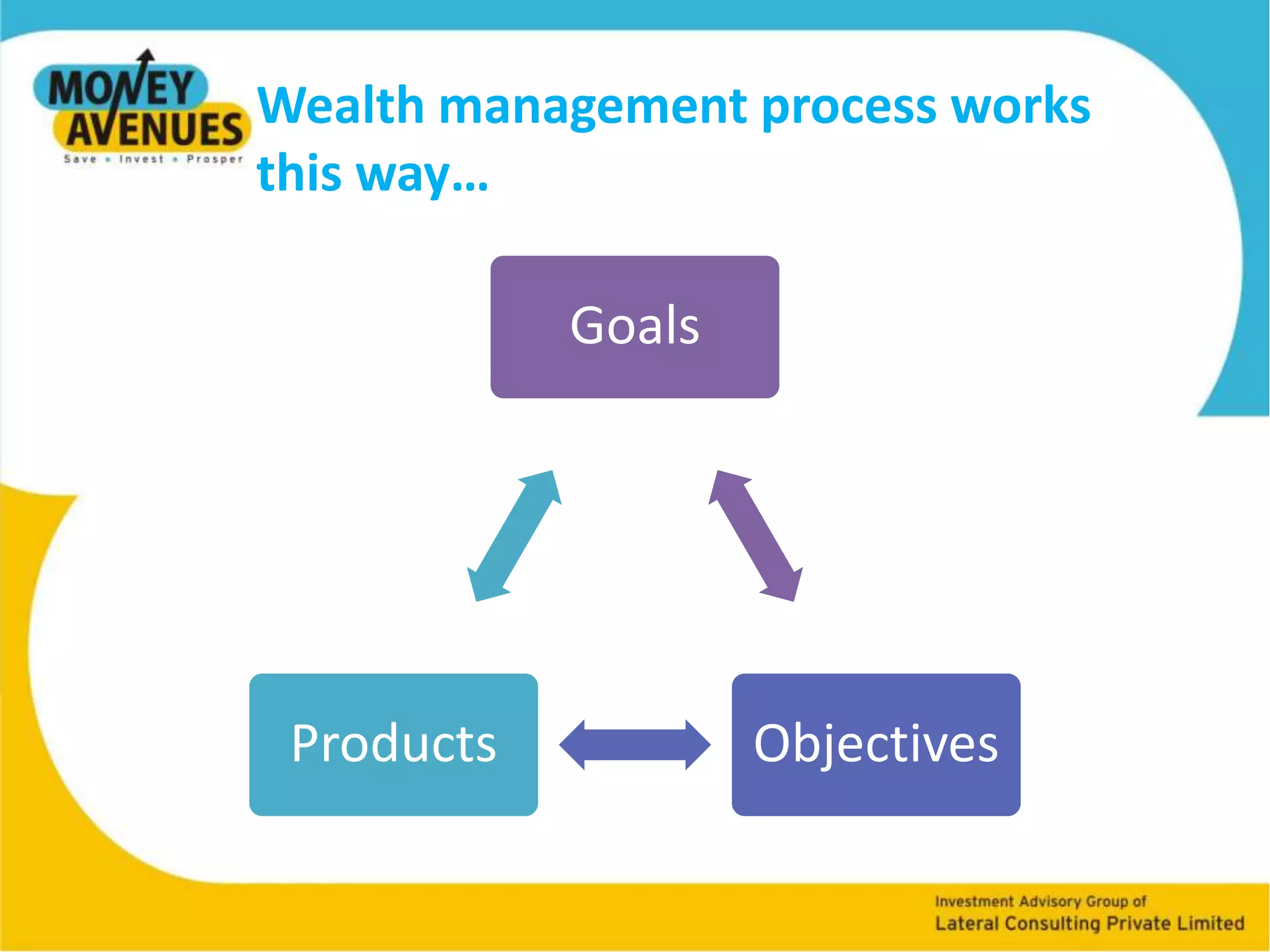

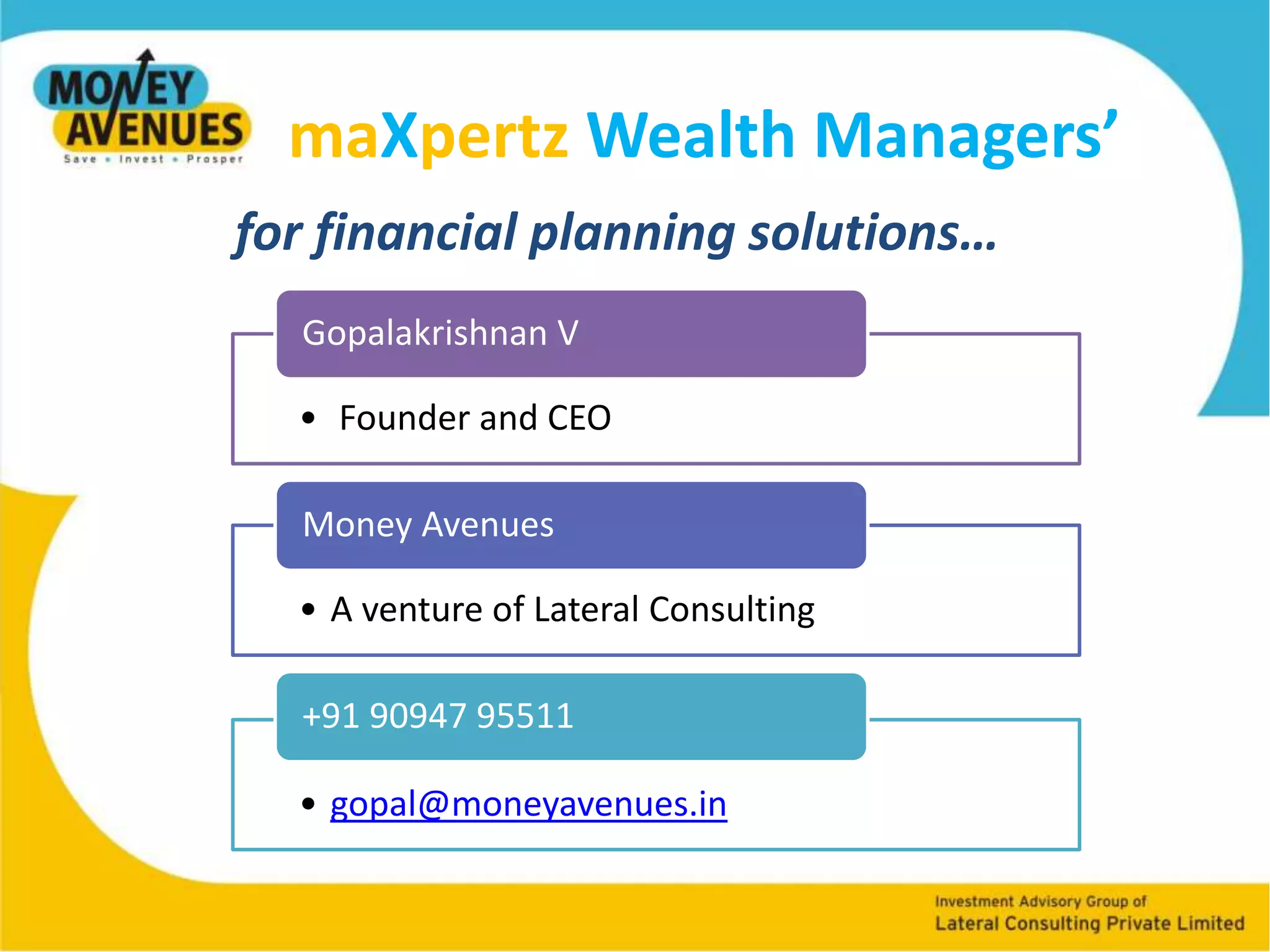

Future planning requires considering rising costs of living and inflation. The document discusses how assuming an annual inflation rate of 12%, expenses that cost Rs. 20,000 per month currently would equate to Rs. 1,92,000 after 20 years to maintain the same standard of living. It emphasizes starting health and life insurance coverage early to cover increasing risks. It outlines seven habits of ineffective investors like not saving regularly or planning investments. The document provides self-assessment questions on spending, savings, debts, and financial planning and introduces maXpertz Wealth Managers for financial planning solutions.