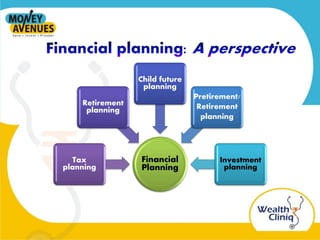

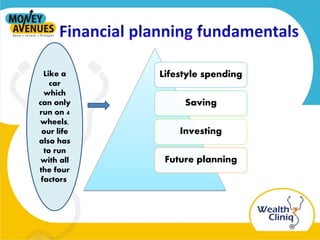

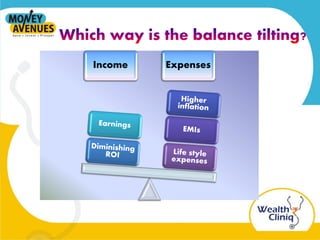

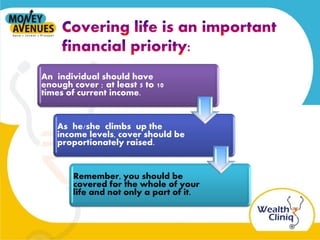

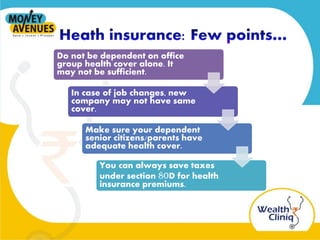

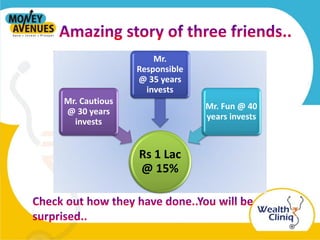

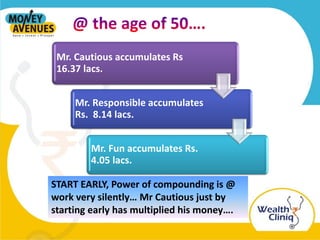

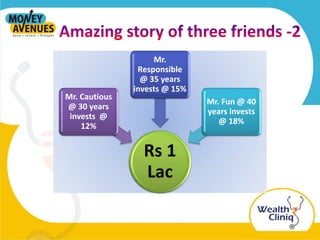

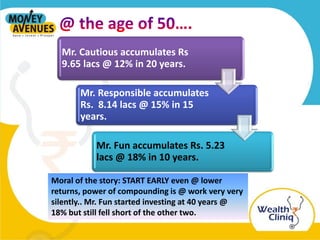

This document discusses the importance of financial planning and outlines key factors to consider. It recommends planning for tax, retirement, children's education, investment, health insurance, life insurance, and goals. It emphasizes starting investments early to benefit from compounding returns over many years. Later examples show that even with lower returns, starting investments earlier leads to higher overall gains compared to starting later with higher returns. The document stresses having adequate life and health insurance coverage and notes taxes can be saved under Section 80D of India's tax code. It concludes by highlighting the importance of financial planning and guidance from a professional financial planner.