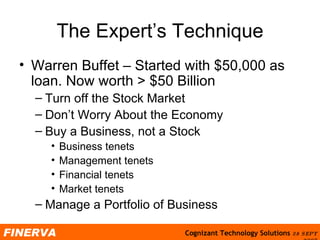

The document provides three steps to financial success: 1) save, 2) invest, and 3) protect. It emphasizes the importance of insurance, pension planning, and passive income through leveraging other people's money and time in investments like real estate, stocks, and mutual funds. The expert's technique is to manage a portfolio of businesses by focusing on management, financial, and market tenets. The key is to develop a flexible financial plan that provides protection and minimizes taxes while accounting for emergencies, risks, dreams, and milestones.