The document provides an overview of financing considerations for startups, including:

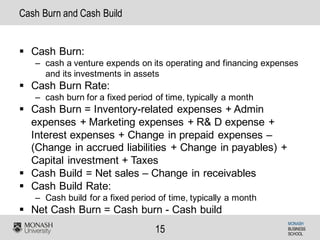

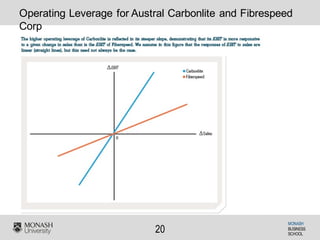

- How to forecast costs, pricing, and break-even points.

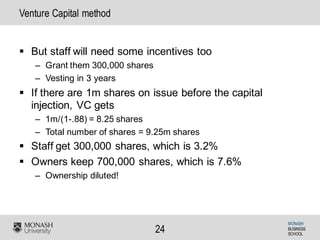

- Managing equity as a startup, including vesting, cliffs, acceleration, and valuation.

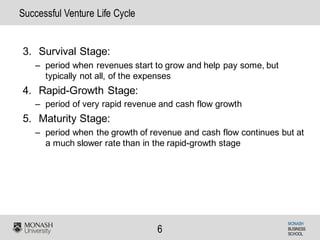

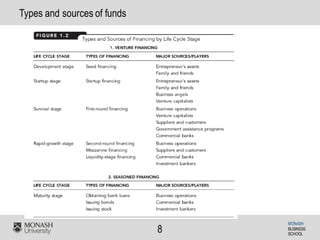

- The various stages in a venture's lifecycle and how external funding needs change.

- Common sources of startup funding include friends/family, angel investors, venture capital.

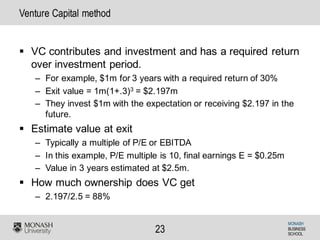

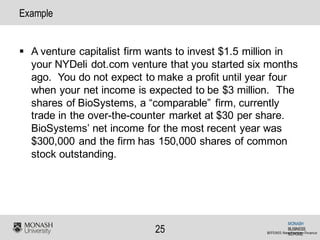

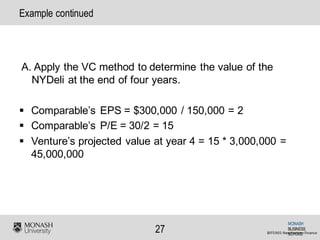

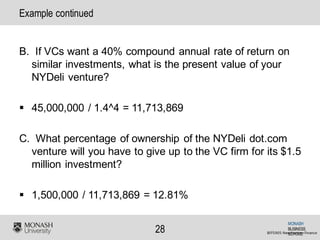

- Valuing startups involves estimating future cash flows and exit values using methods like venture capital valuation.