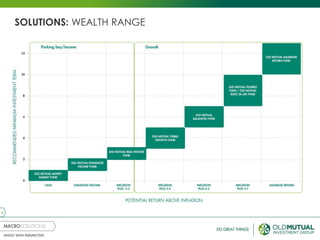

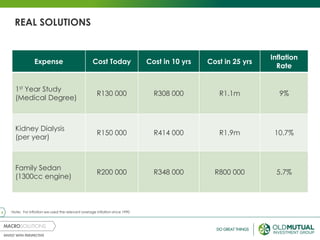

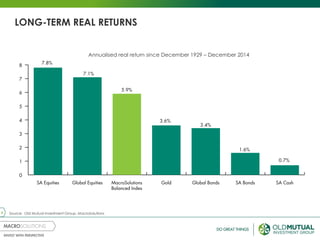

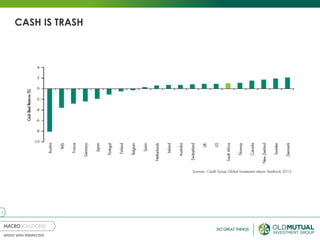

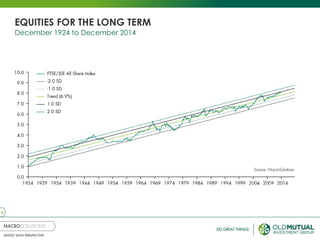

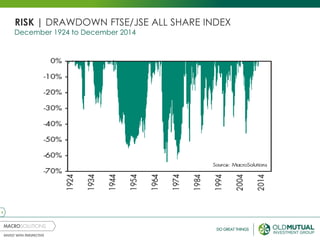

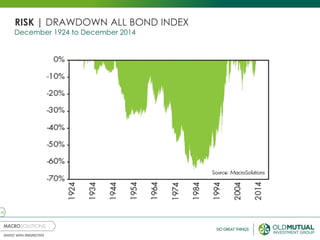

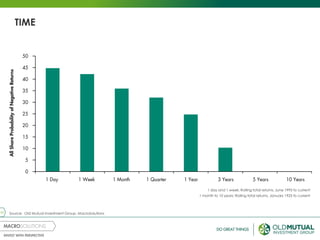

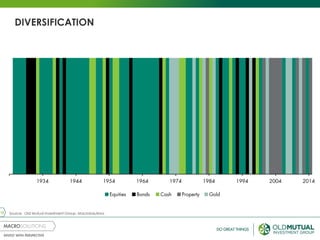

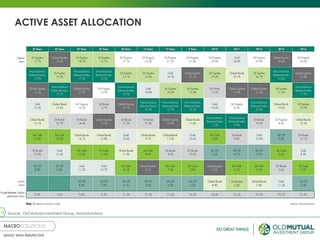

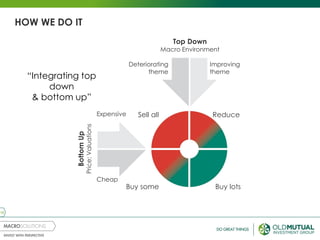

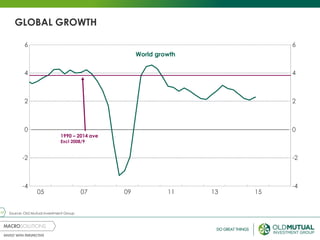

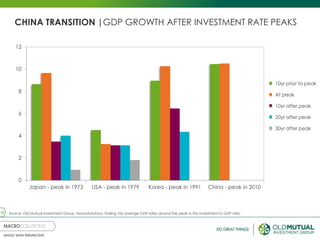

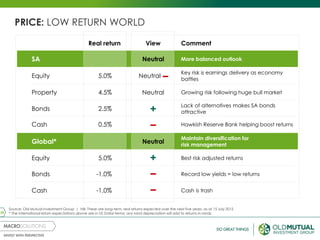

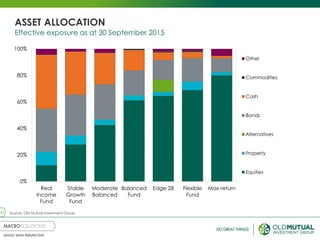

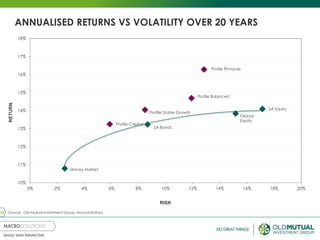

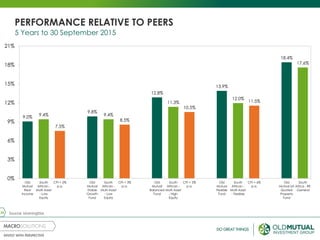

This document discusses long term investment perspectives and solutions. It begins by outlining common investment questions and problems clients face. It then provides principles for problem solving, including taking a long term view, diversification, and active asset allocation. Several charts show long term returns for various asset classes and indexes, demonstrating the benefits of equities and downsides of cash over time. It discusses MacroSolutions' approach of integrating top-down macro analysis with bottom-up stock selection and provides some examples of investment themes. Performance charts show the funds outperforming peers and delivering returns above inflation over multiple time periods. It concludes that a multi-asset class approach can solve most client needs and that active management adds value over the long term.