Embed presentation

Downloaded 172 times

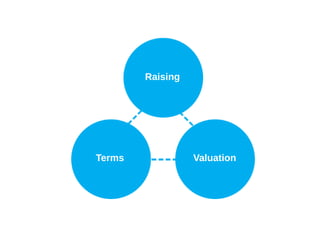

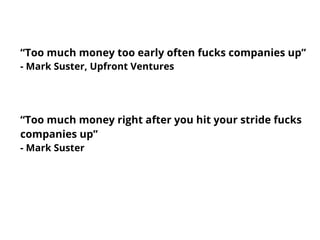

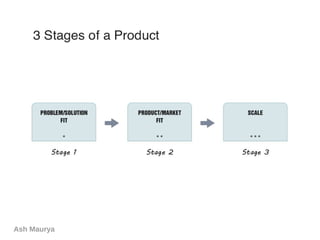

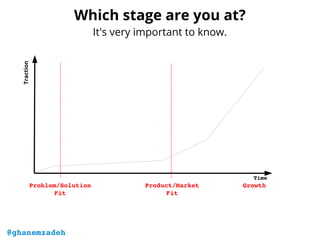

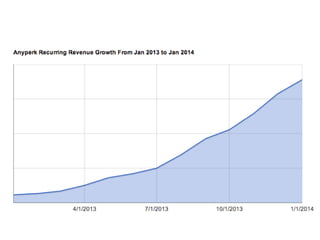

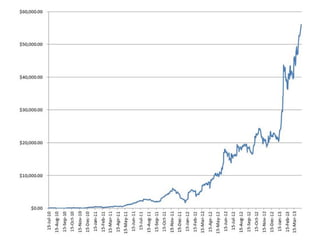

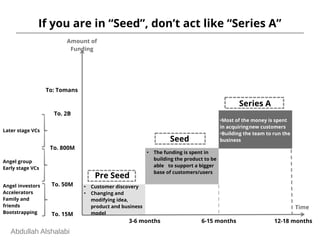

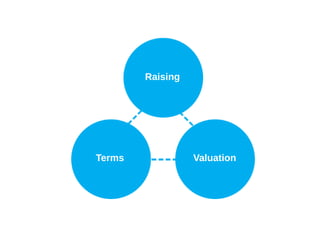

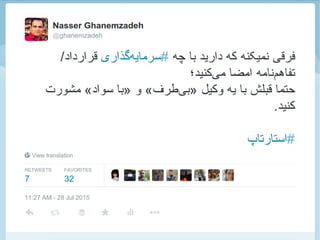

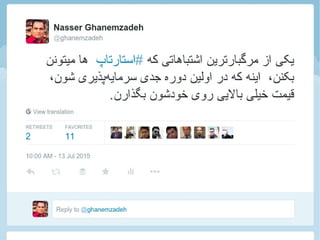

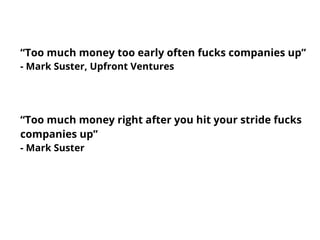

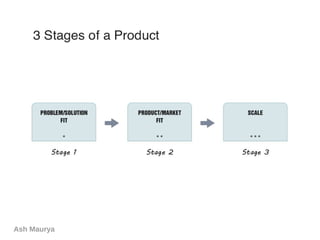

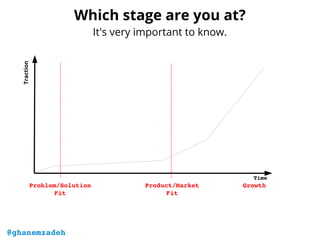

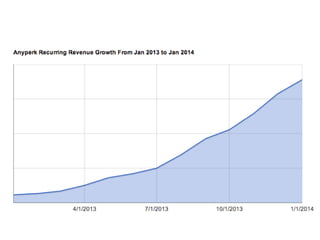

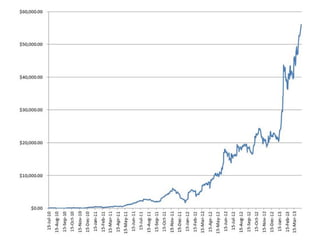

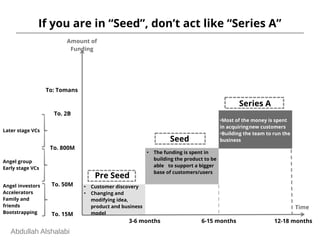

1) Fundraising requires knowing what stage your company is at and understanding the expectations of investors for that stage. The earlier the stage, the smaller the funds needed and the focus is more on customer discovery and validating the business model. 2) Later stages require more funding as money is spent on growing the customer base and building out the team and product. Investors at different stages expect to see increasing traction, revenue, and growth. 3) Companies should avoid overvaluing themselves early on or raising too much money too quickly, which can lead founders to lose focus and companies to fail. The smart approach is to raise money appropriate to the stage from investors who understand what is needed.