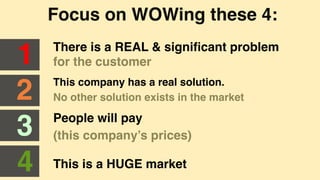

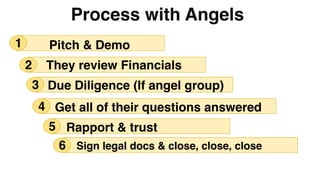

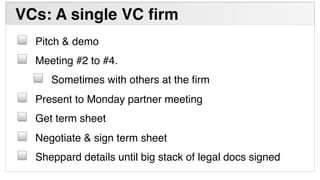

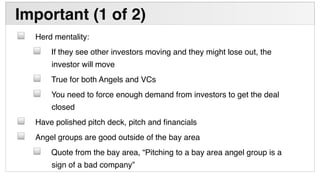

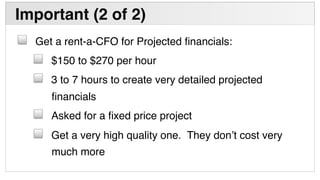

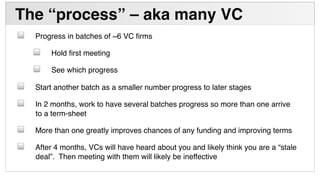

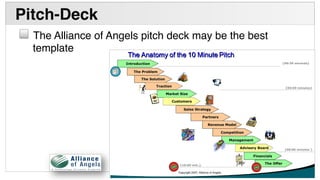

This document provides guidance for first-time founders on raising capital from angels and venture capitalists (VCs). It emphasizes focusing the pitch on demonstrating a huge market size for the solution and convincing investors that the company can achieve over $100 million or $400 million in revenue. The process involves pitching to investors, answering diligence questions, negotiating terms, and closing the deal. It recommends working with several batches of VC firms simultaneously to improve chances of funding and terms.