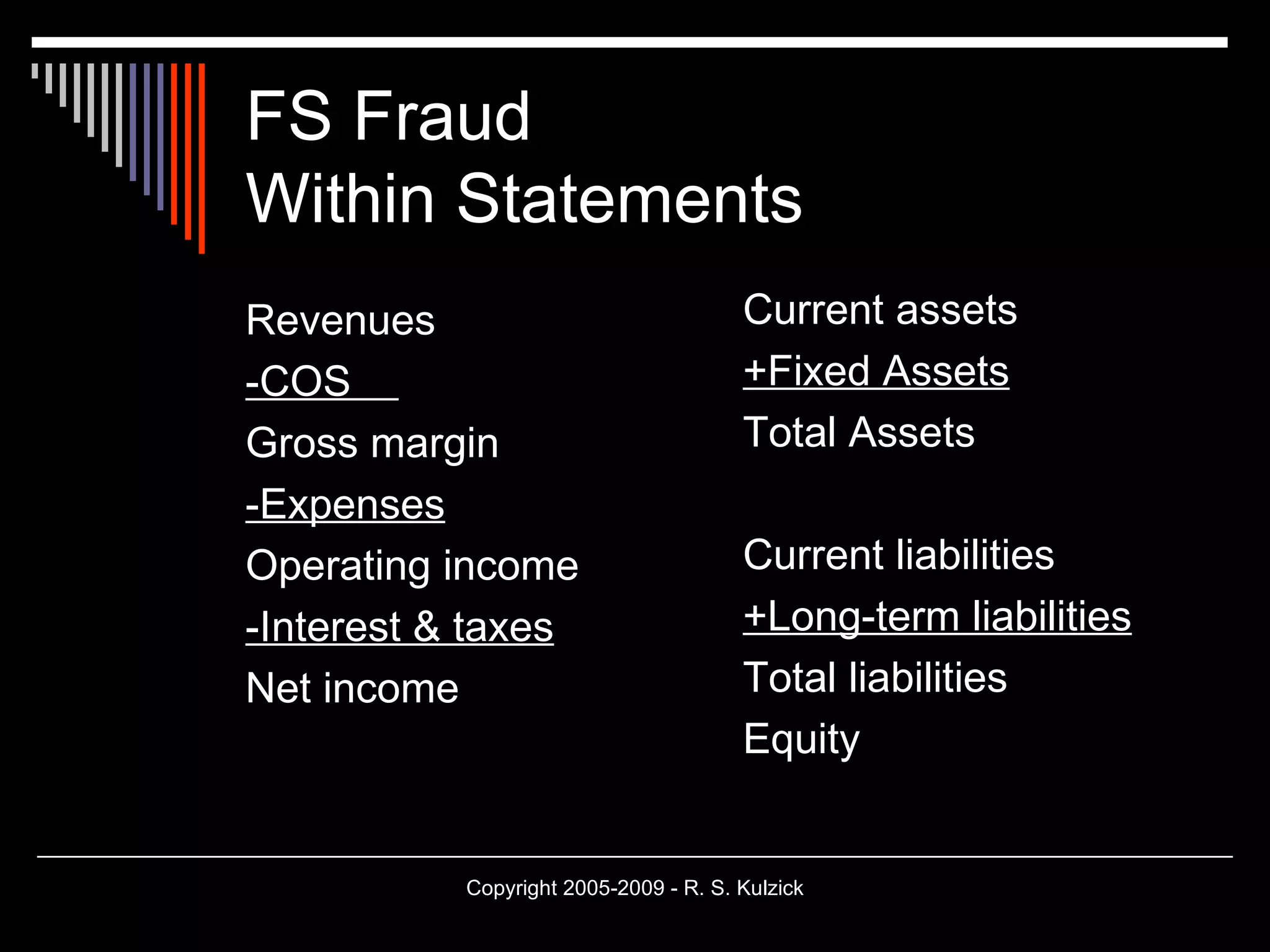

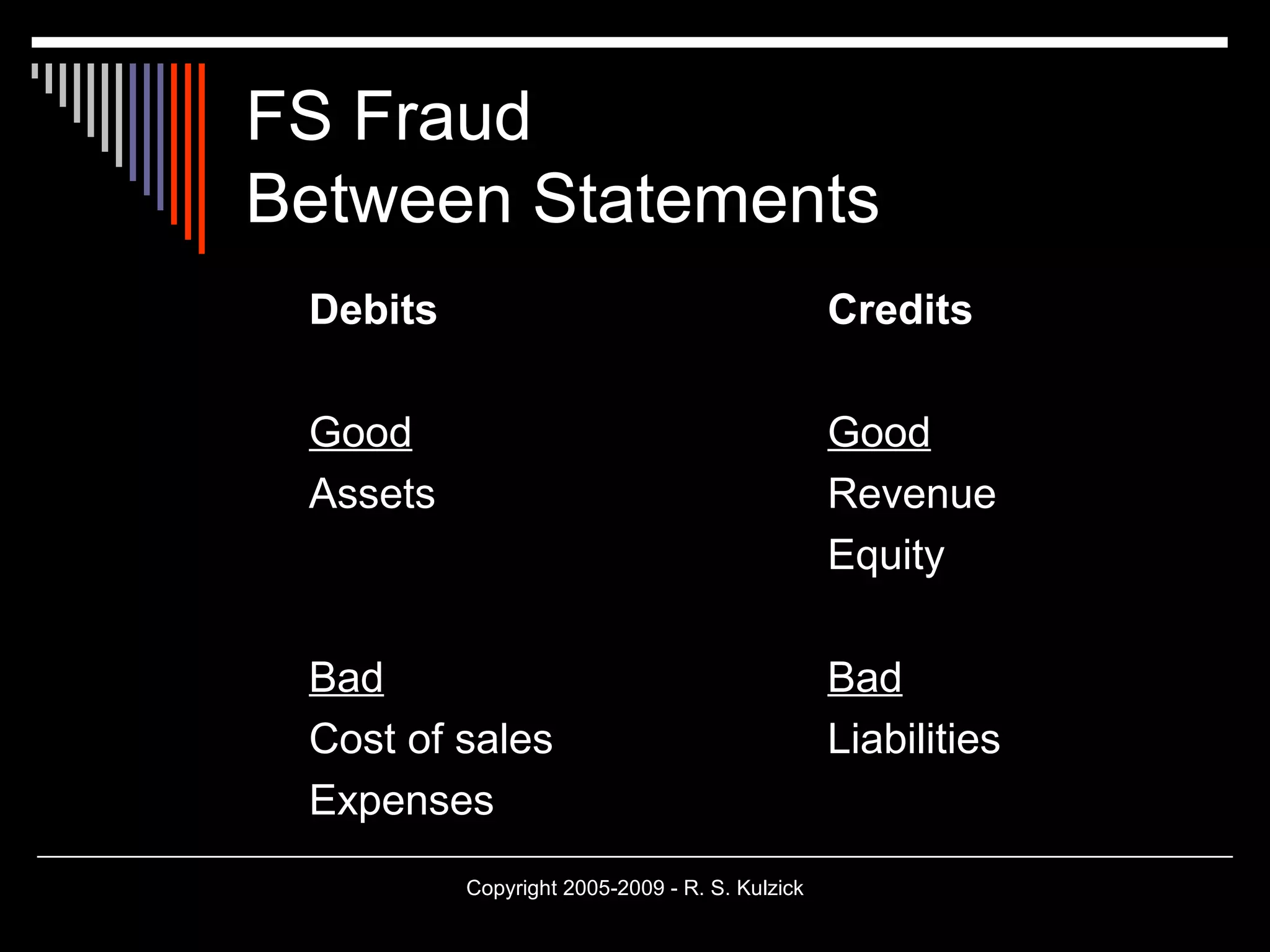

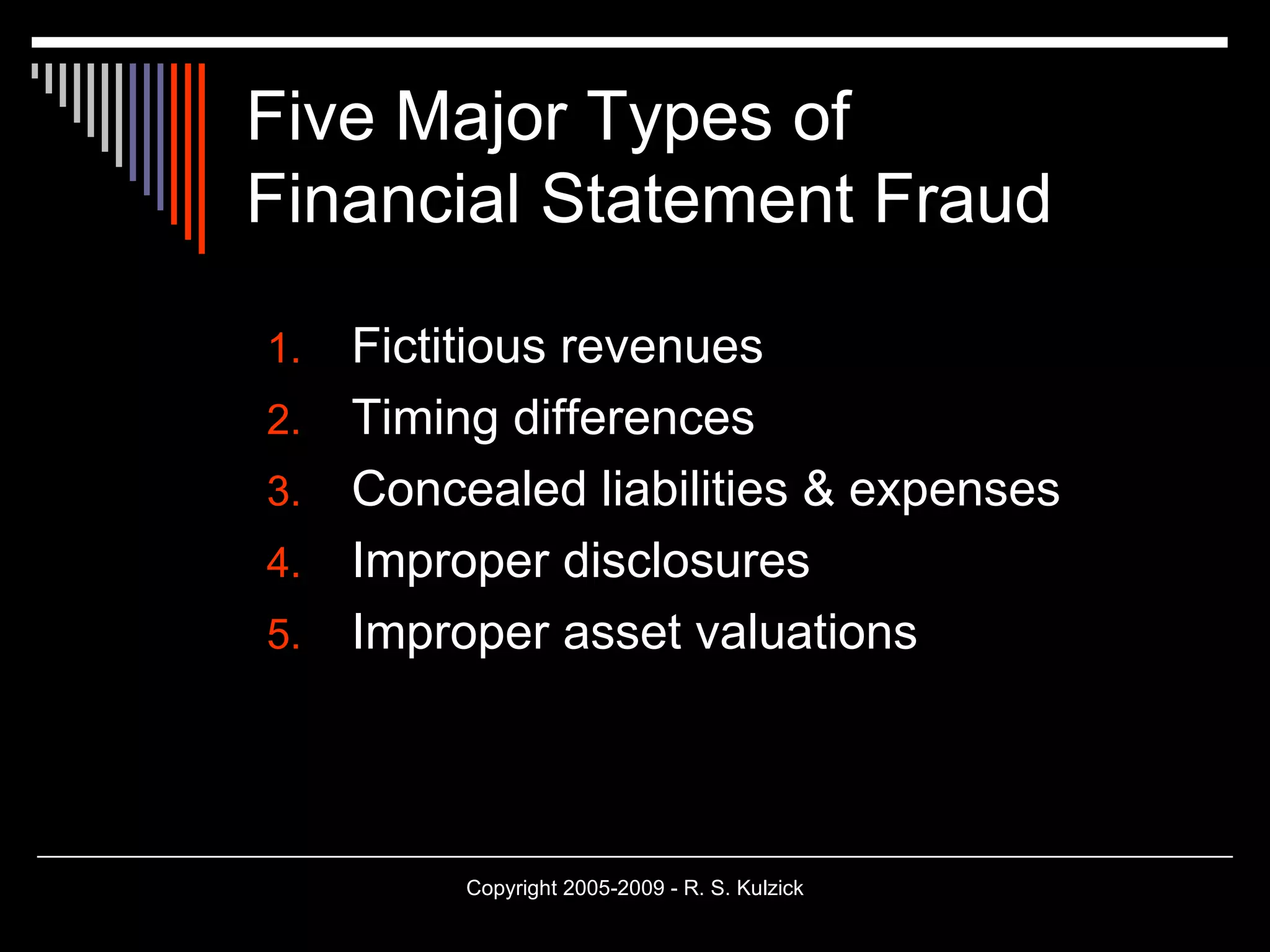

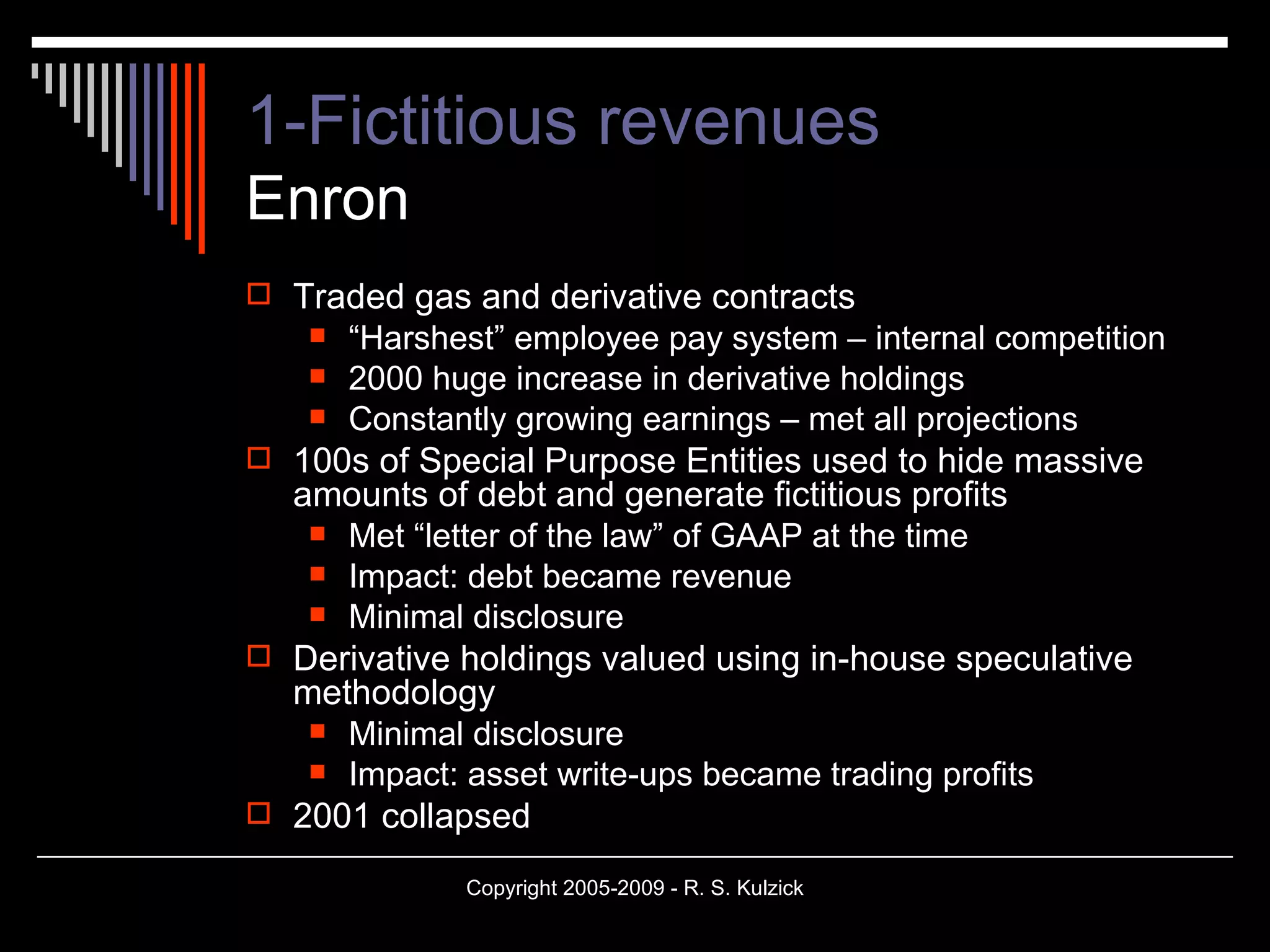

This presentation by Dr. Raymond S. Kulzick discusses the importance of auditing for fraud, outlining various types of financial statement fraud, and the relevant auditing standards (SAS 99). It highlights notable fraud cases and emphasizes the necessity for vigilance in the auditing process amidst changing economic conditions. The document concludes with insights into the risks associated with fraud and the implications for financial reporting.

![Thank you! Questions? Ray Kulzick – 305.812.4998 Kulzick Consulting, PA [email_address]](https://image.slidesharecdn.com/rkulzickfraudauditingcases20090623-12640228803374-phpapp01/75/Fraud-Cases-in-Auditing-38-2048.jpg)